By Alec Hogg

Back stories are usually more interesting than published ones. Ditto, for broadcast media, the chat before and after the microphone is on.

I had one of those moments earlier in the week when chatting to Capitec CEO Gerrie Fourie. He is in London for a couple days as part of Investec’s November equivalent of investment speed dating. The SA-born group brings CEOs of a few SA companies to meet dozens of existing and potential investors from the City of London.

___STEADY_PAYWALL___

It’s become a regular in the Capitec calendar and no doubt helped increase its foreign shareholding to 18%. Without trying to call the immediate direction of the bank’s share price, this kind of exposure certainly won’t hurt the stock in the coming weeks.

But back to the point of today’s missive.

As a personal convert to the Capitec offering of simplicity, convenience and low charges, international expansion is an obvious question when interviewing the team. Especially after former CEO and now chairman Riaan Stassen whispered his only regret was not having had the time to try the model outside the country.

So, naturally, I prodded Stassen’s successor on the topic while the microphone was on. He gave the eminently sensible response that banking is changing everywhere, so any expansion would surely be digitally based. Hence his trip, again, to Silicon Valley last week for a close look at a financial services incubator.

But what happened after the formalities ended was even more interesting.

It stemmed from sharing experiences of the pathetic service of UK High Street banks. That is logical consequence, I mused, from endless contraction of staff numbers, frozen salaries and and absent bonuses, used to settle numerous fines from the regulators.

Ah, said Gerrie, but have you not come across Metro Bank?

He was referring to the UK equivalent to Capitec whose branding looks a little too close to the European retailing group of the same name to have registered with me. A little research, though, exposed my oversight. The more one looks into Metro Bank, the more interesting it becomes.

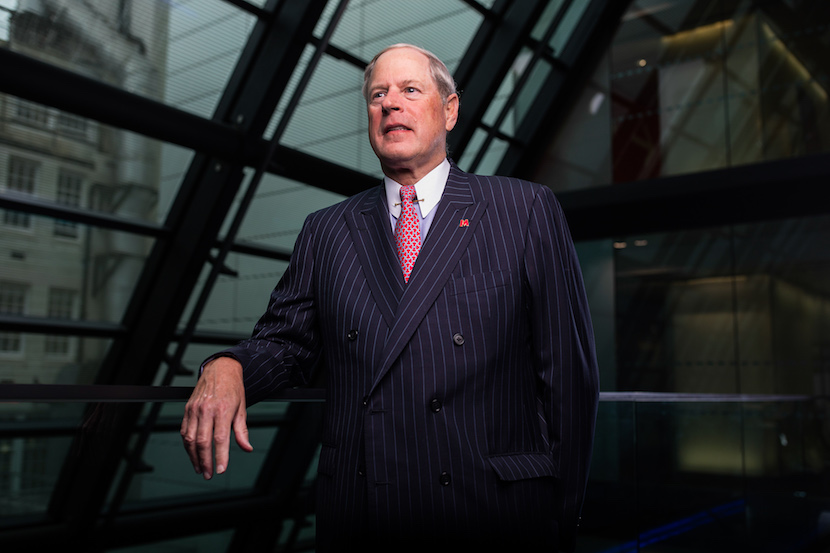

It was founded by a no-frills American entrepreneur Vernon Hill (71) who enjoyed early exposure to retailing through his real estate business. He obviously paid attention when regularly driving McDonalds founder Ray Kroc on scouting missions to buy suitable properties.

In 1973, as a 26-year-old, Hill founded Commerce Bancorp in New Jersey, based on a model that profitability lay in treating each outlet as a store. Staff were incentivised to focus on volume by maximising the number of deposits and accounts.

Hill introduced a lot of other unorthodox ideas and Commerce Bancorp grew from a single branch in 1973 to 470 in 2007 when he sold the whole outfit to Toronto Dominion Bank for a staggering $8.5bn.

Fast forward to 2010 when Hill launched Metro Bank with a branch in central London’s Holborn. It was the first retail bank to be started in the country in more than a century. And like his old Commerce Bancorp (which the new owners killed by merging it into their existing operations) Metro is mushrooming.

Metro is the closest you’ll come to a carbon copy of Capitec.

It offers simple products, low transaction fees and stays open much longer (from 8 to 8 most days). Just like the SA disruptor, Metro views itself as a retailer rather than a traditional bank, calls its outlets “stores” and works on turning its customers into ambassadors or in Hill speak “fans who we continue to amaze…”

Hill has also repeated something that worked for him in the US with Metro welcoming pets into the outlets, encouraging their owners by providing biscuits and water bowls. The bank even pays “fans” for adopting pets from the Battersea sanctuary – £105 for a dog and £65 per cat.

Growth rates are also Capitec-like. In the September quarter, revenues were up 78% year-on-year; annualised lending grew 73% and deposits 66%. From that standing start six years back, the 44th branch was opened last month with another four planned before the end of 2016.

After a capital raising exercise, the company’s shares were listed on the London Stock Exchange in March this year. They traded down from the initial £21.50 a share to bottom out at £16.23 after the Brexit shock. That was the perfect buying opportunity as the shares have risen since to their current £31.37.

But given its South African double’s experience, the rebound may well prove to be just the beginning. Since listing in 2002, Capitec’s share price has enjoyed compound annual growth of 52%. And that was after it went nowhere for the first couple of years.

Overlaying Capitec’s performance onto Metro Bank, a repeat of such returns would turn a £1 000 investment today into £65 000 in ten years. Sounds insane doesn’t it?

But given what Gerrie Fourie told me, Hill’s successful track record with the model and my own experience of its pathetic competition, Metro is a banking horse well worth backing. Some advance warning for you. We intend making a switch into the counter in the Biznews Global Share portfolio next week.