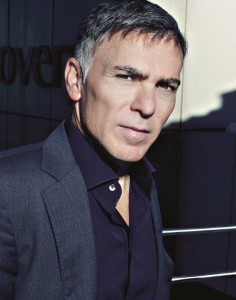

Credo’s chief investment officer Deon Gouws offers his considered views on why the US stock market has risen 9% since Donald Trump’s surprise US Presidential election victory – and warns how London would react if Jacob Zuma were to visit another Finance Ministry reshuffle on his nation. Gouws is optimistic, however, that the rumoured replacement of FinMin Pravin Gordhan is not on the cards – the performance of global investment markets and especially the Rand’s exchange rate weigh heavily against that possibility. In this free wheeling interview he also offers some long-term portfolio structuring advice and shares ideas on where to put your money in 2017. – Alec Hogg

Deon, a lots been happening since we spoke. The Trump Dividend almost, you could call it, has seen the S&P 500 index raised up 9%, since Donald Trump was elected, surprisingly as the President of the United States. How do you rationalise that?

Yes, Alec it’s an interesting one because I think there are different sides to the argument. I think on the positive side, firstly – I think the market figured out pretty quickly that Trump is a Republican first and foremost, before you start getting into the Trump specific rhetoric. Republican Governments are always better for business, and therefore for the markets, than Democratic Governments. That’s just the way they’re wired, in terms of their main policies. More business friendly, more capitalist in their outlook. Lower taxes, which is a specific Trump policy point as well. So, the market figured that out on day one. We know that overnight the market collapsed by 5% or more, when the presidential result came to be known but that very next day markets were actually up, and soon after that we were hitting all-time highs, and we soon got the Dow to nearly 20-thousand, which people are still talking about, more than a month later. That’s the first point, is the core Trump policies. I mentioned the tax and I saw an analysis the other day that for the typically domestically focussed US company it could have an impact of something between 14-29% in their earnings, going forward from this year onwards, and that’s a big impact.

That’s huge.

It is but you’ve got to understand the tax that people paid – it’s not as simple as just applying a lower tax rate to the historic profits of the company. There’s some gearing impact in there given the kind of incentives at play and the way the numbers work. I think that’s been some of the main reasons why share prices have run ahead of themselves – on the positive side. On the negative side – I always try and convince people that I’m a ‘glass half-full’ person, and to be frank, I didn’t believe a lot of the Trump rhetoric when it came to things like trade wars and withdrawing from NAFTA and a few other things. In the same way that I didn’t really expect him to arrest Hilary Clinton on day one.

Or to build a wall with Mexico.

Exactly, well we’ll still see what happens with that one. Now, to my knowledge the wall hasn’t been built yet and they haven’t started yet, maybe they will. To my knowledge, Hilary Clinton is still not in jail and on that same basis, I didn’t think we were going to see all these trade wars and protectionist policies but then I have to admit that I’m wrong because we started seeing the first one this week, when the Trans-Pacific Partnership that was torn-up, and others potentially to follow. Frankly, as far as I’m concerned, going forward, to cut a long story short – this can’t be good news for US Inc. Yes, Donald Trump has his reasons. I’m not sure that he’s thought it through properly. I read an article on your website this morning, Alec, where they said that maybe he should have just observed for the first, I think year, was the statement in the article. Other people talk about the first 100 days. So, for him to follow through on some of these election promises, to do it so quickly – I think that’s ultimately bad news for the US economy and therefore, if I’m right in suggesting that, it can’t really be good for markets in time to come.

So, short term the markets or investors love what Trump is up to. He’s got Elon Musk now, as one of his advisors. He’s appointed Rex Tillerson as the Secretary of State. He certainly has brought a lot of new talent around him but longer term, this protectionist type approach doesn’t look like or certainly economics would suggest that it isn’t going to be positive.

