Walter Aylett is what some may call an Omaha veteran, having attended his sixteenth Berkshire Hathaway AGM this year. This year was slightly different though as he went alone for the first time. It was a year of firsts as the AGM was also webcast, which may have impacted the vibe at the conference. Aylett says “it seemed a bit quieter and numbers were noticeably down on last year’s 40 000.” The Biznews team covered the event extensively through the webcast and wire stories but there’s always value behind a story told by someone who attended in person. Aylett’s Omaha report back holds some unique experiences. None more so than it was written on a Boeing 777 cruising at about 1 000km/hr at 35 000ft above sea level. And while it was a two day round trip for a 6 hour meeting, Aylett says he’ll do it again next year. I know it’s also on my wish list. – Stuart Lowman

By Walter Aylett*

It’s early May 2016 and I’m on the long haul back from attending the 2016 Berkshire Hathaway AGM held every year in Omaha, Nebraska. To lend some geographical perspective, Omaha is located in the heartland of the United States and in 2009 was identified by Forbes as the nation’s number one “best-bang-for-the-buck-city”.

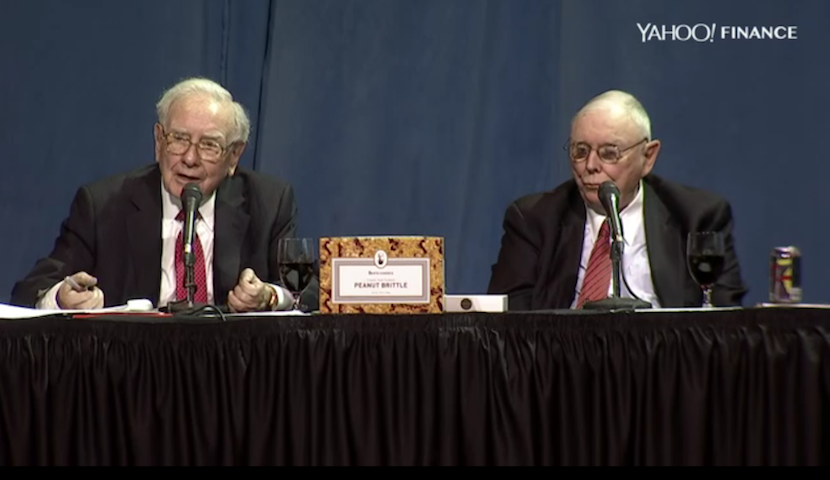

Today Omaha is home to the headquarters of five Fortune 500 companies including mega-conglomerate, Berkshire Hathaway, led by Warren Buffett and his longtime wingman, Charlie Munger. It is to this investment mecca in the flat Midwest that tens of thousands flock annually to spend six hours listening to the “Oracle of Omaha”. I thought I’d spend the 48 hours it takes to get home to Cape Town sharing a few thoughts.

Can you believe that? What on earth inspires South Africans to spend almost two days travelling to attend a 6 hour meeting in the middle of the USA? Perhaps it’s because it’s considered to be the biggest spectator event in capitalism and it’s a chance to sit in the company of two of the world’s greatest investors – 85 year old Warren Buffett and 92 year old Charlie Munger.

Perhaps it’s because over the past 50 years the legendary pair have grown the company at an extraordinary compound rate of 19.2% annually, employing large amounts of capital and minimal debt. Perhaps it’s because Buffett earned 99% of his wealth after his 50th birthday, making his very first stock purchase in 1941, the same year Pearl Harbour was bombed.

One can find any number of reasons to make the pilgrimage to Omaha; for those who don’t know Omaha, it’s a city that’s very much like Bloemfontein (sans best-bang-for-the-buck)!

This time it’s different

Besides the above being the four most dangerous words in the investment world, this time was different. This was to be my first time travelling to Omaha on my own. In the past I was part of a group of fellow investors, several prominent CEO’s* of South African companies, and clients.

We would descend on Omaha with everything meticulously planned, restaurants booked, contingency plans for the unexpected and with the required AGM attendance credentials firmly in hand. On this, my 16th trip, my itinerary was rather different and rooted in the belief that all would work out just fine despite being loosely structured.

What are the odds?

