LONDON — Falling in love with South Africa becomes a lifelong passion. Ask Peter Hain, 67, the high profile British politician who spent most of the first 16 years of his life in the country. The energetic Hain enjoyed iconic status in the 1970s when leading the ultimately successful anti-apartheid campaign calling for a global boycott of South African sport. After a successful career in British politics, a couple years back Hain was recruited as a visiting professor by Wits University, a post which required regular visits to his boyhood home. These engagements exposed Hain to the on-the-ground reality of what was happening in SA, specifically the Zupta network of corruption. This knowledge stirring his activist roots. In recent months Hain has used his position in Westminster’s House of Lords to focus British attention on the noxious crony capitalist family with close ties to SA president Jacob Zuma. In this op-ed, Hain references recent events in the country to ring a bell on money laundering. It is a message he warns the global financial community to heed – or reap a mushrooming of Gupta-like criminality. Hain’s love affair with Africa’s young democracy is as strong as ever. – Alec Hogg

LONDON — Falling in love with South Africa becomes a lifelong passion. Ask Peter Hain, 67, the high profile British politician who spent most of the first 16 years of his life in the country. The energetic Hain enjoyed iconic status in the 1970s when leading the ultimately successful anti-apartheid campaign calling for a global boycott of South African sport. After a successful career in British politics, a couple years back Hain was recruited as a visiting professor by Wits University, a post which required regular visits to his boyhood home. These engagements exposed Hain to the on-the-ground reality of what was happening in SA, specifically the Zupta network of corruption. This knowledge stirring his activist roots. In recent months Hain has used his position in Westminster’s House of Lords to focus British attention on the noxious crony capitalist family with close ties to SA president Jacob Zuma. In this op-ed, Hain references recent events in the country to ring a bell on money laundering. It is a message he warns the global financial community to heed – or reap a mushrooming of Gupta-like criminality. Hain’s love affair with Africa’s young democracy is as strong as ever. – Alec Hogg

By Peter Hain*

Right now in the UK we are debating the new Sanctions and Money Laundering Bill. What bothers me is that we may be missing the mark. Instead of tougher sanctions for those who commit such crimes, surely it would be better to introduce a ‘failure to prevent’ money laundering offence.

Because without this amendment, you have to wonder whether the UK’s new Bill would help deal with challenges like the massive money laundering being organised from the very top of government in South Africa, the Presidency itself, the subject of my oral question on 19th October and my letter to the Chancellor of 25 September.

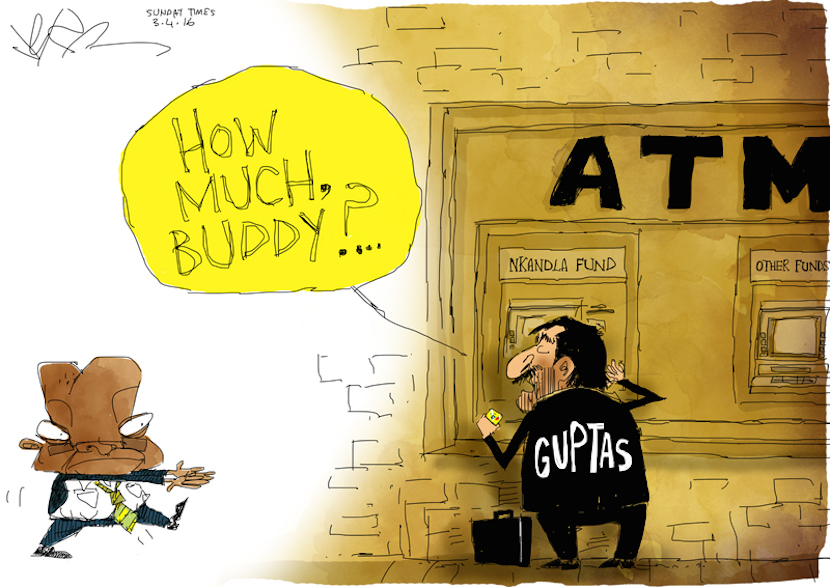

South Africa is the victim today, but unless the world deals decisively with the financial crime implications, next there will be another sovereign country and yet another – with dire consequential instability for the global economy. In which case sophisticated criminal networks, like the Gupta’s and the Zuma’s, will have the last laugh.

Corruption within, and money laundering from, a monopoly capital elite around the President’s family in South Africa show that winning the war against financial crime will require coordination, influence, action and accountability between multi-jurisdictional law enforcement agencies.

Money laundering is a key enabler of organised crime, allowing criminals to transmit multi-billion pound illicit funds into the legitimate economy, undermining its integrity and public trust.

