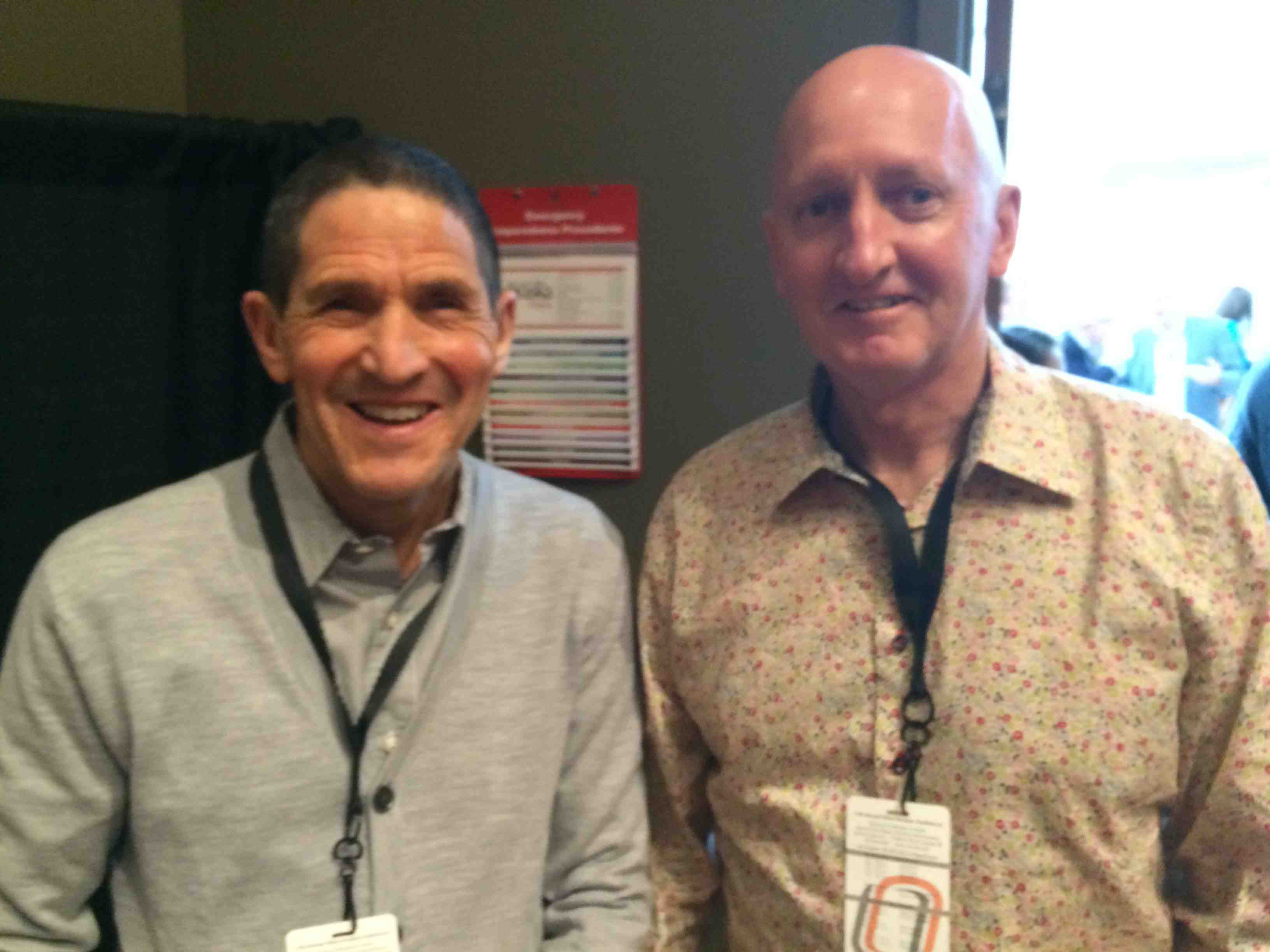

Immediately after the 2014 Value Investor Conference in Omaha I grabbed the Sasfin duo David Shapiro and Duncan Studer for their insights. As you’ll hear from this entertaining podcast, David Shapiro’s eyes were opened by the way shale gas is transforming the USA. He is even more bullish in Sasol after realising how much the SA oil-from-coal group stands to benefit from its US investment. Listen out, too, for some reflection on the Three Golden Rules of investing. – AH

ALEC HOGG: David Shapiro and I have just finished a Value Investors’ Conference. It’s quite a lot of work, Dave.