Yes, and you can go back 100’s of years, in terms of the political kind of history. There’s an old quote, which I think was also featured in one of your articles a month or two ago. I certainly read about it not long ago and I can’t remember whether it was on BizNews, Alec. It was the famous quote that subscribed to Thomas Jefferson, although a lot of people say that maybe he never said it, so it’s one of those funny quotes that floats around. The simple quote that says – ‘That Government is best, which Governs least.’ Now, that’s a general point. I’m no politician here but also, when you bring it down to economics – if you govern less on the economic front, if you have less protectionist policies, if you are more in favour of free markets, which Republicans typically are, and Tories in this country typically are. Then I think that’s ultimately best for the economy, an open economy is typically better because by protectionist policies what do you do? You protect inefficient industries, for example. That’s not good for anyone. It may be good for the worker hired today, if his job is saved and no doubt he’ll be delighted and I understand that from a narrow point of view. But in 5-years’ time, if that same family can’t buy cheap goods from Amazon because it can’t be imported from China, for example – nobody is going to be happy. The population won’t be happy. The worker that’s hired may be happy but there’ll be more unhappy people. It can’t be good for the overall economy.

You know, something that occurred to me when I was reflecting on this is that the current system really suits America well. Their 5% of the global population, with 25% of the world’s GDP. Now, there’s not a whole lot of upside when you’re already outperforming by 5 times. By doing what they’re doing, they are shaking up the status quo, which may be isn’t going to work in their favour.

Absolutely, and there’s another point. I know that you’ve been talking for the last few years about the Fourth Industrial Revolution. I think a much bigger problem, when it comes to US jobs is not the fact that the cheap jobs or the lower-paid jobs are being outsourced to Mexico and China. I think it’s the fact that jobs are disappearing around the world because of machine learning, because of artificial intelligence. As recently as yesterday I saw a very interesting video clip. I don’t know if you’ve heard of AGI as opposed to AI, so artificial intelligence – the next phase is now artificial general intelligence. This is where the robot that was trained to maybe make one product, now will recognise the fact that he’s sitting on a different part of the production line and he can play a different role on the same production line. Or, another example, for a driverless car – if you are used to driving a certain kind of small car or a truck or something else. When you get into the vehicle you recognise what vehicle it is and it can actually drive all of them – that’s artificial general intelligence, as opposed to the narrow definition of artificial intelligence. These things are happening around us and that has a much bigger impact on the future of lower paid American workers, as far as I’m concerned than jobs going to China.

Absolutely, and there’s another point. I know that you’ve been talking for the last few years about the Fourth Industrial Revolution. I think a much bigger problem, when it comes to US jobs is not the fact that the cheap jobs or the lower-paid jobs are being outsourced to Mexico and China. I think it’s the fact that jobs are disappearing around the world because of machine learning, because of artificial intelligence. As recently as yesterday I saw a very interesting video clip. I don’t know if you’ve heard of AGI as opposed to AI, so artificial intelligence – the next phase is now artificial general intelligence. This is where the robot that was trained to maybe make one product, now will recognise the fact that he’s sitting on a different part of the production line and he can play a different role on the same production line. Or, another example, for a driverless car – if you are used to driving a certain kind of small car or a truck or something else. When you get into the vehicle you recognise what vehicle it is and it can actually drive all of them – that’s artificial general intelligence, as opposed to the narrow definition of artificial intelligence. These things are happening around us and that has a much bigger impact on the future of lower paid American workers, as far as I’m concerned than jobs going to China.

All right, bringing it back to the markets themselves. We’ve had a fantastic, and we’re on a good start to the year. Is it still a good place to have your money in US stocks?

I think it depends, as it always does, on a more specific basis. What I mean by that is our own investment philosophy is simply such that we research companies across the board and we try and invest in good quality companies that we understand and that you don’t overpay for when you buy them in the first place. I think on that basis, regardless of where the company is, there are still opportunities around the world and certainly lots of opportunities in America. That remains the case, so if you’re asking me on a country-by-country basis, if you were to buy a country ETF, one relative to the other and go long-short. I think I would be more cautious on the US today than maybe what I was until recently. Until I was proven wrong and, for example, the protectionist fund, as I admitted earlier. But on a case-by-case basis – a lot of the world’s best companies are still in America and I think they will survive Trump and they will survive these policies, and some of them will benefit in the short term. Yes, it’s not like we’re still very heavily exposed to the US because that’s where we find a lot of quality companies with moats around them and they’re relatively well priced.

