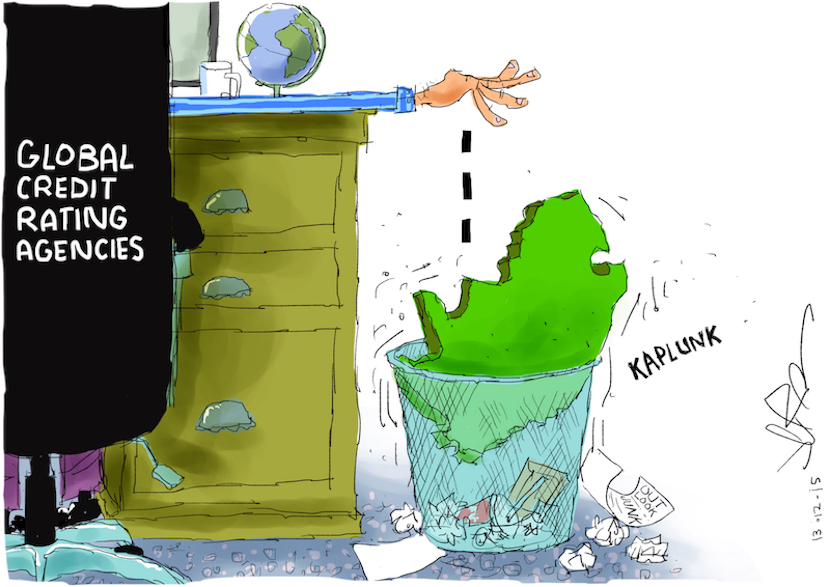

As the coronavirus spread its tentacles to South Africa; the last investment grade rating that the country was desperately hanging on to was cruelly whipped away by Moody’s, 25 years after it was first awarded. As the mat was plucked from under the country’s feet, Fitch delivered another blow, pushing the country deep into junk at the end of April. The rand plunged to a record low and the loss of an investment-grade rating meant that rand bonds were excluded from the FTSE World Government Bond Index. It raised the question of whether it was right for Moody’s, Fitch and S&P Global to slash assessments of vulnerable companies and countries all over the world, in crisis times. The agencies say they are simply reacting to changed circumstances reflecting sudden strains that have emerged during the outbreak. But there is also concern that ratings were set too high before the coronavirus which stem from the business models of the agencies, which are paid by governments and companies. In this article in The Conversation, UCT’s Misheck Mutize writes that the ratings agencies’ downgrades of 10 African countries which include South Africa reflect ‘monumental bad timing’ and he suggests measures that African countries could take to curb the tremendous power of the agencies. – Linda van Tilburg

Why downgrading countries in a time of crisis is an exceptionally bad idea

By Misheck Mutize*

A number of rating agencies have downgraded emerging market economies during the Covid-19 pandemic. Their actions have raised the question: why do so during a crisis?

This is not the first time ratings agencies have adopted a pro-cyclical approach – that is, one in which bad news is simply piled on bad news.

During the 2008 global financial crisis, ratings agencies were accused of aggressively downgrading countries whose economies were already strained. Reports by the European and US Commissions found evidence that their decisions worsened the financial crisis.

Nobel laureate Joseph Stiglitz has also accused rating agencies of aggressively downgrading countries during the 1997 East Asian financial crisis. The downgrades were more than what would be justified by the countries’ economic fundamentals. This unduly added to the cost of borrowing and caused the supply of international capital to evaporate.

In addition to the issue of timing, the effectiveness and objectivity of the rating methodology continues to be questioned by policymakers. Their methodological errors in times of crisis, together with the unresolved problem of conflict of interests, leave both issuers and investors vulnerable to losses.

The procyclical nature of ratings needs to be put under check to avoid market panic. The devastating effects they add on economies that are already strained has to be challenged. The coronavirus pandemic is yet another episode to prove this.

Questionable decisions

Ten African countries have been downgraded since the Covid-19 pandemic started – Angola, Botswana, Cameroon, Cape Verde, Democratic Republic of the Congo, Gabon, Nigeria, South Africa, Mauritius and Zambia.

