A recent Bloomberg article showed how central bankers are putting gold investors and traders on the defensive. It stated that there’s reason to be worried given a shift in stance to monetary tightening in the United States, as waiting too long to raise interest rates risks overheating the economy. But when it comes to investing in gold, how should one react? It’s a much-loved, and hated commodity. But what is the case for gold, and should you include the physical metal or the mining companies in your portfolio? Investec’s Brian Kantor goes digging, and his outcomes may surprise. – Stuart Lowman

By Brian Kantor*

Gold mining companies listed on the JSE have been enjoying a golden year. The JSE Gold Mining Index (rand value) has gained over 200% this year (see figure 1 below). This outperformance of gold mining shares has much to do with improved operating results, gold mining specifics, more than with the gold price, though in US dollar terms the gold price has enjoyed something of a recovery in 2016. In figure 3, we show the daily price of gold in US dollars and rands going back to 2006. As may be seen in figure 2, the rand price of gold has risen more or less consistently since 2006 while in USD the gold price rose very strongly and consistently until 2011 where-after it fell back sharply – until the modest recovery of 2016.

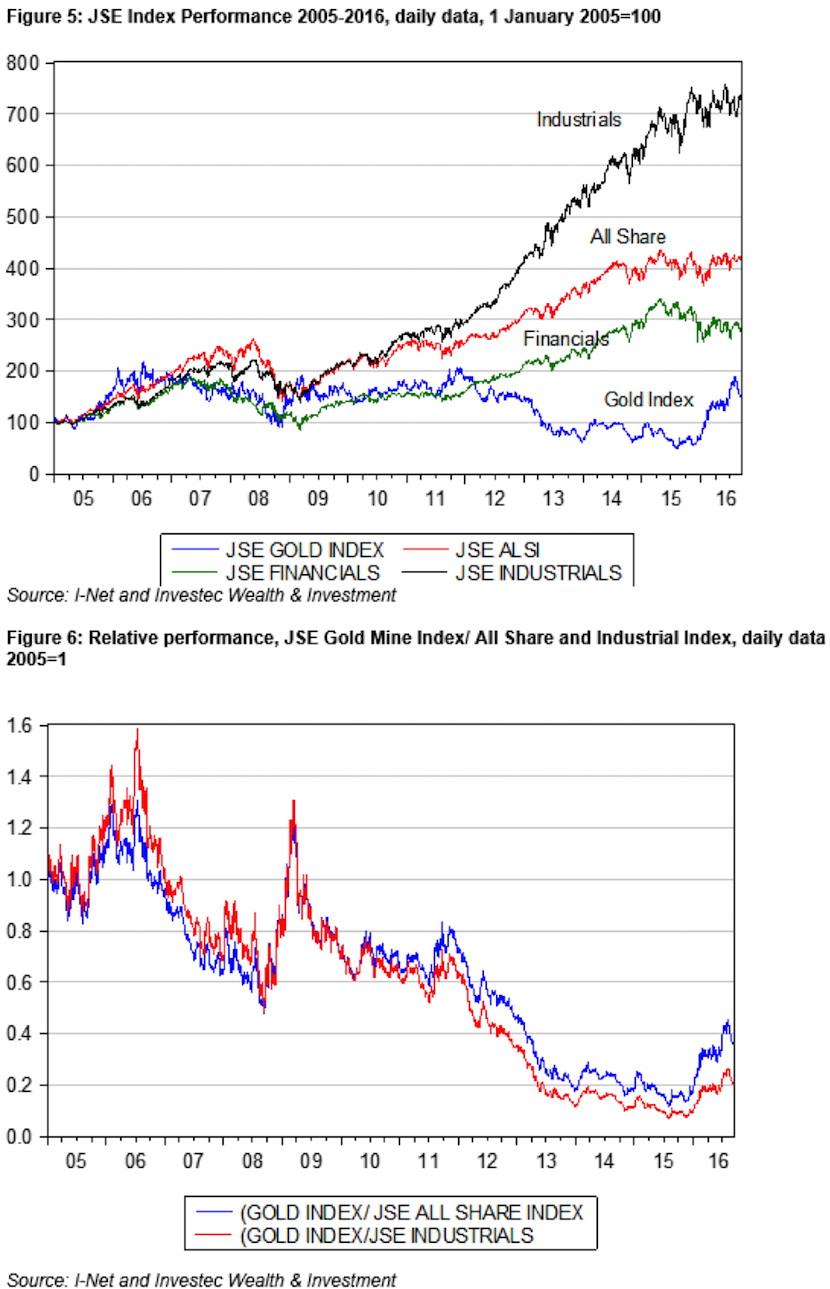

We show in figure 3 below how far the performance of the gold miners lagged behind that of the JSE All Share Index until 2016. The weight of gold shares in the JSE ALSI is now about 3.1% up from 1.45% at the start of 2016. In figures 4 and 5 we compare the performance of the gold miners to other sectors of the JSE. As may be seen, the JSE Industrials have been the outstanding performers over the longer run – but not in 2016. The higher rand price of gold clearly did not translate into higher operating profits in rands or USD. As may be seen investors would have done far better holding gold itself rather than gold shares for much of this period – until very recently.

