Alleged Belvedere Ponzi kingpins Cobus Kellermann and David Cosgrove are attempting to engineer the greatest comeback since Lazarus. The prize is to clear their names of allegations of stealing money from investors through an alleged global web of deceit.

Their businesses have for months been the focus of investigations by three national financial regulators who have already shut down some subsidiaries. Investigations by the regulators is ongoing and due for completion at the end of May.

Last week the senior investigator at Guernsey’s Regulator produced a detailed and extremely damning affidavit when leading evidence to close down another three Belvedere companies and their underlying cells. The court approved the closures. Two more of Belvedere’s Guernsey-registered companies will be assessed by the same court on Friday.

The affidavit contains confirmation of dynamite accusations levelled by David Marchant who accused the South Africans of running a “massive criminal enterprise.” Marchant’s OffshoreAlert, which calls itself the unofficial financial regulator, focuses on malfeasance in financial centres, including those where Belvedere operates.

David Marchant, whose hard-hitting expose attracted public attention to the duo, tells us: “I’ve still not had any complaints from Kellermann, Cosgrove or their representatives.” He is continuing to add to his raft of allegations with fresh articles.

With hindsight, the duo must be rue a decision at the outset not to engage after being sent timely warning of what was due to be published on Biznews. They appear to believe that proving their innocence lies in our hands.

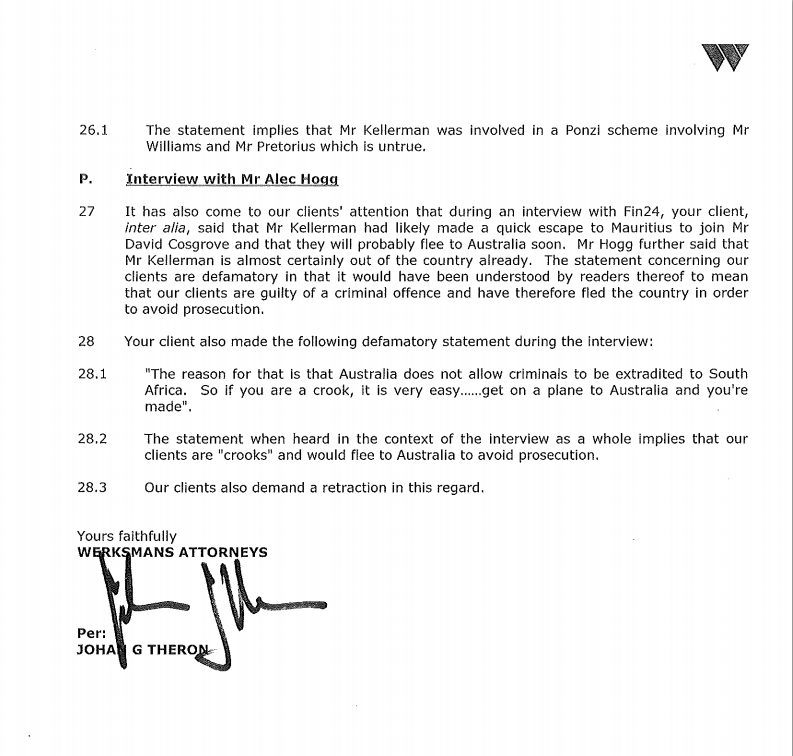

They demanded Biznews publish a “prominent and full” retraction. You can read it all in the lengthy Werksmans letter which has been cut and pasted in full below.

Our answer, once again, is No.

The official response sent by our attorney yesterday is:

We are also awaiting a response to questions submitted to Kellermann and Cosgrove’s attorneys Werksmans on March 30, the relevant part of which reads:

And a day later:

This letter was followed by the full transcript of the interview conducted with David Marchant which Theron says is defamatory as a whole. You can read it here.

* Click here to read the “back story” and access links to all the Biznews.com coverage of the Belvedere saga.