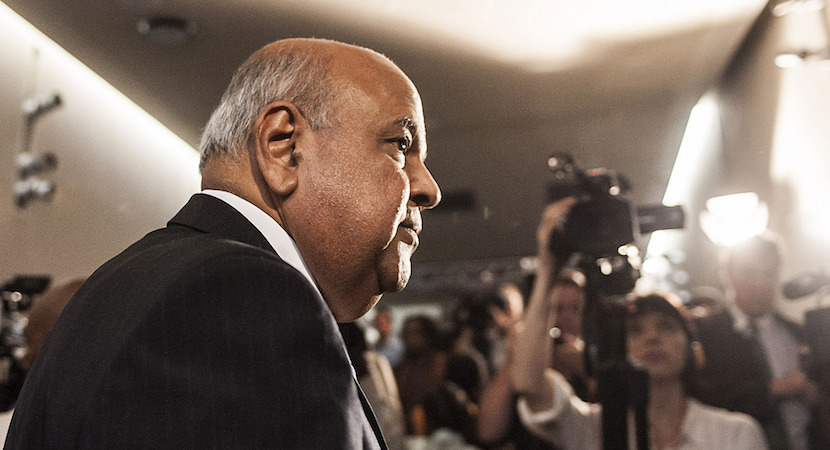

Alec Hogg spent the morning in lock up with National Treasury and the Finance Minister. Below is his 2016 Budget in a nutshell.

- Since October’s Mini Budget, an additional R32bn in additional taxes are being proposed over the next three years. Roughly half of this will go into higher education with just under R12bn the commitment of capital to be injected into the new BRICS Development Bank. SA injected R2bn into capital the new bank during December.

- Taxes will rise by R18 billion this year and by a further R15 billion a year in 2017/18 and in 2018/19. This, together with propsoed spending cuts, will result in the budget deficit falling from a projected 3.2% in the coming year to 2.4% in 2017/18.

- Government spending will be cut by R15bn a year from what had been tabled in the Mini Budget in October through further spending cuts in, especially personnel costs.

- A consolidated revenue target of R1 324 billion is set for 2016/17, or 30.2 per cent of GDP. This is an increase of 8.3% of the 2015/16 year.

- Government expenditure is projected at R1 463 billion (up 6%), resulting in a budget deficit of R139 billion, or 3.2 per cent of GDP. With expenditure targeted to grow at between 2.5 and 3 percentage points less than revenue over the next two years, the Budget deficit is projected to drop to 2.4 per cent in 2018/19.

- The reduction in spending and increase in taxes has been possible because Pravin Gordhan says the ANC is aware that the country is in a crisis. It is primarily targeted at appeasing ratings agencies which have threatened to downgrade South Africa’s credit rating to “junk”.

- The biggest chunk of the immediate tax increase will be generated by a 30c a litre increase in the fuel levy. This will generate the bulk of R9.5bn extra to be paid in excise duties. It comes on top of last year’s 80.5c a litre increase.

- Capital Gains tax is to rise, and expected to raise an additional R2bn, half each from individuals and companies. Property transfer duty on super homes (over R10m) is being increased from 11% to 13% (raising R100m).

- A new tax will be introduced in April 2017 on all sugar-added softdrinks like Coca Cola and Sprite.

- A tyre levy to finance recycling programmes will be introduced in October, with tax increases also applying to incandescent globes, a higher the plastic bag levy and the motor vehicle emissions tax.

- Increases of between 6 and 8.5 per cent are being imposed in the duties payable on alcoholic beverages and tobacco products.

- The balance of the higher tax revenues will be generated through fiscal drag. This year there is modest personal income tax relief of R5.5bn for low and middle income earners. An increase in the monthly medical tax credit has been granted.

- An additional R16.3bn has been allocated for higher education over the next three years – R5.7bn to keep fees constant at 2015 levels; R2.5bn will be used to clear outstanding student debt with a further R8bn injected into the National Student Financial Aid Scheme.

- Government’s spending ceiling will be cut over the next three years by R25 billion, driven primarily by an increasingly powerful Chief Procurement Officer.

- The new powers for the Procurement Tzar will include monitoring of state-owned companies’ procurement plans and supply chain processes, and reviews of all contracts above R10 million to ensure value for money. His mandate is to achieve savings of 5% a year in the next three years from the R500bn procurement spending.

- The successful Renewable Energy programme will be expanded to include gas and coal projects. The proposed nuclear programme is still on the table but the size and scale will be assessed within affordability criteria.

- The Treasury currently expects growth in the South African economy to be just 0.9 per cent this year, after 1.3 per cent in 2015.

- The Industrial Development Corporation will invest R100 billion over the next five years, including R23 billion to support black industrialists.

- Tax revenue for the past year rose 8.5% but was R11.5bn below Budgeted.

- Among projected savings is less money to be transferred to meet shortfalls at State Owned Enterprises. Comparatively radical proposals (for the ANC) have been tabled to fix, close or merge SOEs and introduce more private sector participation including through the sale of minority equity interests and co-investment. Privatisation remains very much off the table.

- A new e-tender portal kicks off in April when it will become obligatory for the entire public sector. This is expected to ensure procurement transparency and standard pricing. Among the consequences is an end to newspaper advertising and printing of tender documents.

- International agreements on information around the fund flows and assets of multinational corporations and individuals kick in from 2017. A six month amnesty will be offered from October for “non compliant taxpayers to regularise their affairs – time is running out for taxpayers who still have undisclosed assets abroad.”

- About 150 000 Tax Free Savings accounts (limit R30 000) have been opened with savings totalling R1bn.

- A merger to be explored between SAA and SA Express, the board of directors strengthened and a minority equity partner introduced to create a bigger, more operationally efficient airline.

- Government guarantees to SOEs now total R467bn (11.5% of GDP) and is putting pressurise on SA’s sovereign rating. This will be addressed through co-funding in Public Private Partnerships.

- Transnet is leading the way through the acceleration of private sector participation in the ports and rail sector.

- A further R598m has been allocated to “enhancing capacity of Public Order Policing units.”

- Ahead of the Municipal elections, National Treasury will launch a data portal to provide all stakeholders with comparable, verified information on municipal financial and non-financial performance. The number of municipalities will be reduced from 278 to 257 after a “significant change” in demarcations costing R400m.

- Bus rapid transport systems that are operatinal in Jhb, Tshwane, CT and George will be extended to Ekurhuleni and eThekwini this year at a cost of R6bn.

- R475 million has been reprioritised to the Department of Small Business Development for assistance to small and medium enterprises and cooperatives.

Visited 92 times, 1 visit(s) today