Much as we Tweeples like to believe otherwise, not everyone’s yet converted to Twitter. So for those who missed my live Tweeting from the Berkshire Hathaway AGM in Omaha, all the postings are together in this and the next piece. They give a great overview of what the 30 000 of us heard from Warren Buffett and Charlie Munger on Saturday.

I sent out 145 messages in all. Here are those from the morning session. Where appropriate, have embellished to provide context (additions to original Tweets in brackets). You can access the originals by going to Twitter and searching for @alechogg. For a comprehensive record of the Tweets from others who attended the AGM, search Twitter through the hash tag #BRK2013.

Here, in 140 character bites, is a record of the 2013 Berkshire Hathaway AGM:

• Shareholder movie started. Warren reminds audience the celebrities in the movie work for nothing. So record + get chucked out

• Asian shareholder interviewed at 2012 shareholder’s meeting: “This is my annual investment cleanup” Mine too!

• They’re really pushing Carol Loomis’s new “Tap Dancing to work” book. (Shareholder) Movie features interview of Warren and Carol. Obviously old friends.

• Asked about state of (the US) economy. Buffett: “What made America great is going to continue to work”..still with the shareholder movie.

• Warren and Charlie have just stepped onto the podium. Thunderous applause. They’ve settled in – water, coca cola, peanut brittle and all.

