By Alec Hogg

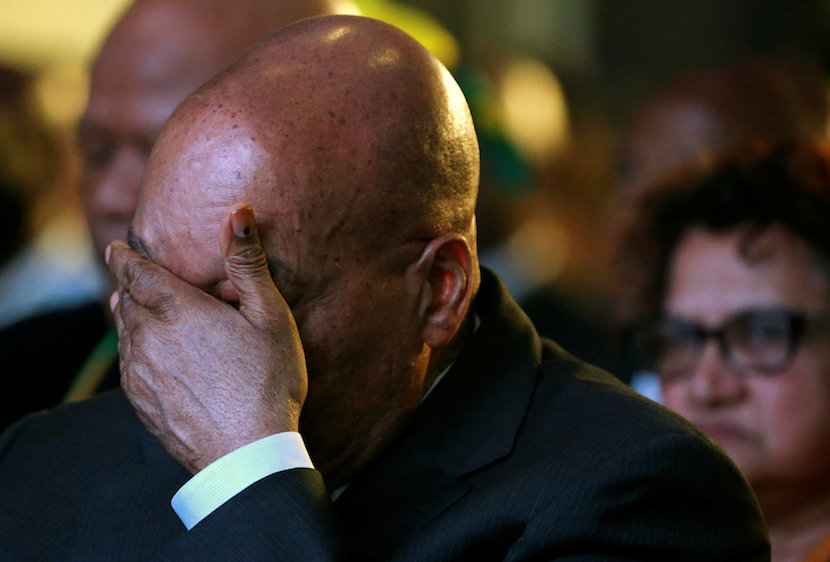

What a difference twelve months can make – as we were reminded during South African President Jacob Zuma’s State of the Nation address last week.

In the same speech last year Zuma was positively preening about his country’s bankers: “We are proud of our Top 10 ranking in the World Economic Forum competitiveness report with respect to financial services,” he gushed. “Maintaining and indeed improving our ranking is important to our competitiveness as a country. It is also fundamental to our ambition to become a financial centre for Africa.”

___STEADY_PAYWALL___

Not so much this time around where Zuma used the platform to launch his “radical economic transformation” plan, threatening all kinds of hellfire onto a business sector that he’s accused of refusing to change. And the first area to be focused on, he says, are country’s Big Four banks – despite their impressive progress in meeting staff transformation targets and gifting tens of billions through BEE schemes.

On Friday, Zuma lambasted the banks at an event hosted by the Gupta-owned New Age newspaper. Over the past few months South Africa’s Big Four banks have closed or refused to open accounts for the Gupta family. The Indian immigrants are close friends of SA’s deeply flawed President, boasting of numerous business partnerships with the Zumas.

Their fight stems from transactions worth R6.8bn through Gupta bank accounts tagged as suspicious by the SA Financial Intelligence Centre. These details were disclosed in court papers submitted by SA’s Finance Minister Pravin Gordhan. The Guptas accuse him of being part of a conspiracy that is targeted them. So the reason for Zuma’s turnaround is pretty transparent.

But rather than stating the obvious, let’s consider the consequences.

Zuma has steadfastly refused to sign into law the Financial Intelligence Centre Amendment bill which was passed by Parliament in May. His signature is the final hurdle for anti-money laundering legislation which would expose “prominent influential persons” – specifying the President, his deputy, cabinet members, provincial premiers, judges and generals.

The President is now agitating for new banking licences to be issued. The most public of these is by Gupta associates who want to buy the licensed Habib Overseas Bank, but have been turned down by the SA Reserve Bank.

Dominic Ntsele, an old friend with deep ANC connections, describes the modus operandi of the Guptas as a crude approach of a puppeteer who handsomely rewards associates while keeping a loaded gun to their heads. This looks like the deeply compromised Zuma’s time to deliver. Not content with putting the money laundering bill on ice, the Guptas now want a banking licence. Finance Minister Pravin Gordhan is blocking their way. Probably not a good time to be buying Big Four banking shares. Or South African Rands.