As may be seen in figure 6 above, the JSE Gold Mining Index has been a distinct underperformer since 2005 – though it outperformed briefly in 2006 and again during the Financial Crisis of 2008-09 and then again, making up for some of the lost ground again this year. R100 invested in the Industrial Index on 1 January 2005 would now be worth over R771; and in the Gold Index about R152; while the R100 invested in the All Share Index would now be worth about R423. The rand price of gold rose by 7.7 times over the same period, gaining as much as the Industrial Index as we have shown in figure 3.

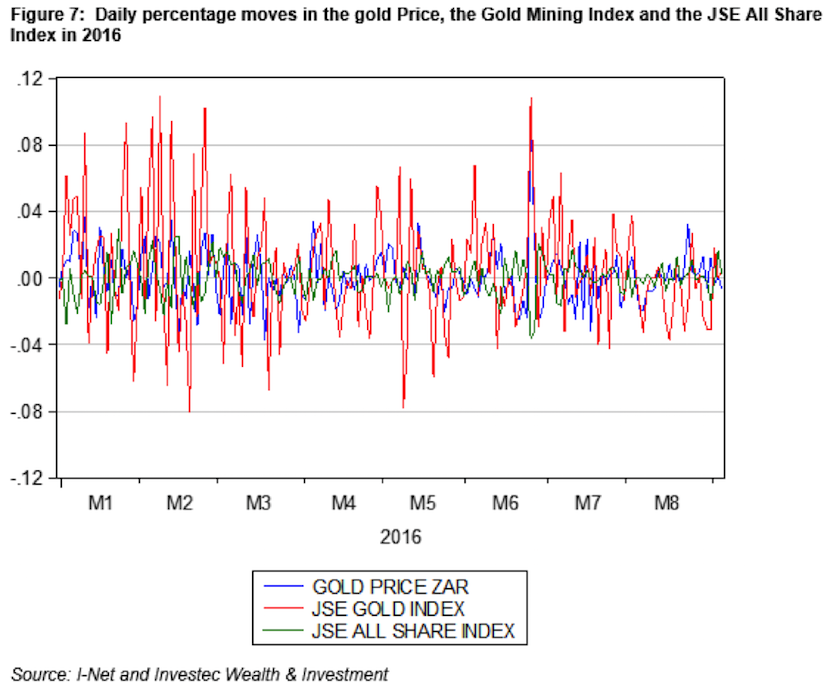

The Gold Index has also been twice as risky as the All Share Index. We show daily price moves in 2016 in 2016 in figure 7 below. When measured by the Standard Deviation of these daily percentage price moves, Gold Mining Shares listed on the JSE have been about twice as risky as the JSE All Share Index in 2016. The JSE All Share Index however has proved only slightly less risky than holding a claim on the rand gold price in 2016. The same pattern holds for much of the period 2005-2016, using daily price movements. On average the JSE Gold Index, on a daily basis, has been about twice as volatile as the All Share Index and the rand gold price. Thus the risk adjusted return expected from the gold mines would have to be significantly higher than that expected from gold itself, or from a well-diversified portfolio of JSE listed shares, to command a place in a risk averse portfolio on its risk adjusted expected retrun credentials alone. The case for gold in a portfolio must therefore be based on its capabilities as a risk diversifier and as insurance against financial crises. This case is made below.

Doing well out of trading gold shares surely would have demanded exquisite timing – both when to buy and when to sell. It is not a sector to buy and hold stocks for the long term. It is a highly cyclical sector of the market, with no long term growth prospects. And as we have illustrated, investing in gold mines, rather than in gold, is much more than an investment in the gold price. It is an investment in the capability of the mine managers to extract profits and dividends out of gold mines that are the quintessential declining industry.