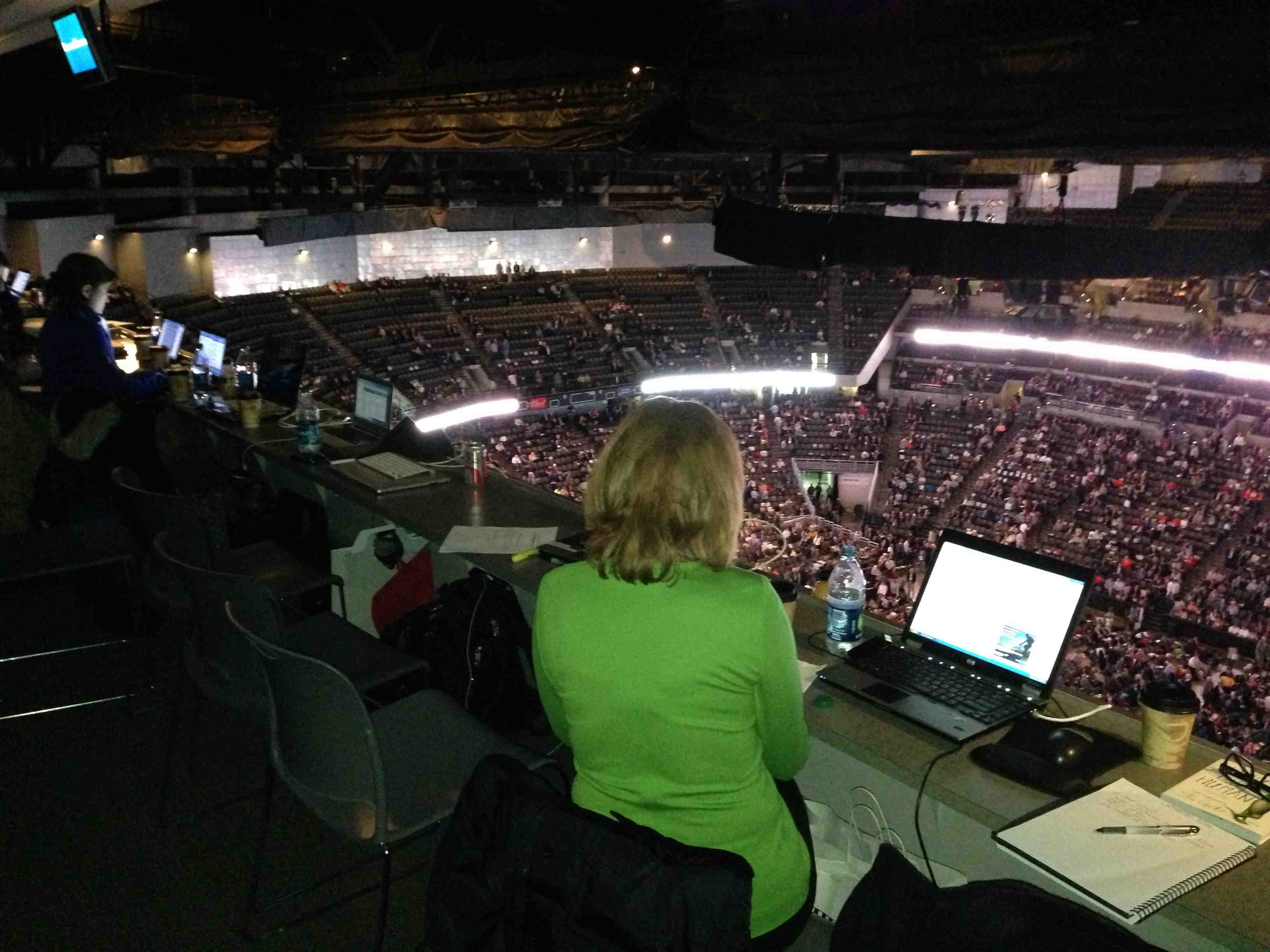

• Have posted some pics from here in Omaha on my Facebook page. Go have a look. They’re at http://on.fb.me/12B1u1J

• Charlie Munger has his first bite of peanut brittle. Warren talking shareholders through the 1Q financials. Polite attention.

• Warren Buffett: Berkshire is now the fifth most valuable company in the world. Behind Apple Exxon, Google, Microsoft. Shareholder applause. Obviously.

• Warren introduces directors. Starts with son Howard. He will be next chairman. Howard has permanent residence in SA. And farms in Limpopo.

• Questions start with Carol Loomis. She says has received thousands of questions. Warren Buffett and Charlie Munger have no idea what questions will be.

• Buffett: Not good Berkshire book value performance recently because last decade not great for business (sector generally). Intrinsic value (comparison) looks better.

• Charlie Munger: Don’t pay attention to next 3, 5 yrs. Berkshire positioned for long term. Buffett: “At 89 Charlie not concerned about short term.” Audience is cracked up.

• Jonathan Brandt, analyst, asks question about Iscar. Buffett gets chance to give history lesson about Iscar (Berkshire’s Israel-headquartered machine tools subsidiary). Says he loves the business.

• Shareholder thanks Warren Buffett for opening the doors early. (because of the icy weather, the doors were opened at 6:30am instead of the usual 7am). Buffett: “If we had someone who sold coats we would have left you out there.”

• Buffett confident that Berkshire culture will live long past him: “Whoever succeeds me – it will be the same thing.”

• Charlie Munger: “To the many Mungers in audience, don’t be so stupid (when I’m gone) to sell these shares. (Berkshire)” Warren Buffett: “That goes for the Buffetts too”

• Cliff Gallant from Nomura, the second of analysts, asks insurance related question about market share of Berkshire operations.

• Warren Buffett: Berkshire will become very significant factor worldwide in commercial insurance field. Follows 4 AIG heavyweights joining week ago.

• Young New Yorker asks question about (direct auto insurance subsidiary) Geico’s technology and how it is working on assessing how people really drive.

• Discovery Insure guys should be here. Warren Buffett outlining way Geico is working on ways to predict likelihood of insured having an accident.

• Media colleague Barry Wood quips to me that Discovery Insure is far ahead on this front. There’s not much data mining on auto in the USA. (Washington DC-based freelancer Barry worked for the Financial Mail in the 1970s and has kept a close eye on developments in South Africa. He is a very well known financial journalist and worked for Voice of America for decades.)

• (A shareholder asks Buffett) What are you doing on Twitter? Warren Buffett avoids answering, Munger: “Hard for me to say anything – I’m avoiding Twitter like the plague.”

• Bear analyst Doug Kass: “The recent buys of Berkshire is turning it into slow growing, more like an index fund?” (Kass, brought in by Buffett to spice up the questions, was a huge disappointment. His questions were long and rambling, he knew this was his 15 minutes of fame so wasn’t going to let the opportunity pass him by. Towards the end of the Q&A time he blew the little credibility he had left by pitching for business – asking Buffett and Munger to give him $100m to do short selling trades with on the understanding that all profits generated would go to his favourite charity, which I think was the Jewish League of Palm Beach – wasn’t listening to him that attentively by the end.)

• (Buffett and Munger bare their teeth a little at Kass, perhaps because of the way he painted himself as a martyr, as Daniel in the Lion’s Den). Warren Buffett: “We’ve paid up for good businesses. We are willing to pay up for an extraordinary business.”

