If you find yourself in the Warren Buffett basket of thinking, then this contribution is not for you. Why? It looks at gold as an investment, something Buffett doesn’t. One of his famous quotes on the subject – “Gold has two significant shortcomings, being neither of much use nor procreative.” But for Financial Hub’s David Melvill, gold is currently offering South African investors an opportunity. Given the rand’s strength, the local gold price, which can be purchased through Krugerrands, is offering a 10% discount. But be cautious, as Melvill himself admits, he doesn’t pretend to have the answers, and in the short-term anything can happen. – Stuart Lowman

By David Melvill*

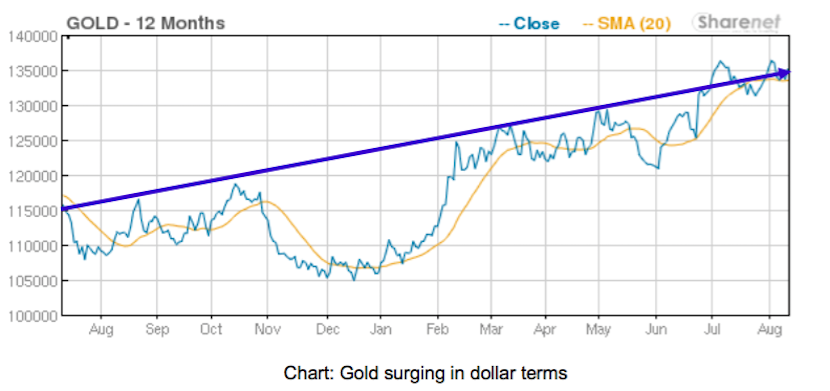

This is just a quick update on the gold price for you over the last 12 months.

Most importantly we as South Africans must remember there are two factors at play when measuring the gold price: the dollar price of gold and the conversion currency factor in rand.

In the first chart below (gold measured in dollars) you will note that gold has been in an upward surge. It has rallied from $1 150 to $1 350. That is an increase of $200 or 17%. A tidy profit for the year indeed. More importantly, this upward trend is very strong

In the next chart below (gold measured in rand) you will note that gold price was in an upward climb for the first 7 months of the 12 month period. We saw an ounce of gold rally from R 14 000 to R 20 000. That is an increase of R6 000 or 42% (the blue line). This was largely due to the weakening in the rand’s value.

Since then the Rand has strengthened over the last five months from R17 to R13,40 to the dollar. That is a very significant trend reversal, it is a 21% rand improvement.

This means that the gold price in rand is down from R 20 000 (its peak) to R 18 000 (today). That is R 2 000 down or a 10% correction (the red line).

Will the rand continue to strengthen?

I really do not know. There is a strong likelihood though, that it will. Why? The rand when compared to its purchasing power parity is three standard deviations away from where it should be. (This means that a basket of goods should cost the same in South Africa as in the United States once you take the exchange rate into account). It does not. Therefore the odds are that the rand will revert to its mean (the long term average).

This does not concern me though, I am comfortable with this, as I am looking for a far higher dollar gold price. What we lose in rand strength, we will exceed in a surging gold dollar price.

Read also: Lawrie Williams: Making sense of gold boom – how to play it from here

Many would disagree with me and would believe the rand will continue to weaken largely for political reasons. The Cadiz director and mining analyst, Peter Major says, “Political reasons are temporary and cause short term fluctuations, it is rather economic reasons that will cause the rand to weaken.”

There remains a risk that we could get downgraded on our sovereign debt status to junk status, this will definitely cause rand weakness. Our minister of finance, Pravin Gordhan, is doing an excellent job to try and avert this. Our last quarter of GDP revealed negative growth and if this quarter follows in its wake, we will officially be in recession. This will definitely be bad for the rand and I see it weaken accordingly.

The US$ gold price surged 25% – the strongest H1 price gain since 1980. Learn more here: https://t.co/zNL3IAgve9 pic.twitter.com/SkjkahF6Uf

— World Gold Council (@GOLDCOUNCIL) August 11, 2016

Therefore if the rand weakens, let’s see it as a bonus, that way we will not be banking on it. The world has far bigger problems, we are involved in the biggest monetary experiment in our life time. There was a wave of cash released by central banks into the market which have pushed up asset prices. There are huge dangers lurking if these asset prices start to rerate. The world has unprecedented debt, global growth is flat and interest rates are negative (no return after inflation). This must be a far bigger problem, which could ultimately lead to dollar weakness, more than the possibility of the rand strengthening.

What should we be doing?

In the light of the above, I believe it is prudent to start or be adding to your Krugerrand portfolio. Due to rand strength, there is effectively a “window of opportunity” – a discount of 10%. Krugerrands have stood the test of time. They offer a wonderful store of wealth, an uncorrelated asset (meaning when one asset tends to move up, another goes down) and a hedge against currency depreciation.

I don’t pretend to have all the answers, in the short term anything can happen, but this I know, the gold price has been pressed down for various reasons. In dollar terms it is roughly 30% off its high of $1 921 some five years ago. It has started its rally from the low base of $1 050 in January and it appears determined to make its ascent for a new high.

- David Melvill, Financial Hub