These decisions were based on expectations that their fiscal situations would deteriorate and their health systems would be severely strained by the pandemic.

Read also: Time to re-assess efficacy of financial canaries Moody’s, S&P and Fitch

But, in my view, the downgrade decisions reflect monumental bad timing. I would also argue that, in most cases, they were premature and unjustified.

Since international rating agencies have tremendous power to influence market expectations and investors’ portfolio allocation decisions, crisis-induced downgrades undermine macroeconomic fundamentals. Once downgraded, like a self-fulfilling prophecy, even countries with strong macroeconomic fundamentals deteriorate to converge with model-predicted ratings. Investors respond by raising the cost of borrowing or by withdrawing their capital, aggravating a crisis situation.

- South Africa was stripped of its last investment grade by Moody’s. The rating agency cited a rising debt burden of 62.2%, which was estimated to reach 91% of GDP by fiscal 2023; and structurally weak growth of less than 1%, which was estimated to shrink to -5.8%. It was hoped that Moody’s would delay its rating action to see the impact of the coronavirus onshore and the country’s policy responses. The pro-cyclical effect of the downgrade magnified the impact of the lockdown. Fitch further pushed it deep into junk a week later.

- Fitch cut Gabon’s sovereign rating to CCC from B on 3 April 2020. The rationale for the downgrade was that agencies expected the risks to sovereign debt repayment capacity to increase due to liquidity pressure from the fall in oil prices.

- Moody’s revised Mauritius’s sovereign rating outlook from Baa1 stable to negative on 1 April 2020. Moody’s said the downgrade was driven by the expectation of lower tourist arrivals and earnings due to the coronavirus. Both would have a negative impact on the country’s economic growth.

- Nigeria was downgraded by S&P from B to B- on 26 March 2020. The reason was that Covid-19 had added to the risk of fiscal and external shock resulting from lower oil prices and economic recession. Yet the investment grades of Saudi Arabia and Russia were spared.

- S&P also downgraded Botswana – one of the most stable economies in Africa – which had an A rating. The agency cited weakening fiscal and external balance sheets due to a drop in demand for commodities and expected economic deceleration because of Covid-19. Botswana’s downgrade came four days after it went into a lockdown and before it had recorded a confirmed case of Covid-19.

These downgrades deep into junk impose a wave of other problems, worse than Covid-19. They cut sovereign bond value as collateral in central bank funding operations and drive interest rates high. Sovereign bond values are grossly discounted, at the same time escalating the cost of interest repayment instalments, ultimately contributing to a rise in the cost of debt. A wave of corporate downgrades also follows because of the sovereign ceiling concept – a country’s rating generally dictates the highest rating assigned to companies within its borders.

Solution

In response to the pro-cyclical Covid-19 induced downgrades, African countries need to implement these four measures.

First, to curb the pro-cyclical nature of rating actions that disrupt markets by triggering market panic, the timing of rating announcements needs to be regulated. Regulators of rating agencies such as the Financial Sector Conduct Authority in South Africa have the power to determine the timing of rating. In times of crisis, rating agencies should defer publishing their rating reviews as markets have their way of discounting risk when fundamentals are conspicuously changing.

Second, the rules of disclosure and transparency should be enhanced during rating reviews. Rating methodologies, descriptions of models and key rating assumptions should be disclosed to enable investors to perform their own due diligence to reach their own conclusions.

Third, in collaboration with other market regulatory bodies in the financial markets, transactions that unfairly benefit from crisis-driven price falls should be restricted. This includes short-selling of securities – a market strategy that allows investors to profit from securities when their value goes down.

Lastly, African countries need to develop the capacity for rigorous engagement with rating agencies during rating reviews and appeals. They need to make sure that the agencies have all the information required to make a fair assessment of their rating profiles.

The African Union and its policy organs need to fast track the adoption of its continental policy framework of mechanisms on rating agencies’ support for countries. This will assist them to manage the practices of rating agencies.

- Misheck Mutize, Post Doctoral Researcher, Graduate School of Business (GSB), University of Cape Town. This article is republished from The Conversation under a Creative Commons license. Read the original article.