Red lights are flashing at some of the key state owned entities in South Africa although the National Treasury says it is maintaining its policy stance that any intervention to support these companies must be “deficit neutral”. Entities receiving support from government will be required to provide “sound business plans” while improving governance and addressing operational “inefficiencies”. The latest figure available for fiscal guarantee exposure was near R500 billion – R469.9 billion to be exact – but the exposure was just R263 billion at the end of 2015/16 because entities had not yet used all their available guarantee facilities. Treasury appears to tend towards a cautionary outlook for four of the seven companies which had been backed by state guarantees. BizNews correspondent and Cape Messenger editor Donwald Pressly reports…

By Donwald Pressly*

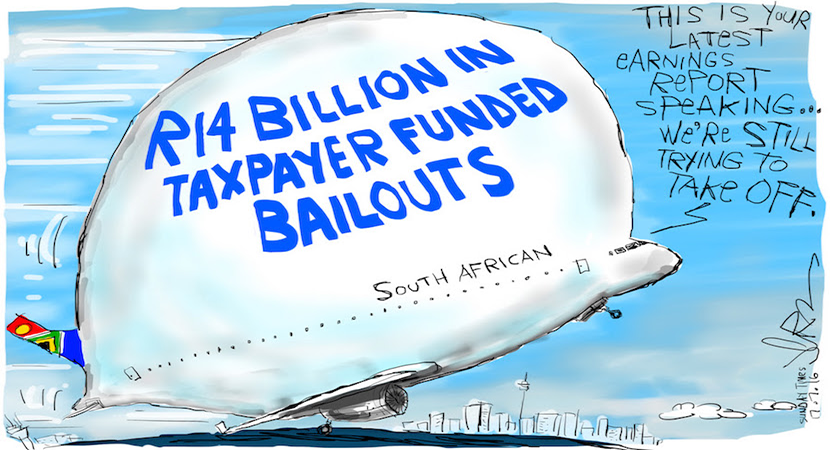

Noting that the state airline, the South African Airways has been issued a R19.1 billion guarantee facility “to ensure the company can continue to operate as a going concern”, treasury reports that the carrier “continues to post losses”. There was currently a R14.3 billion exposure against this facility”. Without the guarantees, SAA “is technically insolvent,” reports the medium term budget policy statement.

But it is noted that a new board has been appointed – something which is mired in controversy as the sitting chairperson Dudu Myeni has had her controversial reign extended – and it had been “tasked with returning the airline to financial sustainability”.

There could be a stormy path ahead for the South African National Roads Agency Limited, the body that manages the toll roads “portfolio”, as it is described in the policy statement. Treasury is candid about the liability risks here: “If government does not proceed with tolling to fund major freeways, difficult trade-offs will need to be confronted to avoid a deterioration in the national road network.” It reported that fiscal exposure to SANRAL debt stood at R35 billion as at 31 March 2016. A guarantee was put in place to support the expansion of the agency’s toll roads portfolio.

A new tolling dispensation had been implemented for the Gauteng Freeway Improvement Project – where a public outcry has occurred about the imposition of tolling. A 60 percent discount was offered to road users between November 2015 to May this year “on the settlement of the outstanding amounts”. E-toll collections and auctions were still closely monitored against projected collection levels to ensure recovery, it is reported. Significantly Treasury reported that the national government and the Gauteng provincial government “will supplement e-toll revenue”.

#Gordhan has perfect opportunity to sell #SAA & all these non-performing #SOE's instead of taxing South Africans again in 2017#MTBPS2016

— Ricardo Mackenzie (@ricardomackenzi) October 26, 2016

The Passenger Rail Agency of South Africa is also a source of concern for the Treasury. The fiscus has committed R53 billion to fund PRASA’s purchase of new rolling stock and signalling equipment. The Auditor General and the Public Protector “have found weak expenditure controls and contract management in this programme”. This raises concern, Treasury reported, that PRASA “will not be able to complete the programme on time and within budget. In addition, projected declines in PRASA’s fare revenue and ridership numbers raise concerns about the company’s sustainability”.

Noting that the period ahead “suggests that fiscal risk is elevated, primarily because the potential for weaker-than-expected economic performance threatens the revenue forecast, the National Treasury noted that the outlook for contingent liabilities – including the fiscal exposure to the state owned companies – “is a source of vulnerability”.

Fiscal and macroeconomic policies were designed to “reduce these risks”, however.

The Road Accident Fund remains a major source of concern. The RAF’s liabilities at the end of March 2016 were revised up to R155 billion – from R132 billion reported in the February Budget. It is protected to grow to R345 billion by 2019/20. “The RAF has been insolvent for over 30 years, despite having a dedicated stream in place to settle claims,” it is reported.

Treasury noted that one could not exclude the possibility of increases in the RAF fuel levy. “Government has not yet tabled legislation to create a new equitable and affordable benefit arrangement to replace the fund.”

We believe Gordhan faces 5 challenges in #MTBPS2016:

Economic Growth📉

Fiscal Consolidation

SOE's✈️

Student Funding

Ratings Downgrade⬇️— Democratic Alliance (@Our_DA) October 24, 2016

The National Treasury paint a more optimistic picture of the Land Bank, the South African Post Office and Eskom. Government has a R4.4 billion guarantee exposure to the SA Post Office. “A new board and CEO were appointed, and the copany has been able to raise funding to repay creditors, implement a turnaround plan and reach a settlement with labour to mitigate the possibility of strike action.”

Government had provided the Land Bank with a R6.6 billion guarantee in 2014/15 of which R5.3 billion had been drawn down as at 31 March 2016. This guarantee had helped the bank to expand its lending by 10 percent in 2015/16, despite a weak operating environment “and chart a path to stabilisation”. The bank is conducting an internal review to improve efficiencies. Treasury noted that lenders had highlighted the bank’s “strong governance and relationship with the shareholder as reasons to continue supporting its funding programme”.

Government’s largest guarantee exposure was to Eskom – more than R170 billion. This supports its capital investment programme. An exposure of R200 billion related to the Independent Power Producers. “Eskom is obliged to purchase power from these independent producers over a 20-year period based on a power-purchase agreement approved by the National Energy Regulator of South Africa. Should Eskom be unable to do this, government must purchase the power on Eskom’s behalf.”

- Donwald Pressly is editor of Cape Messenger.