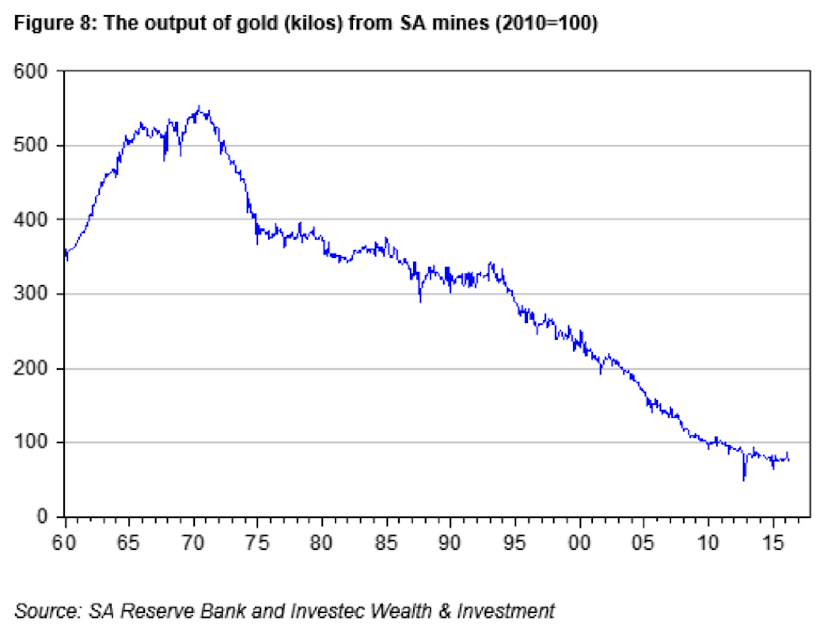

Gold mines run out of gold as SA gold mines have been doing consistently for many years. Deeper mines are more costly and dangerous to operate and green field expansion is subject to more expensive regulation, to protect the environment as well as miners. All these considerations help make the case for gold over much riskier gold mines, though the stock of gold available to be traded will remain many times annual output over the long run. The market for gold is a stock market rather than a flow market. It is demand for the stock rather than extra supplies that drive the price.