But confronting this is difficult, partly due to fragmented information-sharing arrangements, across borders, and between banks and law enforcement agencies.

It’s all very well to develop better protection for our own country as this Bill purports to do, but without simultaneously enhancing cross-border cooperation, we will not win the war against financial crime.

In regular visits to South Africa – most recently last month – I have been stunned by the systemic transnational financial crime network facilitated by an Indian-South African family, the Guptas, and the Presidential family, the Zumas.

If there had been more proactive and genuine cooperation between the multi-jurisdictional law enforcement agencies and within and between the Banks, which have been moving money for the Gupta/Zuma laundering network, the devastation wrought on South Africa could have been significantly reduced, and perhaps the financial institutions involved may have been able to better mitigate their exposure.

I have received new information, which is still being corroborated, that the Gupta-Zuma network may be using the global metal recycling sector – some of the company names I have received have a UK presence – to launder the proceeds of their corruption.

Indeed, this preliminary information suggests that, as South African banks have shut down Gupta accounts in response to the financial crime risk they pose, so the family has simply shifted their laundering machine into the metal recycling sector, using intermediaries within these companies in South Africa, the Middle East, possibly the UK and Hong Kong, to move their funds for them.

My question therefore to financial institutions is whether their compliance departments are applying the necessary forensic eye to this “secondary-layer” threat – as primary accounts are shut down, so the illicit funds must find alternative channels – and are law enforcement agencies and regulators applying their minds, sharing information insofar as they can and acting?

Read also: Love him or hate him, Hain the Pain is back – this time, slaying Zupta corruption!

My latest information (supplied as before by South African whistleblowers deep inside the system and disgusted by the corruption at the heart of the state) suggests metal recycling is the latest conduit. But there may be other sectors these criminal networks are penetrating.

Unless we use the opportunity before us to meaningfully crack down on these criminals, they will always be one step ahead. Over the past few months, several multinational companies have either fallen or been massively contaminated as a result of their complicity in the Gupta scandal – Bell Pottinger, McKinsey, KPMG and SAP.

The US justice department and US Securities and Exchange Commission (SEC) is now investigating German multinational SAP after it apologised the other week “wholeheartedly and unreservedly” to the people of South Africa for paying over £6 million in kickbacks to Gupta companies as part of the their network of corruption headed by President Zuma and his family.

I believe it is a matter of time before financial institutions in South Africa, in the Middle East, in Hong Kong, the UK, in the US will be forced to answer hard questions about their own complicity. And they must.

I am today formally asking the US regulatory authorities to intervene as the FBI has already begun to do. I am also asking the UK Government to press the financial authorities in Hong Kong and Dubai to cut all links with the Guptas and Zumas.

But it is not only financial institutions and governments which need to ensure they are above reproach. A number of other global firms – whether legal, auditing, forensic, or advisory in nature – have provided professional services to some of these complicit individuals, companies and institutions.

These include UK based firms such as Grant Thornton and Hogan Lovells, which have conducted forensic investigations at South Africa’s revenue service (SARS) under brief from it’s Gupta-aligned head Tom Moyane.

Norton Rose Fulbright and Morrison & Foerster have assisted in the internal investigation at McKinsey into that company’s links to the Guptas. There are other examples.

I am not suggesting that these firms are necessarily complicit in the corruption – in most cases they have been employed by the complicit companies (for example, Norton Rose and Morrison & Foerster by McKinsey) to try and surface the corruption.

However, I am suggesting that it is absolutely critical that all professional firms cut their contacts entirely with any individuals or entities associated with the Guptas or Zuma families, or their associates.

Or at the very least – whatever pressure they may come under from their clients and whatever the cost is to their commission or fee – they must conduct themselves according to the highest professional standards, which most if not all have palpably failed to do so far – as we saw with KPMG, McKinsey and SAP.

To its credit law firm Cliffe Dekker recently upheld the highest professional values by boldly exposing corruption and dishonesty by senior executives at the country’s power utility, Eskom.

The complicity of our financial institutions in this, as well as the responsibility of law enforcers and regulators in all the concerned jurisdictions, should make UK Government Ministers and UK parliamentarians hang their heads in shame.

Just as they were complicit in sustaining apartheid so they are complicit in sustaining the corrupt power elite in South Africa now betraying the legacy of the anti-apartheid struggle.

- Lord Peter Hain is a British Labour Party politician who serves in the House of Lords. He was the Member of Parliament for Neath between 1991 and 2015 and was a member of the Cabinets of both Tony Blair and Gordon Brown.