• Charlie Munger: “We’ve said we can’t do as well in future as we did in the early days. We think we’ll do very well in spite of getting big.”

• Warren Buffett: “We feel very good about acquisitions of the past five years. Berkshire owns 8 businesses that would be in Fortune 500 if they were separately listed companies.”

• (Asked about the rising prominence of the Chinese economy and whether its currency, the RMB, would replace the US Dollar) Warren Buffett: “(It is) Very unlikely that any other currency will usurp the US Dollar as world’s primary reserve currency for many decades if ever.”

• Warren Buffett: Corporate profits are extraordinary high as a % of GDP. Income tax is half of what it was 40 years ago as a % of GDP. (The answer related to a question about what the correct level of corporate profits should be as a % of GDP. Buffett has referred to the fact that the 6% of some years back had risen to the current 10%.)

• Warren Buffett: “So I would take it with a pinch of salt that US business is getting less competitive because of corporate tax rates.” (A questioner quizzed him on the call from American corporates that they need lower tax rates to regain global competitiveness.)

• Warren Buffett: “Corporates have done very well in terms of profits from where we were in 2008. Employment has not come back as well.”

• Charlie Munger: “If the rest of the world keeps bringing corporate tax rates down there is some disadvantage for the US to be higher.” Applause. (Warren and Charlie don’t agree on everything. Charlie is the more conservative. He votes Republican, Warren is a Democrat. Their views on issues like tax reflect their philosophical differences.)

• Warren Buffett: “I think my successor will organise things differently but never change principle of (Berkshire subsidiary) CEOs running their businesses independently.”

• Warren Buffett: The best acquisitions are bolt-ons by subsidiaries. Best acquisitions of all are where we add to an existing position.

• Warren Buffett: As the Hunt Brothers found out with silver, it is a lot easier to buy things than to sell them.

• Warren Buffett: “Quantitative Easing has the potential to be inflationary. My guess is the (US) Fed is disappointed they haven’t seen more inflation.” (Buffett has often pointed to the fact that inflation is the cure to excessive borrowing by Governments as by depreciating the worth of the currency it effectively reduces the value of the debt.)

• Charlie Munger: “Who would guessed interest rates would stay low for so long? I worry about more than inflation. The next century will be difficult.” (Munger is an ultra long-term investor.)

• Charlie Munger: ” I strongly suspect interest rates are not going to stay this low for an extended period. What has happened would have been thought impossible.”

• Warren Buffett: “There are insurance businesses we’d liked to buy. They weren’t available (when we were looking either because of price or just not for sale). Berkshire will build a significant global commercial insurance operation.”

• Warren Buffett: Disputes suggestion Berkshire subsidiary Pampered Chef is a multi level sales business. He clearly doesn’t like that kind of practice. (One of the questioners referred to the controversy around a US-based natural health product operation accused of being a pyramid scheme and suggested that Pampered Chef has identical business processes.)

• Warren Buffett: “Berkshire is the 1-800 number when there’s panic. Our reputation becomes more solidified by providing capital when others are frozen.”

• Charlie Munger: “We’re always trying to stay sane when other people are going crazy. That’s a competitive advantage.”

• Charlie Munger: “We treat our people the way that we would like to be treated ourselves. That is a long term competitive advantage.”

• Warren Buffett: “We very seldom buy businesses from people who want to retire. (Instead) We offer a permanent home for the business and the people who built it.”

• Warren Buffett: “Oil moves a whole lot faster by rail than it does by pipeline.” Come on Transnet. Get your trains rolling and South Africa will save a fortune.

• Warren Buffett: “2008 was a special time. I wish those 5 year bond deals had been 10 year deals. We won’t see something like that for a time”. (Buffett was referring to the excellent returns Berkshire achieved when stepping in to provide finance to Goldman Sachs and General Electric when panic gripped during the financial meltdown. A clear case of being greedy when everyone else was fearful.)

• Warren Buffett: “Berkshire’s asset managers (Todd + Ted) have no restrictions on what they buy. I do not tell them how much to invest or where.” (Buffett is referring here to the two portfolio managers that he appointed a couple years back. Both were given an initial $1bn and as he mentions in the annual report, both comfortably outperformed Buffett himself in 2012. He is proud of having selected them and uses their performance as proof that Berkshire’s excellent investment portfolio is in good hands and good returns will continue live on long after he has gone.)

