With its PE above 18 making it one of the JSE’s favourite retailing stocks, R51bn clothing and food chain Woolworths, today announced a 17% improvement in HEPS and in its interim dividend for the six months to end December.

With its PE above 18 making it one of the JSE’s favourite retailing stocks, R51bn clothing and food chain Woolworths, today announced a 17% improvement in HEPS and in its interim dividend for the six months to end December.

Investors, however, were expecting even more. The share price dropped 3% in immediate response to the release of the numbers. But as often happens in cases like this, once analysts have had time to crunch the numbers, they may reach a different conclusion to the one traders jumped at.

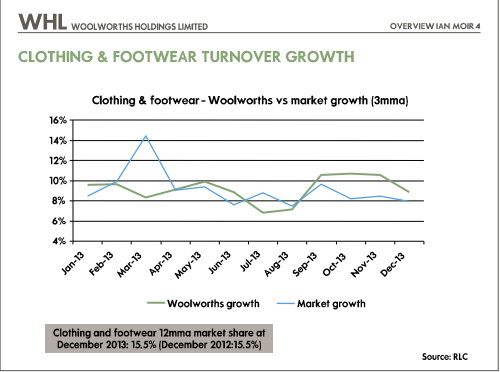

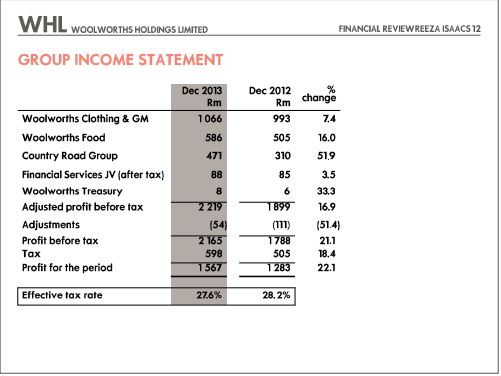

Just under half of the company’s profit is generated by the Clothing & General Merchandise business where sales grew 9.7% with around two thirds accounted for through volume growth. Woolworths says this was ahead of the SA apparel market (see graph below story).

The company says in the Food division, which accounts for a quarter of the company’s bottom line, the strategy aiming at capturing a bigger slice of the customers’ total food shop is working.

After the inclusion of recently acquired Witchery, the Australian-based clothing retailer Country Road posted sales were up 27.5% in Australian dollars. Gross margins improved from 61.3% to 63.0% and profit before tax grew 50%. The Australian operation now delivers 21% of overall profits.

After the inclusion of recently acquired Witchery, the Australian-based clothing retailer Country Road posted sales were up 27.5% in Australian dollars. Gross margins improved from 61.3% to 63.0% and profit before tax grew 50%. The Australian operation now delivers 21% of overall profits.

Negotiations for the conversion of 33 of Woolworths’ previously franchised stores in Botswana, Namibia, Swaziland and Ghana have been concluded.

Moir said trading for the first six weeks of the second half of the financial year has been positive: “We expect South African sales growth to be broadly in line with the first half and to remain ahead of the market in Australia.”

Read the full SENS release by clicking here.

Download the presentation to investment analysts by clicking here.