Our job is evaluating the probability of a successful outcome of an investment decision, notwithstanding ever present possibilities of statistically abnormal surprises. I will share two personal anecdotes that lend some credence to this philosophy. After disembarking in Chicago airport, ahead of me I saw Rhys Summerton, a fund manager and friend who had just flown in from London.

Chicago’s O’Hare airport border control is a huge area with over a hundred booths. The odds of finding myself in the same queue at the same time as Rhys were indeed slim. He invited me to join him later in Omaha at Gorat’s; Warren Buffett’s favourite steakhouse where he favours the T-bone house speciality, served rare, with a double order of hash browns and a cherry coke!

Read also: Berkshire AGM transcribed – Why Buffett believes anti-sugar lobby is wrong

On arriving at my hotel I discovered that my AGM credentials had not arrived which meant rescheduling the following day to sort it out because no credentials means no admittance to the meeting. As it turned out, that evening at dinner Rhys came to my rescue by offering to get me credentials which meant I could keep to my original schedule.

The next day, when I called him to make arrangements to collect my credentials, he persuaded me to go for coffee, despite the fact that I wasn’t feeling well. Unbeknown to me, Rhys had also arranged to have Henry Hall, a respected banking analyst from South Africa, join us for coffee. Henry arrived with George, a Greek, in tow. I greeted him in Greek asking how he was and how life was in Abu Dhabi.

He was taken aback…how did I know him? I remembered him from an investment conference we had both attended the previous year. He had forgotten that we had met queuing for last year’s Berkshire AGM and that I had recognised him from the earlier conference we had both attended. I had asked him in Greek how he was? He had forgotten that meeting and now, a year later, there he was sitting in front of me, with Henry, unpredictably meeting again.

Had my credentials arrived on time, I would not be there meeting up with him, in such unlikely circumstances! It reminded me that there is always room for the unknown to occur. The lesson for fund managers and for those who believe in robotic investing is to allow for the unexpected. This is what I think is the weakness in quantitative investing and strengthens the case for common sense and rational thinking.

How things have changed

When I first attended the Berkshire Hathaway AGM back in 2000 there were about 9 000 attendees. In 2015 this number had swelled to approximately 40 000. This year, for the first time, there was a separate room for Mandarin investors with translators provided. I am not sure how one goes about accurately translating the mid-west straight talk Charlie Munger is known for.

For example, at the May 2000 AGM, in reference to how the internet and technology offer both benefits and risks, Charlie came up with the following “If you mix raisins and turds, they are still turds”!

Read also: Omaha’s frenetic weekend cools off as Berkshire webcast hits AGM attendance

Perhaps the biggest change has been the increase in security, to the point that this year attendees had to go through metal detectors for the first time. I tried to think about the significance of this increased security. Whenever I enter the USA it feels like a police state and anyone in uniform appears threatening.

I still cannot understand why a customs officer has to carry a gun and a Taser in a secure building like an airport. While the secure environment is welcome and we are being protected from terrorism, at times the very people charged to protect us appear as menacing as the threat itself.

A few new things

I could not help noticing the American public’s obsession with pet food. There was seldom an ad break on television that didn’t include commercials for superior food brands for beloved pets; food that was pure, free from colourants and additives, containing real chicken, salmon and meat. Dare I mention that they might well have marketed it fit for human consumption! From an investment angle I sense some merit in looking into the pet industry market.

The AGM stadium doors normally open at 7am to admit the queues of people who’ve been lining up since 4am. By 6.30am the queues stretch 300 to 400 meters in length, although this year the queue was a mere 25 meters. For the first time that I can remember it was raining buckets on the day of the AGM and, being ever practical, the facility managers had opened the venue earlier to save shareholders getting wet. Good old America!

The conference was web cast for the first time, broadcast by Yahoo Finance. The vibe at the conference seemed a bit quieter and numbers were noticeably down on last year’s 40 000 although perhaps the poor weather conditions had something to do with it. In his annual letter to shareholders, Buffett wrote “Charlie and I have finally decided to enter the 21st Century”.

In his letter he also wrote that his shareholders “would also want to look in occasionally to make sure we hadn’t drifted off into la-la land” but that he didn’t want to force them to travel all the way to Nebraska to do so.

