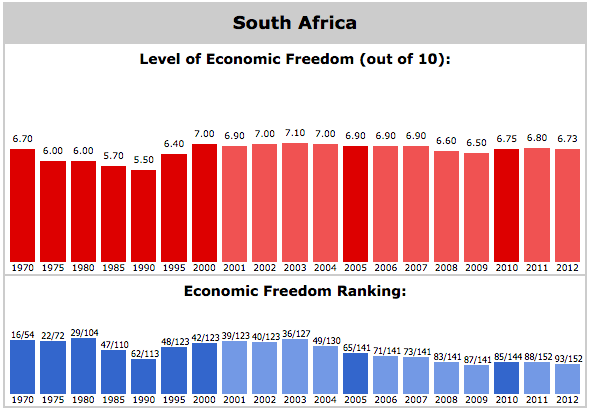

The road to hell is paved with good intentions. And intellectual arrogance. Hell, in the context of the latest Economic Freedom Index, translates into a population who die younger and poorer. Last week, Canada’s Fraser Institute released the 2014 edition of its closely followed index. It revealed a further decline for South Africa, down from 41st at the turn of the century, to 93rd of 152 countries surveyed. We’re now right down there with Haiti, Mexico and Tanzania. Even more disturbing, as you’ll hear in this CNBC Africa Power Lunch interview with the IRR’s Neil Emmett, is how this will be interpreted within President Zuma’s cabinet. The ideological leaders of this ANC Administration – proud socialists and communists – are likely to celebrating the slide as a victory, recognition that their economic plans are digging deeper roots into the South Africa we are becoming. The Achilles Heel of socialism, though, is paying for it. Kill off initiative and you kill off taxes. Borrowing to close the gap can only tide you over for a while. Maybe the penny will drop when Finance Minister Nhlanhla Nene shows his colleagues in his Mini Budget next week what their ideology is doing to the national balance sheet. – AH

ALEC HOGG: The Fraser Institute in Canada has told us that South Africa is continuing to slide down in terms of its Index of Economic Freedom. Neil Emerick is the author of an IRR Policy paper on the subject. Just to start off with Neil, we recently had the World Economic Forum’s Global Competitiveness Report where South Africa’s fallen from position 40 in 2006, to position 56 now. Now we have another report where our decline is even sharper. When I put forward to Rob Davies, the Trade & Industry Minister that we seem to be sliding everywhere, he said ‘well, do we really have to take the World Economic Forum Report seriously’. The question here I guess, is the one I would put to Rob Davies. Do we have to take the Economic Freedom Index seriously? Is the Fraser Institute something, which is highly regarded internationally?

NEIL EMERICK: Yes, I think we do. The index itself is an attempt at creating an objective measure of countries and their economic freedom. That’s only interesting in itself if the score correlates with things that you’re interested in. You’re obviously looking at the independent variable (economic freedom) but you want to be comparing it with things like economic growth or GDP per capita income. The good news is that the economic freedom correlates very well with all the good outcomes you would expect.

ALEC HOGG: The decline of South Africa from 41st, 13 years ago to 93rd today should be ringing alarm bells all over the place particularly if, as you say, there’s a close correlation between economic freedom and economic growth.

NEIL EMERICK: Well, that’s correct but that would depend on your ideological perspectives. From the free market point of view, we obviously see it as a slide, but Rob Davies would probably see it as a move in the right direction. For example, on the size of Government, South Africa has dropped considerably – I use the word ‘dropped’ and he would probably say ‘ascend’ – to 122nd place out of 152. We now have a much larger Central Government than we did previously. We have to assume that was the intended goal.

GUGULETHU MFUPHI: If that’s the intended goal then surely, there are some unintended consequences?

NEIL EMERICK: We would think so. Every country wants to be painted as a unique story, but South Africa is not that different if you look at the statistics. We’re very average in many regards, but the index would seem to suggest that we will start seeing those problems manifest.

ALEC HOGG: Neil, what are the issues that raised by the Fraser Institute in this Economic Freedom Index that are the reddest of flags that are waving?

NEIL EMERICK: Sure. The index itself is broken up into five categories and it draws from other reports, so part of the index is from the Global Competitiveness Index. Some of those drops in rankings there would obviously reflect in the Economic Freedom Index.