What about the UK? We’ve seen the market here in London improving since Brexit despite some dire warnings.

Yes, it has. I do think though that it’s not as simple as saying this is the only reason but I do think one of the big reasons why the market has improved as much as it has is the currency. Before Brexit, in the months building up to Brexit the Pound averaged probably £1.45 to the US Dollar. When we went to sleep on the 23rd of June it had kicked up to £1.50, because the markets expected Brexit not to happen. Brexit happened, of course and on the 24th June, it went down to £1.40 and soon tumbled to £1.20, today it’s £1.25. The way that translates into the market of course is the fact that the FTSE has probably two-thirds of its earnings coming from offshore. Therefore, when you’ve got a fundamentally weaker currency, it will have a very geared impact, a positive impact, on the profits of those companies and ultimately, the share prices as well. That has been a very big factor.

The economy has been stronger as well, than what people had anticipated on the one hand. On the other hand I’d point out that yes, Brexit was decided 7-months ago, but it hasn’t happened yet. We haven’t really seen the impact of jobs moving to Frankfurt, Paris, and elsewhere. That’s still to come and time will tell how big that impact is.

There’s some interesting issues that came up in Davos. I was at dinner with George Soros, not sitting at his table but sitting a little way away, but he was interviewed that night and he said he did not believe that Theresa May would last for very long. Now, I don’t know if Soros is losing it or if this is a perception that is held more widely.

Yes, it’s an interesting one. I speak as somebody who, as long as I’ve had a political opinion in this country – I’ve been biased towards the Conservative Party, as is practically everybody else who works in financial markets. From that perspective I was delighted when the Tories regained the government from the old Tony Blaire regime and Gordon Brown. Then more recently, when David Cameron stepped down I was very much in favour of Theresa May because she seemed like the right candidate to me. Since then, and I speak as a Tory supporter, it has been difficult to support her and the reason I say that is her own policy points have sounded quite populist as well, and have sounded a little bit like the old Labour rhetoric on many fronts, including an anti-business like, or so it seems. There are counter arguments for that. Philip Hammond has spoken about the UK and London, specifically being a bit of a tax haven going forward but we’ll see. So, from a business point of view – one is not sure. I do think that she is standing relatively strong and I think one has to give her time to see how this whole Brexit argument plays out. I’m no politician but there’s been so much in the press about the hard-line she’s taken, as far as Brexit is concerned. I would, in the end, probably give her the benefit of the doubt and say I’m not sure she had much of a choice. If you were to weigh up my opinion relatively to George Soros – I would say back Soros, he’s definitely a much more credible commentator than I am. I would give her time and I don’t see any threat to her leadership in the very short term. I think it will all depend on how Brexit plays out ultimately and we’re still in the first innings to use an American football or, for that matter, a cricket analogy.

It’s interesting. Here we’re talking about investments and the dominant part of the conversation is to do with geo-politics, which is a similar situation when you go back to South Africa where geo-politics, once again is front and centre.

Yes, that’s right and even though we sit here in London, I know you follow it even more than I do, Alec but it’s important for both of us and for all of us. From our perspective, as a firm, we have many reasons why we want it to go well in South Africa. We have clients that are based there, we have family there, we go there a lot, so yes, very much so. I can only hope that when it comes to some of the things that I read in the newspapers – the rumours about potential changes within Government, etcetera, that they’re just rumours and that they don’t play out but I guess time will tell. We’re looking for the State of the Nation address by the President in the next few weeks and maybe we’ll get some clues there.

Let’s talk about the big elephant in the room and that is the rumour, or the rumour that Nkosazana Zuma, who is clearly her ex-husband’s tip for next president, or the one he wants to become the next president. That she will be given a senior cabinet post and that cabinet post could be the Finance Ministry where she replaces the respected Pravin Gordhan. If that were to happen how would it be viewed in London?

