The departure of Naspers’ long-time CEO Koos Bekker came over a weekend, giving punters time to reflect before voting with their chequebooks. As a result, a message of a “second sabbatical” before his return as chairman, had sufficient time to be absorbed. As did the decision to appoint a 40-something Dutch ecommerce specialist as his successor. Today was the first time I had the opportunity to talk to Bekker’s replacement as CEO, Bob van Dijk, albeit on the phone. He doesn’t have Bekker’s ease – yet – but his responses were no staccatos. We asked Naspers fan Sasha Naryshkine to watch the video recorded for CNBC Africa’s Power Lunch. His responses also make interesting reading. – AH

ALEC HOGG: South African headquartered global media group Naspers delivered some solid financial results for the year-to-end March, but the highlight was a near 80 percent surge to almost R8bn in development investments. The new CEO of the R500bn group is Bob van Dijk. I spoke with him this morning….

BOB VAN DIJK: Yes, we are investing substantially into the future. If you look at the reality of the business we’re in, we’re really seeing a number of substantial and concurrent investment opportunities, most notably in our classified business worldwide, our e-tail business, and in DTT (digital terrestrial television), and we feel those opportunities are very significant, and we are pursuing them simultaneously. Fundamentally, that’s the reason for more developments.

ALEC HOGG: It’s interesting. You talk about the e-tailing business. Here at the home, there’s a bunch of your former colleagues from Naspers who’ve started a company called Takealot.com and they have funding of R1bn from the Tiger Fund. Are you seeing the market as big enough to have both them, and your operations in South Africa, compete quite happily?

BOB VAN DIJK: If I look at the year behind us, I think both Kalahari and the competitor have shown really strong growth and the market is still in early days compared to some of other e-tail businesses across the globe. There’s a lot of further upside and I think with Kalahari, we’re now in a great position to compete in a productive market, and we have a lot of confidence in the team that we have now.

ALEC HOGG: When you say that there’s more upside in South Africa, how does it compare with a more developed country?

BOB VAN DIJK: South Africa, in terms of internet users and penetration, is still in relatively early days. I think that’s very familiar for everyone. We’re seeing that change particularly in the mobile internet. It’s going to make a huge difference in South Africa, as it’s done in many of our markets. If you take India for example, it was a market with very low Internet penetration for a long time. I think the growth in smartphones has really transformed that market to being one of the fastest-growing internet markets in the world. It’s actually well on its way to becoming the second-largest internet market after China. I think it’s very much on the back of mobile and I believe over time, we’ll see the exact same thing happening for South Africans.

ALEC HOGG: Because Naspers is a R500bn company; there’s been a lot of focus and attention on your appointment, with some pundits saying that you’re an ecommerce specialist. Are you going to be much different to your predecessor, Koos Bekker?

BOB VAN DIJK: Well, of course he leaves large shoes to fill, so I hope I’m going to be delivering as much for both the company as well as for the shareholders, as he did. I think my background in operating large internet business, I think that’s fundamentally what we’ve been doing very successfully in the last years. We’re going to do more of that going forward and we think it will serve our customer and our shareholders very well.

ALEC HOGG: What happens to the old print operations of Naspers into the future?

BOB VAN DIJK: If you look at the year that just was, the trade conditions for our printers are quite tough. I must say that I’m very proud of the Media24 team and how they’ve actually adjusted the reality of our business to the economics they faced and they’re delivering a profit for the group, which is I think is a great result. The Abril business…we have a share in Brazil that has been less ‘on-the-ball’ in making those adjustments. Media24 have done relatively well, given the tough conditions, driving profit for the group and actually investing in very exciting new business like Media24.com, a business that shows a lot of promise. It’s frustrating conditions for the base, but I think they are doing the right things and its delivering profit for the group.

ALEC HOGG: So the old print businesses themselves are going into the internet?

BOB VAN DIJK: Yes, there are selected investments that Media24 is making into the internet. Online news is actually a big focus for them, and I think they’re doing quite well.

ALEC HOGG: Abril, as you say, hasn’t done quite as well. It was interesting to see that you’ve written off that investment now in your balance sheet.

BOB VAN DIJK: Yes, that’s right. We have fully written off the Abril investment.

ALEC HOGG: What does that tell us?

BOB VAN DIJK: The market conditions in Brazil have been very tough. The advertising market in particular, with some significant requirements different to Media24. I think they’ve been slower in adjusting to the realities of their operating costs and structure, to that change in the environment and it hurt the results tremendously, to that extent that we believe the good thing to do would be a full write-off on the business.