• Warren Buffett: “If I were starting a direct insurance business, I would attempt to copy Geico.” Maybe we should tell Buffett about Discovery Insure?

• Warren Buffett: “Charlie and I have very simple lives. We get to do what we love. We both like to read a lot. Charlie likes to design buildings.” (And, he added, Munger is getting to do a lot of the actual designing now through his substantial property development interests.)

• Charlie Munger: “I cannot remember an important decision that Warren’s made when he was tired. He’s never tired. His (caffeine/sugar nutrition) is perfect.” (Buffett’s “unhealthy” diet is legendary – meat, bread, hash browns and lots of sugar. At 82 he has the energy of many people who’re much younger. )

• Bear analyst quizzes the duo about Henry Singleton. Charlie Munger says he was a genius but they have reservations. Charlie Munger: “I knew him, he lived in my community.” Note to self – research Singleton.

• Warren Buffett: “The number one problem for US business is healthcare costs. For companies (this is) a huge competitive disadvantage to rest of world.”

• Warren Buffett: “Healthcare is a huge cost for us. We do very few things on a centralised basis at Berkshire. But we’ll work together on this.”

• Charlie Munger: “Nobody knows how this will work out. But I confidently predict there’ll be more solar generation in deserts than rooftops.” (Munger was answering a question about the wisdom of incentives which countries like Germany are offering to residents who install solar power generators on their roofs.”

• First question from outside the US – from a Canadian shareholder. Warren Buffett: “Being born in the USA was a huge advantage for me.”

• Warren Buffett: “The Crash of 1929 was lucky for me. My father was a stockbroker. I was conceived in Nov ’29. So he wasn’t busy at the time.” Raucous laughter.

• Charlie Munger: “We’re old fashioned, boringly trite. You’ve got to work where you’re turned on. I’ve never succeeded at something I didn’t like.”

• Warren Buffett: “Berkshire is an unusually rational place. Insurance is rational. We won’t do something where we get paid 90c for a loss of $1.” (Buffett was referring here to the predilection which many insurance companies have for expanding for the sake of growth, without realizing that much of the business written in competitive times is loss-making. Part of Berkshire’s insurance operations’ success, he maintains, has been the ability to resist such temptation.”

• Warren Buffett: “Anything Wall Street can sell, it will sell. You can count on that. You can’t afford to go along with the crowd in investment.”

• Shareholder asks Warren why so few women in top Berkshire jobs? Perfect for Warren Buffett – points her to his piece in the latest Fortune magazine where he addresses this in detail.

• Warren Buffett: “Women in my lifetime haven’t had the same opportunities as me. A lot of improvement been made, but there’s still a way to go.”

• Warren Buffett: “I use the example of Katherine Graham who I knew very well. Her stock went up 40 for 1 when she was CEO (of the Washington Post). She won a Pulitzer……but she (Katherine Graham) couldn’t get rid of a little voice that came from her parents, teachers, saying men should get the important jobs.” (Buffett was very close to the late Kate Graham, one of the giants of the media sector. Although I didn’t see it there this year, her Pulitzer Prize-winning autobiography has long been offered for sale at the annual meeting – in it she writes extensively of her friendship for Buffett and credits him with providing the guidance that took her from being a cocooned housewife into a brilliant businesswoman and fearless publisher. The love was clearly mutual.)

• Charlie Munger: “I would like to see something more extreme in banking regulation. The more bankers want to be investment bankers, less I like it.”

• Warren Buffett: “The investment world has been very successful in extracting (excessive) fees from investors for themselves.”

• Half way into Warren Buffett’s 10-year bet against Hedge Funds he’s winning easily. In 5 years S&P Index Fund up 8.69% pa. Hedge Funds 0.13%. (In 2008 Buffett offered to bet $1m on the S&P outperforming any group of hedge funds that one of that industry’s experts would offer as an alternative. This was done to prove his logic that fees charged by financial services companies makes them uncompetitive against the low cost route of investing directly into the underlying assets.)

• Warren Buffett refers us to http://longbets.org where rules, arguments of protagonists and the performance of his $1m bet vs Hedge Funds is recorded.

• Lunchtime break. The first four hours have flown by. Hope you’re enjoying the tweets. Am having lots of fun. But starving. Catch up later.