Let’s just unpack that. I think for her to enter the government in a senior position, I can see why that is being rumoured and I can understand the likelihood and I probably wouldn’t bet any money against that. However, with that position, being the Minister of Finance, I personally would like to suggest that I think it’s unlikely. Were it to happen – I think we’ll have a Nenegate 2.1 happening and I think the Rand will go from where ever it is today, call it R16 or R16.50 against the Pound, to R20 overnight, and similar moves against the Dollar, I’m just slightly closer to the Pound exchange rate. I think it will be viewed in a very dim light and for that same reason I frankly, at a personal level, I don’t think it’s likely to happen. Not only do I not think it’s likely to happen because I think it’s written – there’s such a record of all the consequences the last time we had the Nene affair, but I think if you look at the relative strength and stability of the South African currency over the last 12 months. Frankly, ever since Nenegate, where it improved and then it’s been stable ever since. I think with the Rand as relatively strong as it is today, and as it has been for the last month or two – I think the Rand is telling you something. I think that risk of Nkosazana being Minister of Finance is relatively small.

Well, the ANC’s presidential elective conference happens in December, which means the incumbent literally has 10 more months to impose his will or not, on the country. You don’t think that given his track record, Zuma might do something unusual? He might do the unorthodox.

He might and, I’m not a political analyst as such, but as I’ve said, the way I read the situation it may be important for him to have someone like Nkosazana in his government. As a Minister, I just don’t see it being the Minister of Finance. I guess you can’t put the probability at zero but my gut tells me, maybe it’s just the ‘glass half-full’ person in me, putting my hope on the fact that it won’t happen.

Very good news coming out of Davos and the cohesiveness between business, government and labour – not least that there’s an internship program that’s going to be kicked-off in June, to give 330 thousand new jobs for young people, which is quite extraordinary. Then that Brian Joffe and Adrian Gore, two really good entrepreneurs, have put together this SME Fund. They’ve already raised R1.5bn to support small businesses, so it almost gives you an insight into what South Africa could be if everyone pulls in the same direction.

That’s true and as you speak there, I’m reminded of Adrian Gore’s own key note address at the Discovery Summit, in September last year. I wasn’t there but I read the reports about it. He was basically, trying to tell people in the audience ‘listen the glass is half-full and stop with all this negative talk – let’s focus on some of the achievements that we’ve had in this country, and the potential going forward.’ I think very much, that fits with the ‘glass half full’’ analogy and I think it does give one a lot of hope.

All right, so looking ahead to 2017, how are you positioning yourself now, given we’ve spoken about those 3 big markets, (US, UK, and South Africa)?

Alec, our own investment approach is very much a long term focussed one and based on that we don’t try and forecast what’s going to happen and thank goodness for that because if we try to forecast Brexit or Trump – we would have got both wrong and by getting them wrong we would have probably lost a lot of money for clients. We didn’t try and forecast. Our portfolios were positioned in terms of the kind of parameters that I mentioned before, quality companies that you understand and don’t overpay for them. From that perspective it’s very much unchanged. If you do however, go and analyse it, in terms of the underlying, I do think that if you had to ask me, for example, what’s likely to happen with currencies, going forward, in the next few years, not the next few months because that’s a just a guess, but in the next few years. Is something like the Pound relative to the Dollar, the famous old cable. Are we likely to see a stronger Pound over time, or a weaker Pound? My guess is that we’re likely to see a stronger Pound, and that’s got nothing to do with the fact that Trump is the President. That’s simply the fact that around £1.20, where we were just the other day, a week or two ago, the Pound is at a, maybe not at an all-time low but a 30 to 40 year low, against the US Dollar. Logic just dictates that currencies do bounce back from these very oversold levels. Ultimately, even though I didn’t vote for Brexit, I’m a bit of a Brexit bull, and what I mean by that is I think the UK will come out of this stronger but it will take years and not months. Once that becomes clearer, in years to come, I think that’s when you’ll see the Pound recover relatively quickly. I think that partly answers the question. I think if you want to take a currency position and you’ve got a longer-term view – I think the Pound is a good currency to back, relative to the Dollar, and certainly relative to the Euro, because I think they’ve got bigger problems in Euro-Land today than we have in the UK.