DAVID SHAPIRO: To sit through all those talks and how it is… You need to have high concentration powers and at my age, it’s not that easy. I was nodding off a lot of the time but Alec, you learn a lot and I think it’s so important to travel, come to these conferences, and just to learn. Do you know what’s impressive? It’s just the amount of work that those fund managers do. Many of the successful ones get off their backsides, go, and visit the companies. As a number of speakers told us, you have to go and meet management face to face. You can’t do it over the telephone.

ALEC HOGG: Did you know many of the speakers here, Dave?

DAVID SHAPIRO: Not really. I knew Chuck Akre, the last one.

ALEC HOGG: He was excellent.

DAVID SHAPIRO: He was very, very quick.

ALEC HOGG: You could see he spoke with experience.

DAVID SHAPIRO: I know Pat Dorsey. He’s coming to South Africa soon. He wrote a little book on moats. He’s very, very good. I’m trying to think who else I know that might have been…

ALEC HOGG: The lady.

DAVID SHAPIRO: Oh, the lady – Jane Siebel.

ALEC HOGG: Jane worked for John Templeton.

DAVID SHAPIRO: Sir John Templeton – yes.

ALEC HOGG: And two other top investors, but anyway, she was good value. There were some outstanding talks and some were maybe not that hot.

DAVID SHAPIRO: The one I also liked, which we had to end early was on the game-changer, which is the natural gas and the impact it’s going to have on the United States – on the energy in general. That’s also something we have to cover.

ALEC HOGG: Didn’t you like the point he made about his electricity bill going down by ten percent in the last year? Come on, Eskom.

DAVID SHAPIRO: We have to note that and I think it’s going to keep going lower. I think energy costs globally are going down, so it’s not going to have the impact. I was just talking to Duncan now. The impact is going to be geopolitical as well. It’s not only economical. It’s geopolitical as well because America will become self-sufficient in energy, therefore not be an importer of energy and I don’t know how it’s going to change their attitude to the rest of the world.

ALEC HOGG: Big changes. Duncan, does he always talk a lot at the office?

DUNCAN STUDER: Dave?

ALEC HOGG: Yes.

DUNCAN STUDER: Constantly.

ALEC HOGG: What did you take out of this?

DUNCAN STUDER: Well, a lot of useful information. I agree with you about the energy story. When the costs come down its very beneficial for the overall economy.

ALEC HOGG: Yes, it is extraordinary. The whole shale gas revolution that we were exposed to here from the American perspective – reindustrialisation of the U.S. We spoke about having the first plastics manufacturers built here for 30 years. These are big changes.

DUNCAN STUDER: And we have Sasol. Sasol has $150bn investment in South Carolina, all related not to natural gas, but to gas-to-liquid, which is diesel.

ALEC HOGG: Based on natural gas.

DAVID SHAPIRO: Sure, and it’s a big investment from there. It’s up to them to make it work.

ALEC HOGG: But Sasol are ahead of the game, aren’t they, Dave?

DAVID SHAPIRO: Absolutely, and they’re welcomed into the country. The one thing is that they’re welcomed. They don’t have to give up, which unfortunately happens in our country. If you want to start something now, the government has new rules.

ALEC HOGG: Election. There’s no way those rules can be applied. The other thing he said about shale gas (although we have these huge deposits), is that they haven’t cracked the geology in other parts of the world yet. They cracked it in America, but they’re five years ahead. We should not just assume that we’re going to be able to pull this…

DAVID SHAPIRO: America allows it; that’s one thing about America. They support entrepreneurship and they support that kind of business, whereas we look for impediments. I know you’re going to do a lot more work on this shale gas presentation, but what fascinated me was how the methane creates water, so there are many elements that we didn’t know about in this plan.

ALEC HOGG: Particularly the environmentalists. You would have almost hoped that they were in the audience, because the way he went through it… He said firstly, they were upset about water. Now that’s been sorted out. The second thing was the chemical compounds that are put into the fracking. That’s been sorted out. Now, it’s some kind of small issue, so the environmentalists in South Africa are still on a different page.

DAVID SHAPIRO: They are and I think they can learn from this. Globally, you have environmentalists who are concerned about it. What he said…he’s in Pennsylvania…he said that you don’t even recognise or see the wealth. Can you imagine if they had all these huge windmills?