South Africa scores very poorly on the size of Government, in the sense that we have a very large Central Government.

We do reasonably well with the court system and property rights. Then, there’s ‘sound money’, which is looking at the inflation statistics. We do reasonably well there. However, openness to trade and freedom to trade with foreigners: we’re comparable to Uganda in that regard. With regulation of credit, labour, and business, we look a lot like France does.

It’s the size of Government, the extent of Government, and the extent of red tape that seem to represent South Africa’s problems and of course, labour law, where we are in the top ten of ‘most regulated labour force’.

ALEC HOGG: We have the Mini Budget coming next week. It will give us an indication if Government is running out of money in South Africa. The good times are way behind us. Would that maybe sober people up, in that the size of Government means higher taxes as well?

NEIL EMERICK: It could well. We are just hoping for a lower spend. We’re not really commenting on the size of the budget or the budget deficit, but we would just like to see a reduced percentage of consumption by the Government as a percentage of GDP.

GUGULETHU MFUPHI: Neil, I’d like us to pick up on the freedom to trade with foreigners that you highlighted a moment ago. Doesn’t this maybe call for us to review the legal structures and policies that we have in place in that regard?

NEIL EMERICK: Yes. The variable itself is made up of a few other sub-variables. One, which we do particularly poorly in, is the deviation of tariffs. What they’re looking at there, is whether we have a common policy with all countries. For example, a ten percent import tariff on goods. What South Africa has is very much a very wide variation across many products and that tends to look like a Government, cherry picking its industries. That obviously leads to arbitrary Government, so we can do a lot better there if we standardised our tariff rates.

ALEC HOGG: I guess it all has to do with people who know better than the market forces. Just getting back to the overall ranking of 93rd: give us an indication of the other countries who are around us there. In the early 40’s where we used to be – what countries are there?

NEIL EMERICK: In the 40’s you were looking at the European-type countries and many of the Arab countries are doing particularly well on the index now, in the last ten years. At the 93 level, which is where we sit now… I can read it to you.

Slightly above us (two places above us) are Mexico and Haiti and just directly below us are Tanzania and Swaziland, so that’s where our peer group would be.

Again, that’s quite different across the five categories. If I can paint a picture for you… In the size of Government, we look like Sweden (a welfare State). We have inflation that looks like Mexico and regulation that looks like France.

ALEC HOGG: What happens from here? I guess that if we continue to slide…if we were to look out another ten years from today, what kind of countries would we look like then?

NEIL EMERICK: I would hope that South African starts to look to its peer group in Africa. We’re seeing increased freedom in places like Kenya and Uganda. Botswana is already in the top 50. Mauritius made the top five this year, so I think it’s going to be a case of following by example. If we don’t grow and we’re becoming poorer and poorer as we go along (where we have examples around us that are doing better), one would hope that we’d follow those policies.

GUGULETHU MFUPHI: If you could give us practical examples, what are they doing right that we can pick up on?

NEIL EMERICK: That’s a bit difficult because it’s across approximately 50 different variables. Some of them are opening their borders to trade. Others have smaller governments. They’re trying to do less. They’re not all, doing the same thing and it’s reflecting differently.

ALEC HOGG: Has anybody followed the ideology that South Africa is clearly following now, successfully?

NEIL EMERICK: Well, that’s rather the point of the index – to see whether that mix of policies is the right one. The only way you can objectively do that is to correlate some sense of the mix of policies, with outcomes you’re interested in such as growth and income levels. One that would interest me is the fact that the bottom ten percent of people earn $11,500.00 in the free countries. They earn one-tenth of that in the less-free countries. I think there are lessons there in terms of absolute wealth creation. If you were going to be poor, where would you want to be poor? The answer is, in a free country.

ALEC HOGG: Just to close off with Neil, you did say there was a close correlation. Can you be more specific on that? Clearly, the richer countries are freer, but those that are growing…

NEIL EMERICK: Yes, there’ve been many papers. There was a survey this year. Over 400 papers use the Economic Freedom Index. One of them would be longevity.

You would live until you’re 79 in a free country. You would die at 62 in an un-free country.

Your growth is three-and-a-half percent on average, in a free country. It’s two-and-a-half in an un-free country. Income levels: you would earn $40,000 per year in a free country and (let me get this right) $6,000.00 in an un-free country. All those are very meaningful variables that people should care about.