Visit Berkshire Hathaway 2016 Annual Shareholders Meeting for the full webcast that will be available for 30 days following the meeting. At the time of writing, this first online broadcast had been viewed 1.8 million times according to Associated Press. Welcome to the power of the digital reach of Messrs. Buffett and Munger!

Finally, while South Africans may think our political fiascos are unique, dominated by characters like Julius Malema, the USA is no different and their Malema also sports the colour red but goes by the name of Trump. I could not help noticing how little attention US politics is given by the voters. Politicians have relied on the strategy of simply lying to get their votes in.

In today’s world, with all the transparency and social media skirt lifting, the politician who is in tune to suit with the social mood and media, will go on to dominate their respective landscapes . News travels instantly and facts are out before they can begin to be managed. It would appear that only matters of security and foreign affairs are left in the hands of Commander in Chief, otherwise the voters simply move on, go about their business and seemingly bypass the system.

The USA or emerging markets?

In my 22 years of investing the question that always seems to come up is where to put one’s money? It has been argued that the developed world is ex-growth and emerging markets are the panacea. Just as I’m always amazed how a plane the size of an Airbus 380 takes to the skies, the sheer magnitude and power of the USA’s economy never fails to astound me.

Read also: Berkshire AGM transcribed: Buffett makes case against active money managers

For a small investment team like ours, we see the USA as an emerging market and there are ample opportunities to find companies that, in our opinion, will grow faster than companies elsewhere in the world. Our investment opportunities lie in the small caps where the large managers, ETF’s and program traders cannot play.

In some cases the US obsession with short term performance and the inability to suffer short-term paper losses will be to our advantage. There is always scope for exceptions such as the next ‘Singapore’, but then again we have also made money in Greece. I agree with Buffet’s sentiment that the USA is going to be a better place in the next 100 years.

We will continue to invest in the USA as we look to discover the next Apple or Google or simply a small company that benefits from this wealthy society that loves and feeds its pets better food than is consumed in emerging markets where pets are more likely to be threatened and its citizens undernourished.

All parties come to an end

It was a great meet, and for me the AGM gets better each time. Although, I thought Mr. B did ramble on too long at times this time. He certainly uses the meeting to pump up his managers. He is perhaps also a bit too dismissive of some things that are pertinent to general society such as health matters; for example the debate over Coke and sugar. He gave long answers that didn’t always address the question but thankfully Charlie Munger was more than happy to be bad cop, often chiming in with a crisp and wise quip.

I thoroughly enjoyed going on my own. It was different and wonderful to be responsible for just myself but in the end I admit I felt the absence of those who could not make it to Omaha this year; the long suppers, the laughing and the serious debates were greatly missed.

So why do I continue to go? Well, beside it being a wonderful ritual to reset the compass to true north and to clear the investment windscreen for the year ahead, Berkshire Hathaway is a remarkable company.

Read also: Berkshire AGM transcribed: Would Berkshire survive a Trump Presidency?

In conclusion, I’d like to share this story that reflects the profound impact this company has had on me. I started going to Omaha sixteen years ago. The next two years would be the ideal time to buy Berkshire Hathaway shares. In the following years my late father would frequently ask me about the price of Berkshire? After a while it started to bother me why he was always asking me? He had never shown any interest in the markets before. So one day I asked him and it turned out he had invested in a few Berkshire shares! What do you know about Berkshire I asked him? He answered “it’s a great company, it must be – you go there every year”. He bought six shares and after his death he left one share to each grandchild.

And that’s why I keep going back to Omaha…

One final anecdote, many years ago we named our dog Munger and my young son was astounded to learn that a wise old man in America was named after our beagle.

*SA CEO “Berkshire Alumni list” with whom I’ve had the privilege of attending the AGM.

Thys du Toit (Coronation)

Laurie Dippenaar (Momentum)

Peter Cooper (Rand Merchant Bank Insurance)

Johan Burger (FirstRand)

Ian Kirk (Sanlam)

Nick Booth (Italtile)

Graham Edwards (AECI)

Dave Whoolam (African Bank)

Fred Robertson (Brimstone)

Thys Visser (Remgro)

Marcel von Aulock (Tsogo)

*Walter Aylett is founder of Aylett & Co fund managers.