ALEC HOGG: Bob, does it concern you when you go to bed at night that so much of the value ascribed to the Naspers shares are tied up in Tencent?

BOB VAN DIJK: Quite the contrary… I think if you look at the internet market and the size of the Chinese internet market, which is by far, the largest in the world – and actually, the growth rate compared to some mature markets – I would say that the Internet market in China has a tremendous amount of runway. I think the Tencent team is one of the strongest teams in the Internet in the world, and in mobile in particular. I believe strongly in the value of our Tencent investment. I think the fact that our market value is driven to a good extent by Tencent, is a market issue.

ALEC HOGG: But as far as you’re concerned, there’s no question that you would be wanting to unbundle that or sell it…

BOB VAN DIJK: There’s no question. I think we believe strongly in the huge potential of the Chinese Internet.

ALEC HOGG: We often discuss this with market commentators here at CNBC Africa, and some of them say it’s overvalued and they’re looking at the PE ratios, which are very high. Others say ‘we don’t always understand exponentiality and what exponential growth will do to a business’. Clearly, Tencent has had an exponential growth. Can you see it continuing and how do you unpack it there within your group?

BOB VAN DIJK: If you really want to understand Tencent, it’s best to speak to the Tencent management team. Fundamentally, what impressed me is that they’ve managed to really transform themselves and get into new business lines continuously and made the transition to mobile in a very proactive and convincing way. They’re really transforming the way the internet works and that management team has proven to be of excellent quality – very adaptable in shaping the way the Internet works.

ALEC HOGG: Much like what you’ve done at Naspers as well. I’m sure you saw the article that Michael Moritz from Sequoia Capital wrote, comparing yourselves to the New York Times. Have you had a look at that leaked document, the famous leaked document from the New York Times on where they’re going wrong in digital?

BOB VAN DIJK: I haven’t seen it. It sounded a bit lengthy, I must say. I believe it was 97 pages. I haven’t had a chance to look at it. I think the credit for the Naspers transformation goes to the team that made it happen. I think it’s deeply ingrained in the company to look carefully at what happens in the world around us and make sure we adjust early on, and are not surprised.

ALEC HOGG: So even though Koos (Bekker) is not around with you on a day-to-day basis anymore, the culture is there and the spirit is there.

BOB VAN DIJK: I think it’s deeply ingrained in the company. We’re more concerned about looking for what we don’t know than being happy about what we do know. That’s rather how I approach business as well and frankly, it’s the only way you survive in an Internet world, in particular. I would say it’s not only changing fast, but faster than ever before.

ALEC HOGG: Just to close off with Bob, the investment you made in development in the past year, which we started this interview with, is impressive. Are you likely to repeat about R8bn this year?

BOB VAN DIJK: Yes. We think we can see our growth expand further and we expect those developments to expand as well.

ALEC HOGG: So you’re not worried about the R5bn losses that you’re carrying on the Internet side. It will come home I guess, one day in the future.

BOB VAN DIJK: Yes, we believe that we have a set of great opportunities and if we invest, it might have short-term impact that we don’t like, but we believe the long-term direction is sound and it will translate well.

ALEC HOGG: That was Bob van Dijk, the new Chief Executive of Naspers. Sasha’s still with us in the studio. Didn’t you like the part where he says ‘we concentrate on what we don’t know, rather than on what we do know’?