That would be supported by the PWC Chief Executive Survey, another, without beating the Davos drum too hard, but another thing that came out there, the latest research, which was about 14-hundred chief executives around the world rated America as by far, their favourite destination to invest in. China was second, Germany was third, and fourth was the UK.

Yes, I actually read the coverage on your site this morning about that and I would agree with that. As I said, I think Europe has a lot of problems, with post-Brexit, with Germany having lost its biggest, closest, and most profitable, financially strongest partner, within Europe. I personally, take a pretty dim view of the future for Europe and I think Germany will suffer as a consequence, if I’m right. If the European Union actually does break up over time, which looks very possible if you look at what’s happening in Italy and elsewhere, as far as populous referendums are concerned. Then I think it can’t be great for Germany and I think that’s why the UK has overtaken Germany in that survey. Yes, with a slightly longer term view, which is hopefully what’s in the chief-executive minds’ when they filled in that survey – it doesn’t surprise me that much that the UK remains a good destination. In fact, it seems to be a slightly better destination.

Yes, I actually read the coverage on your site this morning about that and I would agree with that. As I said, I think Europe has a lot of problems, with post-Brexit, with Germany having lost its biggest, closest, and most profitable, financially strongest partner, within Europe. I personally, take a pretty dim view of the future for Europe and I think Germany will suffer as a consequence, if I’m right. If the European Union actually does break up over time, which looks very possible if you look at what’s happening in Italy and elsewhere, as far as populous referendums are concerned. Then I think it can’t be great for Germany and I think that’s why the UK has overtaken Germany in that survey. Yes, with a slightly longer term view, which is hopefully what’s in the chief-executive minds’ when they filled in that survey – it doesn’t surprise me that much that the UK remains a good destination. In fact, it seems to be a slightly better destination.

Well, they’re just behind Germany still, so the Germans are still a little bit ahead.

Forgive me, I read that wrong, but yes.

Generally speaking now – the world is changing. It’s become a more turbulent place. No one can really call Trump yet. No one call really call Brexit yet. We are hopeful in both instances but that’s about as far as you can go but in structuring your investment portfolio – still with equities, do you still stay there or are you building up cash because of nerves?

Ultimately, Alec, I want to quote one of the people that I know you read widely as well, Charlie Munger, Warren Buffett’s partner. Where they have made a lot of money over a lifetime of investing, by being structurally in equities. Where Charlie Munger says that if you can’t stomach, and I think he mentions a 50% draw-down. He says, then you shouldn’t be in equities in the first place because if you’re going to be in the markets for a lifetime, like they’ve been, he said you’re going to live through that, two, three or four times in a lifetime. I want to bring that back to the question. As far as I’m concerned – if you’ve got the right risk profile, if you’ve got a long term view it won’t be true for everybody. There are people who can’t afford equity risk and certainly not with a 100% of their portfolio but if you’ve got the right risk profile and a long-term view. I think ultimately, the equity risk premium is what creates wealth over time. From that perspective I never try and call a crash in the market. Bearing in mind that the same question that you’ve just asked me – you might have asked me and certainly other people have asked each other, commentators have speculated about for the last few years. Markets have been demonstrably expensive, 12 months ago, 24 months ago, and 36 months ago – it only feels more volatile today than in the past because we’ve got all these big news events but markets are never really certain if you try and look forward. We often make up narratives about what’s happened in the past but they’re never easy to forecast if you’re actually trying to look into the future. From that perspective, we remain constructive as far as our portfolios are concerned, for clients with an appropriate risk profile. We remain exposed to equities. We think the way to manage risk is not to move the cash but is simply to buy quality and not to overpay for it.