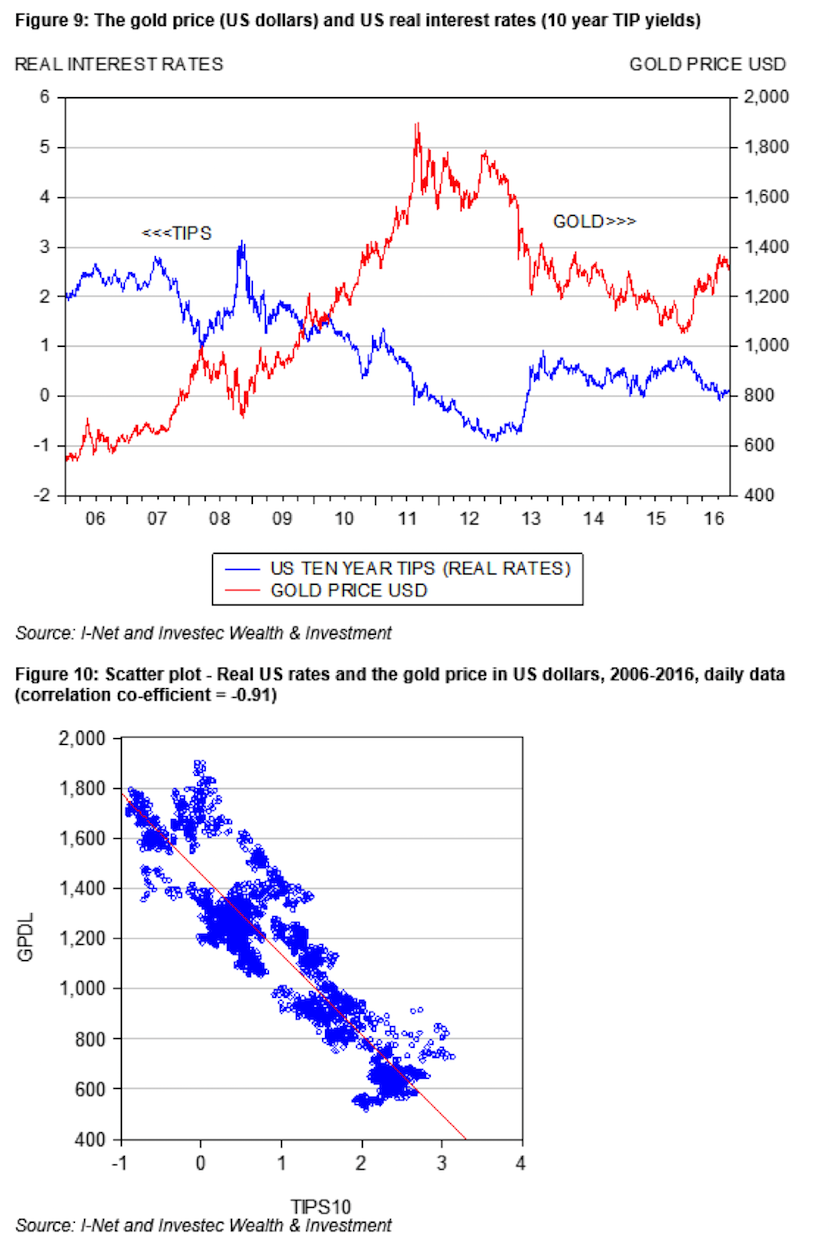

It would appear easier to explain the price of gold than the value of a gold mine. Since gold does not pay interest, the cost of holding gold is an opportunity cost – income from other assets foregone when holding gold. Using US real interest rates – the real yield on a US Inflation Linked Bond of 10 year duration has done very well in explaining the US dollar value of an ounce of gold since 2006. The correlation between the daily level of the gold price and the real interest rates has been as high as a negative (-0.91) (see figures 9 and 10 below). In other words, as the cost of holding gold has gone up or down (as measured by the risk free real interest rate) the gold price in US dollar has moved consistently in the opposite direction. Real interest rates in the US fell consistently between 2005 and 2011 encouraging demand for gold – then increased to a higher level in 2013, where they stabilised until declining again in 2016, providing it would seem, a further boost to the price of gold. These real interest rates reflect the global demand for capital to invest in productive assets. They have been declining because of a global reluctance to undertake real capital expenditure and so to borrow for the purpose. Low real interest rates reflect slow global growth. And so gold has been a good hedge against slow growth, as well as insurance against financial disruption.

Inflation-linked US bonds have provided some protection against the S&P 500 – the daily correlation between the 10 year TIPS yield and the S&P 500 Index was a negative (-0.43) between 2006 and 2016 while the correlation between the S&P and the level of the gold price is a positive, though statistically insignificant (0.18). The correlation of daily moves in the S&P and the TIPS yield is a positive (0.23) and negative (-0.20) between daily changes in the gold price and the S&P. As important, the correlation between daily moves in the gold price and the S&P 500 are close to zero. Gold has been a useful diversifier for the S&P Index. For rand investors the diversification benefits of holding gold – valued in rands is equally impressive. There has been a very close zero correlation between daily moves in the rand gold price and the JSE ALSI. The correlation between the daily moves in the ALSI and the Gold Index has been 0.31 and between the gold price and gold index 0.34. The correlation of the Gold Index (rand value) and the dollar price of gold is higher (0.40).

It will be understood that portfolio construction can benefit greatly from combining assets or asset classes with low or even better negative correlations of returns – or in other words prices that go up when other go down and vice versa. (or at least do not move consistently in the same direction) Including such hard searched for assets in portfolios can improve the trade-off between risk and expected returns. Helping realise more returns for the same risk- or less risk for the same return. Gold in a South African portfolio appears to serve as well as cash in this regard – with similarly low daily correlations with the JSE All Share Index

This past performance suggests that gold can be held in the portfolio as a potentially useful hedge against economic stagnation – stagnation that means low real interest rates – and also as insurance against global financial crises. The case for gold shares is much more difficult to make on the basis of recent performance. The problem with holding gold shares is the difficulty and predictability of turning a higher gold price into higher earnings for shareholders. Shares in gold mining companies comes with operational risks. If the gold miners could resolve these operational issues then gold shares could become a highly leveraged play on the gold price. The share price would then reflect the increased value of gold reserves: gold in the ground as well as gold above it.

Not all gold mines will be alike. The search should be on for gold mines with significant reserves of gold and highly predictable operating costs and taxes and regulations. The more highly automated a gold mine, the better the mine will be in this regard. Gold mines with these characteristics could give highly leveraged returns to changes in the gold price – in both directions – making them more attractive than gold itself for insurance and risk diversification.

- The views expressed in this column are those of the author and may not necessarily represent those of Investec Wealth & Investment.

- Brian Kantor is chief economist and strategist at Investec Wealth & Investment.