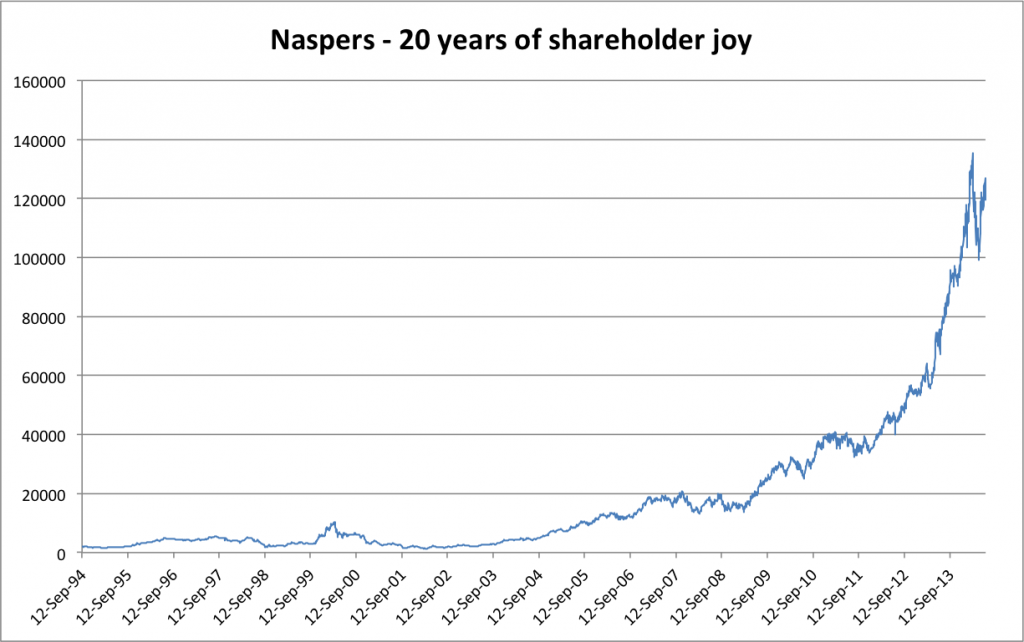

SASHA NARYSHKINE: If you look at their timeline inside of the results presentation, it says ‘print 1915’, so their original print business will be 100 years old next year. Pay TV – you would have thought that is was in the nineties: that’s in the mid-eighties. The Internet – ditto – but that’s in 1995. Did you have Internet connectivity in 1995? They started these businesses as the trend was shaping. Of course, the ecommerce 2008 – that business revenue is R20bn now, from 2008.

ALEC HOGG: Losing five billion.

SASHA NARYSHKINE: Losing five and more. Most of that is research and development.

ALEC HOGG: You’ve got to have it to lose it, but they’re making some big bets.

SASHA NARYSHKINE: Massive, and not too dissimilar to Amazon. Remember, last year Amazon invested $3.8bn in developing that business, which is automating, warehouses, it’s making sure people get their stuff within 24 hours, drones, and keeping inside the ecosystem – very exciting. Amazon trades on roughly two times sales, so you do a quick calculation. EBay trades on three-point-nine times sales, so if you want to take that ecommerce business and value it on more or less the same – plus that business is growing at over 60 percent per annum in revenue – that’s why it’s so tricky to value Naspers.

ALEC HOGG: You don’t want to say ‘two times sales on R62bn in sales” because then you’re at R120bn and it’s valued at R500bn, so you’re in a bit of a problem.

SASHA NARYSHKINE: No, because they break the ecommerce business down. Sales is R20bn so two times that is R40bn. If you take the Tencent stake, which is 33.85 percent multiplied by what Tencent closed at. It equates to somewhere around R490bn. In addition, what’s the TV business worth? Anywhere from R80bn to R90bn, so you’re getting a whole lot of businesses free.

ALEC HOGG: So you still like Naspers?

SASHA NARYSHKINE: Still holding….still buying them on weakness.

GUGULETHU MFUPHI: Alec asked him about the reliance on Tencent.

SASHA NARYSHKINE: As Bob van Dijk said it’s not a problem because that business continues to grow. Now, you must view Tencent as an ecommerce business, part eBay/part Google advertising/part Chat, so that’s a little bit like Facebook’s page for WhatsApp as well as gaming. It’s therefore an entertainment business, so it’s everything to everyone and you have this massive subscriber base as well. People forget that China was only liberalised in an Internet context – and isn’t liberalised yet, as we speak. That’s why Google doesn’t do business there.

ALEC HOGG: When we were at this Value Investor Conference in Omaha, there was a presenter who only had ten stocks in his portfolio – he’s based in Switzerland – and one of the stocks he has is Baidu. I asked him why he doesn’t have Tencent. He said it’s because he understands Baidu as it’s a lot closer to the American companies. Tencent, he says, has much better entrepreneurs than they have in Baidu, but he couldn’t really value it and that was the only reason why he didn’t have it. I like the point he makes when he says the entrepreneurs in Tencent are better, and you got that with Bob van Dijk as well, saying that they’re always looking.

SASHA NARYSHKINE: They’re all about the same age too, which is young in this context, when you consider people like Larry Ellison’s nearly 70. These guys are 40, so they’re a whole generation behind that seventies generation.

ALEC HOGG: So Sasha is a bull. I think we’ve been fairly bullish on Naspers here – Gugu and I – over the last little while, because we don’t really grasp exponentiality as human beings. However, when it was unpacked in the way that Sasha did so, it tells you that you certainly aren’t overpaying for Naspers at the moment. Of course, the big bet there is on Tencent – the big Chinese operation. That was Sasha Naryshkine from Vestact.