One of South Africa’s more neglected natural resources is its people. Unemployment is high, and the education system, burdened by the legacy of apartheid, is still struggling to improve standards. This puts ADvTECH in a unique position. As a private education and recruitment company, ADvTECH is wholly focused on nurturing young talent, and finding and hiring working talent. Thus, it’s encouraging to see the company’s full-year results – a return to profitability, a slightly higher dividend, and a multi-year, billion-rand investment programme that aims to improve its schools and facilities to better educate the next crop of students. Sadly, ADvTECH’s well-respected CEO Frank Thompson (58), who has overseen a turnaround and aggressive growth strategy at the company, is planning to step down, although he will remain at the company for some time, helping the incoming CEO adjust and smoothing the transition. – FD

ALEC HOGG: ADvTECH has posted positive full year results. Directors are happy, not surprisingly, to report a return to earnings growth for the year and the company says that the resourcing division will maintain its resolute focus on key niche markets and efficient operation. Well, joining us perhaps for the last time, with this set of financial results, is Frank Thompson. We spoke in December Frank, and although you’re 58, you’re handing the baton over to somebody else pretty soon. It’s not an Eskom-type interim CEO, because you’re still going to be there for a while.

FRANK THOMPSON: Yes, that’s right. We’re doing an extended handover. That will give the board time to do all the right things when searching internally and externally for the best possible successor.

FRANK THOMPSON: Yes, that’s right. We’re doing an extended handover. That will give the board time to do all the right things when searching internally and externally for the best possible successor.

ALEC HOGG: I was reading through the transcript of our interview in December, and it was interesting – the point you made there – that your team have been with you for a long time.

FRANK THOMPSON: Yes.

ALEC HOGG: Isn’t there a danger now, that (a) if you appoint someone from outside, the team is going to say ‘why not me’ or, if you appoint someone from inside, the other members of the team will also say ‘why not me’?

FRANK THOMPSON: Well, you put your finger on a very important point and one that is certainly being thought about very carefully. I think the plans are in place to make sure that we deal as best we can with that situation.

ALEC HOGG: You would want to keep the team intact if you can.

FRANK THOMPSON: I think that’s absolutely right, and we’re doing a lot of work to do that.

ALEC HOGG: We spoke to Wilhelm Hertzog from Regarding Capital Management earlier and he’s a fan of yours. He says he likes your business model. He likes the strategy that both you and Curro are going towards, but you offer the better value. Are you finding that shareholders are starting to come to you more often because of the high-flier you have in the same sector?

FRANK THOMPSON: No, not really. We’ve had a very loyal and stable group of large institutional shareholders for a long time. We know each other very well and I must tell you that the sessions we have with them when we discuss our results and their analysis, is acute to say the least. However, they’ve learned to understand perhaps, and believe in what we’re doing. We’re very happy with the loyalty we’re shown and we try to reciprocate that.

ALEC HOGG: Let’s look at the numbers now, and it’s a similar question, that I had for Standard Bank. In 2007/2008/2009, your EBITDA margin – in other words, your profit margin – was around 20 percent. You were making 20 cents in every Rand of revenue that you generated. That’s now coming back to around 15 percent. It was the same with the banks. Ben Kruger, the joint CEO there, said ‘it’s a different ballgame for us. The new norm was more like 15 percent’. Is it the same for you?

ALEC HOGG: Let’s look at the numbers now, and it’s a similar question, that I had for Standard Bank. In 2007/2008/2009, your EBITDA margin – in other words, your profit margin – was around 20 percent. You were making 20 cents in every Rand of revenue that you generated. That’s now coming back to around 15 percent. It was the same with the banks. Ben Kruger, the joint CEO there, said ‘it’s a different ballgame for us. The new norm was more like 15 percent’. Is it the same for you?

FRANK THOMPSON: Firstly, – as you would be more aware than I am – that earlier period you refer to was pre the famous/infamous global financial crisis, and the rules have changed a little. The South African consumer is certainly under some stress. The first point I would make is that in our minds, the EBITDA margin is not as useful an indicator as the EBIT margin. I think there needs to be a recognition even in margins, of the capital employed and the cost of that capital.

ALEC HOGG: Well, I didn’t do that one, so you have me here. What’s the difference? Has that been growing – the EBIT margins?

FRANK THOMPSON: No, the trends are very similar, but we watch EBIT margin as a business, very closely and perhaps with more emphasis on that than the EBITDA margin. What I would also say is there are two other features of ADvTECH that have impacted here. If you look at our return on capital that, in fact, has also declined a bit through this period, but I think that’s a good thing. The reason for that is as we have accelerated over the last five or six years – our investment program – the proportion of our business, which is in newer infrastructure, which was therefore relatively more expensive and the proportion of our business, which is still growing into its boots, has increased slightly. Both of those features will tend to push downward your average return on funds employed and your average margin, but we would regard that as a good thing. In fact, a business that is operating at its absolute optimal return on capital and margin, is probably not investing in its future.

