By Alec Hogg

In an investment world which pays too much attention to “quarteritis”, it’s unusual to come across a business which requests its financial progress be judged on a Five Year Plan.

Given African Bank’s history, few would deny it such leniency. And on that basis, results for the half year end March 2018 released today will delight those who bailed out an organisation which less than four years ago was on the brink of disaster.

The solid base being built at the SA financial sector’s phoenix should also encourage sceptical retail savers to take another look at highly attractive interest rates (up to 10.5%pa) available from a name most will remember for its existential crisis.

On a broader scale, while it’s still very early days, today’s African Bank looks to be progressing rather smoothly towards its goal of returning to its position as a leading player in the country’s buoyant secured lending sector.

As African Bank only emerged from curatorship in April 2016, this set of financials is the very first where numbers can be directly compared on a like-for-like basis.

Bottom line growth is strong at over 40% in all the main profit measures in the bank. Although off a low base, scale-wise there’s also nothing shabby about group operating profit of over R700m for the six months, the bulk of which comes from insurance operation Guardrisk and a successful partnership with MMI.

It’s notable, too, that after significant pruning, the active client base is now 1.1m. More importantly, over 13 000 retail depositors have entrusted R680m at an average of R52 000 per deposit – growth of 90% on end September 2017.

While profitability is critical, the focus is on executing a strategy which will make African bank sustainable.

Progress on this front is sure to please international bondholders who are owed billions in debt. And delight the SA Reserve Bank (50%), the PIC (25%) and SA’s top six banks (25%) which own the company after injecting R10bn in equity required to bail out a lender whose collapse threatened South Africa’s banking system.

Given the disaster wrought by the disgraced former CEO Leon Kirkinis and his cohort, there will be disproportionate attention from stakeholders on the management team. There will be comfort on this front.

This is the first set of numbers presented by the new CEO and former COO Basani Maluleke, a lawyer with an MBA (Kellogg) who was previously at RMB. Maluleke was groomed for the top job since joining African Bank in 2015 and recently took over from interim CEO Brian Riley (ex MD of Wesbank). Top retail banker Louis von Zeuner (ex Absa) is now the chairman.

Maluleke says her focus is to take African Bank back to “relevance” by 2021.

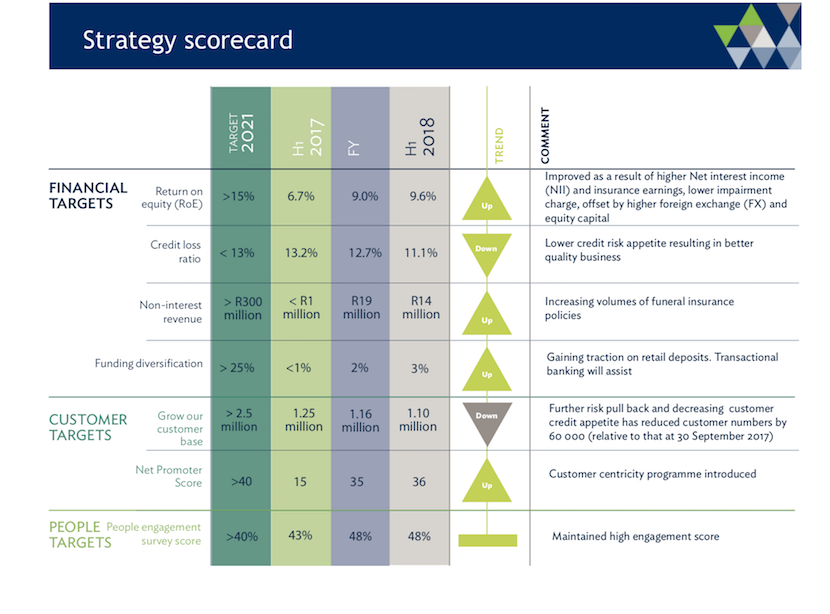

Partly because of a conservative lending policy (loans granted rose a modest 9% in the half year), bad debt write-offs, at 11.1%, are already below the 2021 target of a maximum of 13%.

With Tier One Capital of 32.6%, African Bank is comfortably the best capitalised South African institution, although is accompanied by a relatively low Return on Equity. For the six months under review, its ROE edged up from the 2017 financial year’s 9% to 9.6%. there remains a way to travel to reach 2021’s target of 15%.

On a line through these numbers, the other two big challenges for Maluleke and her team are to diversify both the revenue and funding base.

Non-interest revenue of R14m for the six months is a long way from the targeted R300m a year by FY2021. And with only 3% of the funding base from retail depositors, the goal of 25% three years hence looks even further away.

But the new CEO is confident it’s not too great a stretch.

Its MyWorld digital platform is in the practical test phase having been launched to African Bank staffers. A pleasing 53% of the staff whom are active customers (1 862 accounts). Maluleke says their usage shows there is “significant appetite” for the phone/web/call-centre product. This augurs well for future takeup from its million plus clients.African Bank expects the downsizing and revamping of its branch network will help. But its big bet, much like that by UK challenger banks, is on driving transactional revenue through the new digital initiative.

Growing the funding provided by retail deposits is perhaps a greater challenge. Market-topping interest rates do help. But the bigger task is to convince a sceptical public the new African Bank is a very different animal to the old. Because in banking, trust is the most valuable commodity by far.

This set of numbers will send a message that the phoenix is now in rude financial health. Successfully executing on its Five Year Plan, though, will require an equally successful approach to the softer stuff. Thus far, the portents are good.

| African Bank Holdings | 1H 2018 | 1H 2017 | % rise | |

| Operating profit (Rm) | 494.0 | 345.0 | 43% | |

| Pretax profit (Rm) | 715.0 | 501.0 | 43% | |

| Net profit (Rm) | 448.0 | 315.0 | 42% | |

| Insurance earnings (Rm) | 371.0 | 280.0 | 33% | |

| African Bank Limited | ||||

| Operating profit (Rm) | 123.0 | 83.0 | 48% | |

| Net profit (Rm) | 77.0 | 53.0 | 45% | |

| Net advances (Rbn) | 18 969.0 | 18 743.0 | 1% | |

| Cash deposits (Rbn) | 8 638.0 | 12 862.0 | -33% | |

| Capital Adequacy Ratio (Tier 1) | 32.6% | 32.0% | 2% |