(Bloomberg) – Platinum prices are languishing near decade lows, yet investors in the No. 1 supplier of the metal haven’t had it this good for years.

Anglo American Platinum Ltd. declared its biggest dividend since 2008 as the company reported full-year earnings that nearly doubled, thanks to a weaker rand and surging prices for sister metal palladium. The Johannesburg-based miner’s shares have risen 104% in the past 12 months.

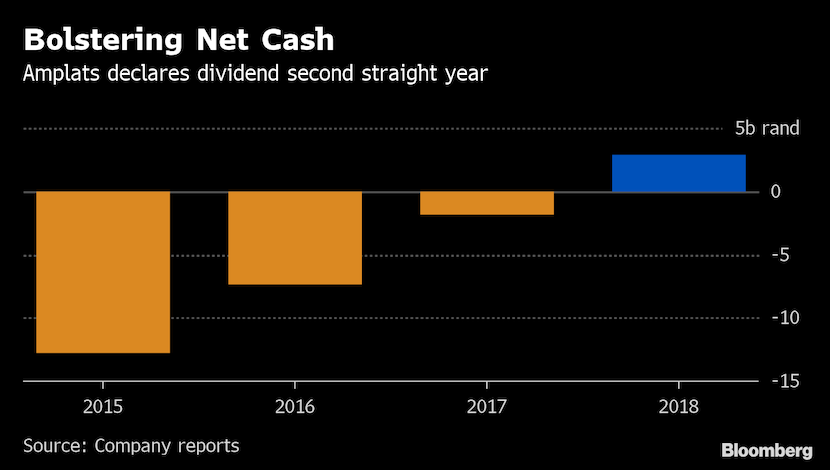

While rivals such as Impala Platinum Holdings Ltd. and Lonmin Plc are also benefiting from higher prices for palladium and rhodium, which they dig up alongside platinum, Amplats is in a particularly strong position. The company resumed dividends last February after a six-year hiatus, during which it sold and wound down older, less profitable operations.

Palladium has surged 47% to successive records since the end of August. Demand for the metal, used primarily in the auto industry for catalytic converters in gasoline engines, is projected to exceed supply for an eighth straight year in 2019. The South African currency has also weakened 18% against the dollar in the past 12 months, which lowers costs at local mines.

Amplats said it expects the three major platinum-group metals – platinum, palladium and rhodium – will again be in a combined deficit in 2019, although platinum itself will see a “modest” surplus. Palladium will be in a “strong and widening” deficit this year, the company said.

“Automotive demand seems set to increase, even with little or no growth in vehicle sales, as average vehicle size increases and emissions rules tighten,” it said.

Amplats rose as much as 2.6% on Monday to R708.89 a share, the highest since February 2011.

The company’s strong balance sheet will enable it to increase investment in projects with low capital requirements and fast payback, while it advances studies to boost output at its key Mogalakwena mine that’s highly geared toward palladium, Ian Botha, the outgoing finance director, said on a conference call.

Amplats plans to complete studies by about 2020 to add annual output of 270,000 ounces of palladium and 250,000 ounces of platinum at Mogalakwena, Chief Executive Officer Chris Griffith said. The expansion may take about four to five years, he said.

Meanwhile, Amplats expects the palladium deficit to persist until there’s a meaningful move by auto makers to substitute platinum in their designs, the CEO said.

More details from today’s report:

- Amplats, as the company is known, will return 40% of so-called headline earnings to shareholders, up from a previous policy of 30%.

- The company declared a final dividend of R7.51 ($0.53) a share, bringing the payout for 2018 to R11.25 a share.

- Net cash at the end of 2018 increased to R2.9bn, from net cash of R500m at mid-year and net debt of R1.8bn at the end of 2017.