ALEC HOGG: We learn so much. Dave, what shares? Sasol: you already told me it’s a good long-term investment. What else, from listening here…Capitec? That jumped out at me.

DAVID SHAPIRO: Capitec, yes.

ALEC HOGG: Management.

DAVID SHAPIRO: Three things came out and Chuck Akre really reinforced it right at the end as well. You have to find a company with a good business model – and he mentioned Visa and MasterCard. The other thing is management. You have to trust management. The third thing was reinvestment. That was a big theme – the ability to reinvest profits at the same kind of growth rate, as well.

ALEC HOGG: Brian Joffe was mentioned.

DAVID SHAPIRO: Yes, Pat Dorsey mentioned Brian Joffe.

ALEC HOGG: It’s not often that you have a South African mentioned as one of the top businesspeople in the world.

DAVID SHAPIRO: What Pat said about him was that many businessmen were very difficult to analyse because they’re unpredictable and unconventional, but they keep producing the goods. I think Joffe comes into that.

ALEC HOGG: Were you sleeping during some of this? I asked you just now ‘what stocks came out of this for you’. Were there any stocks in the world that you now want to go back…you laughed at me with Capitec, but Sasol I guess, would be one. Are there any others?

DAVID SHAPIRO: MasterCard and Visa. If you noticed in the Indian presentation, the growth in the middle class – the massive growth, how many people are moving from poverty to middle class…?

ALEC HOGG: So you’re going to buy Indian shares.

DAVID SHAPIRO: Not Indian shares, but what they’re going to spend it on I think, is going to be international brand names. I didn’t understand the companies he brought up – the Indian companies.

ALEC HOGG: They’re very small.

DAVID SHAPIRO: They’re very small and I’d rather look for international companies that are going into emerging countries.

ALEC HOGG: Duncan, you said Richmont.

DUNCAN STUDER: Yes.

ALEC HOGG: Why?

DUNCAN STUDER: Well, there’s a very high return on equity, surplus cash, they reinvest well, and they have pricing power. It seems that way on most of the presentations. You mentioned Capitec as well – a very high and consistent return on equity, and they have a competitive advantage in that they can price their systems in such a way that their competitors can’t really compete.

ALEC HOGG: What was also interesting was that this was a Value Investors’ Conference and yet, it wasn’t low-cost. It wasn’t ‘cigar butts’, as you said. They were good companies. What about Discovery as an example?

DAVID SHAPIRO: I’m not sure about Discovery. I don’t know whether they’d fit into it, but what they did come through…another changing theme was ‘don’t worry if the PE is high. Rather go for good companies’ and chap admitted that he lost so many opportunities because he stuck so religiously to some of the value time strategies. Therefore, you can buy high PE because good companies will always trade at higher PE’s as well.

ALEC HOGG: That’s what Duncan was saying now with Richmont.

DAVID SHAPIRO: With Richmont?

DUNCAN STUDER: Correct.

ALEC HOGG: He’s a man of few words, this Duncan friend of yours. Is he like that in the office too Dave, or it is just because he’s with you? He doesn’t get a chance to chip in.

DAVID SHAPIRO: He has it in his head there. He just doesn’t want to share it with us.

ALEC HOGG: Oh, is this the Sasfin way?

DAVID SHAPIRO: It’s Duncan’s way.

ALEC HOGG: Dave, when are you going home?

DAVID SHAPIRO: I’m going after the meeting tomorrow.

ALEC HOGG: Straight away – Saturday night.

DAVID SHAPIRO: Yes, but I fly back to Johannesburg on Monday. One more day in New York with my grandchildren and then back.

ALEC HOGG: What time are you up tomorrow morning for Berkshire?

DAVID SHAPIRO: Five o’ clock. I was up at 5:30 this morning to go and run.

ALEC HOGG: What time are you going to be in the queue?

DAVID SHAPIRO: What I do is I’ve learned over the years, you let somebody else queue for you and book seats.

ALEC HOGG: So Duncan, you’re going to be up at 4:00.

DUNCAN STUDER: No, not for him

ALEC HOGG: Okay. Well, here we are at the Value Investors’ Conference. David Shapiro and Duncan…what’s your surname?

DAVID SHAPIRO: Studer, Duncan Studer.