FRANK THOMPSON: No, the trends are very similar, but we watch EBIT margin as a business, very closely and perhaps with more emphasis on that than the EBITDA margin. What I would also say is there are two other features of ADvTECH that have impacted here. If you look at our return on capital that, in fact, has also declined a bit through this period, but I think that’s a good thing. The reason for that is as we have accelerated over the last five or six years – our investment program – the proportion of our business, which is in newer infrastructure, which was therefore relatively more expensive and the proportion of our business, which is still growing into its boots, has increased slightly. Both of those features will tend to push downward your average return on funds employed and your average margin, but we would regard that as a good thing. In fact, a business that is operating at its absolute optimal return on capital and margin, is probably not investing in its future.

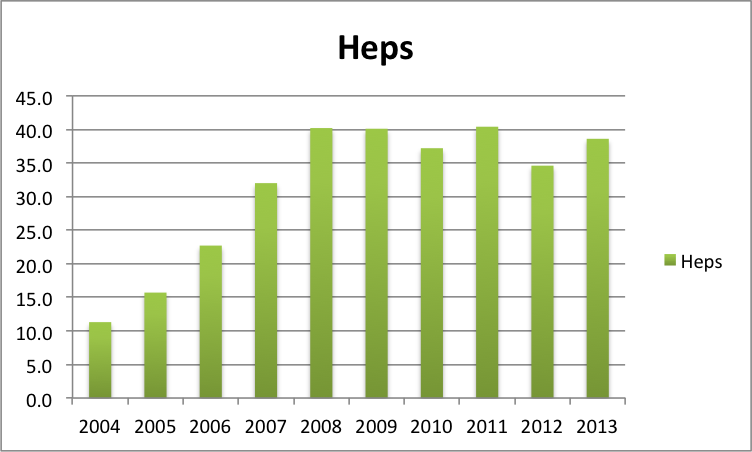

ALEC HOGG: Well, we had this with Transnet yesterday, where Brian Molefe said that the average age of the locomotives, is 32 years. You could have old schools I guess, in your context, but by not improving them, eventually you’re going to run out of…people would rather go to a better place. Perhaps a more important measure is headline earnings per share, which did improve in the past year but are still down from where they were in 2011. In fact, they’re down from where they were as recently as 2008, so it’s been level pegging.

ALEC HOGG: Well, we had this with Transnet yesterday, where Brian Molefe said that the average age of the locomotives, is 32 years. You could have old schools I guess, in your context, but by not improving them, eventually you’re going to run out of…people would rather go to a better place. Perhaps a more important measure is headline earnings per share, which did improve in the past year but are still down from where they were in 2011. In fact, they’re down from where they were as recently as 2008, so it’s been level pegging.

FRANK THOMPSON: That’s correct. You commented in your initial remark about the fact that the directors are pleased. Pleased as they may be, they’re not yet satisfied that we’re where we want to be. I think the satisfaction in these results stems from the turnaround. You will know that the toughest job in doing this is in fact, getting the ship to change direction. We think that has been achieved. What we now have to do is sustain and grow that, and we have very exciting plans to do that. We are not satisfied with where we are at this point. We think we’re on the right track, though.

ALEC HOGG: You had an investment cycle anyway, over a period of many years. Is it time to harvest?

FRANK THOMPSON: No, we still have a three billion Rand investment plan for the next decade, notwithstanding the investment of over 300 million in this period. Our capital commitments have grown, which would suggest that during the same time we’ve managed to find even more new projects to add to the cycle. We certainly believe in doing it in a manageable and sustained way that ensures we’re able to sustain the institution as a whole, as well…but no, we’re not at the end of our investment cycle.

ALEC HOGG: That’s rather…maybe the last question, just to dwell on it a little… Your distribution to shareholders, your dividends or distribution per share, and your capital repayments or whatever you used to call it in the past, has continued to grow when earnings have been fairly flat. That means you’re giving more money back to shareholders, but you have an expansion program.

ALEC HOGG: That’s rather…maybe the last question, just to dwell on it a little… Your distribution to shareholders, your dividends or distribution per share, and your capital repayments or whatever you used to call it in the past, has continued to grow when earnings have been fairly flat. That means you’re giving more money back to shareholders, but you have an expansion program.

FRANK THOMPSON: Yes, well the great strength of our business is that the free cash flow for example in the last year, was some 300 million compared to earnings of just under 160, so our cash conversion of the earnings is excellent. This enables us to confidently plan for, and fund the capital expansion, the three billion we talk about and return a reasonable dividend to shareholders. On your point  though, we have marginally increased the dividend cover in this period. In other words, the rate of increase of dividend in this period was not quite as much as the rate of increase of earnings. While the board has chosen not to adopt a forward-looking dividend policy and tie the hands of future boards, this is something that…

though, we have marginally increased the dividend cover in this period. In other words, the rate of increase of dividend in this period was not quite as much as the rate of increase of earnings. While the board has chosen not to adopt a forward-looking dividend policy and tie the hands of future boards, this is something that…

ALEC HOGG: So you’re taking cognisance of the fact that you have this expansion program as well.

FRANK THOMPSON: Indeed.

ALEC HOGG: Well Frank, hopefully we’ll see you in six months’ time.