Here’s a South African good news story that long begged to be told. CCi is a low profile consulting business founded 30 years ago by four UCT engineering graduates. After earning its stripes with long-time client SABMiller, the company’s TRACC system has expanded into dominance of the global Food & Beverage and Chemicals sectors. Still headquartered in Cape Town, the privately owned company generates 90% of its $20m-plus annual revenues outside of Africa and has 2,000 installations in 70 countries. It has now created an effective competitor by selling a global licence to EY Catalyst, a member of the Big Four services group. EY will white label the TRACC system to sell it into its own global client base. CCi chairman John Mulcahy is a South African turned global citizen who helped start the Business Day newspaper before leaving for Hong Kong in the 1980s. I caught up with him today as he took the wraps off a major SA success story whose light has for too long been hidden under a bushel. – Alec Hogg

A warm welcome to John Mulcahy on the line from Cape Town, John, a South African company called CCi, Competitive Capabilities International, been around since 1987, very low profile though. You are a South African yourself, originally anyway and you’ve been chairing this company, how long have you been involved with it?

Alec almost ten years, I was invited into the company by an old school friend and at the time they were a group of engineers who had completed MBAs at UCT and had developed this product to enable companies to embark on a journey of continuous improvement, but in a way that did not require extensive client based consulting services over a long period. In other words, the methodology is embedded in the organisation and that was the genius of the invention if you like.

It’s an extraordinary business, very much under the radar, but it operates in 70 countries, 2000 installations around the world and some very big names there.

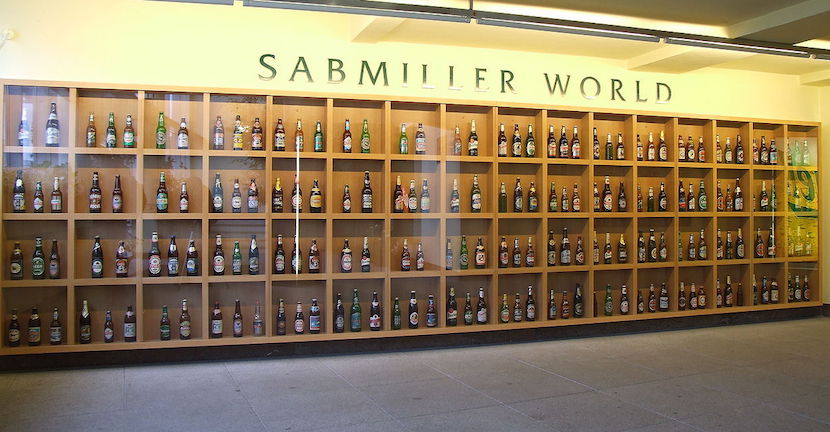

SABMiller was and remains a customer 23, 24 years later and in fact was really the gateway to CCi’s international development. After 1994 and the new democracy, SAB embarked on a very extensive expansion programme in Africa, Latin America, Eastern Europe etc. and in many cases brought CCi and our TRACC product with them. To a large extent that gave us a footprint in many regions around the world.

You say the TRACC product and that’s really what the news angle is, a deal that has been announced today with EY, where they will be marketing the product globally. Just explain how something like that works.

EY has actually acquired a perpetual licence from CCi to take on the TRACC product and embed it within its own organisation and EY has rebranded the product and will be marketing in its own name as the EY Catalyst product. We will not have a continuing relationship with EY for various reasons, but we will really be competitors of theirs, although they will be obviously operating with our primary and originating product. Our business continues and our customer base remains as it is and we continue to develop and innovate.

Who are your customers?

We have customers almost literally all over the world. We have concentrated on two verticals primarily and that’s for no reason other than the fact that, as a relatively small organisation, we felt we needed to concentrate on areas that we knew best. We had a good knowledge of food and beverage or primarily beverage through the association with SAB and subsequent to that we developed knowledge of the chemical industry when we signed DuPont as a customer in North America and in deed for its global operations. So our focus has tended to be on those two verticals, F&B, and chemicals. On the F&B side, other than SABMiller, we’re doing a lot of work with Diageo, Danone, Coca-Cola, primarily with the bottling side. We have extensive Coca-Cola bottling sites in China that have embraced TRACC.

We’ve also done a lot of work with Heinz, Kellogg’s, and a number other smaller companies, Lion Breweries in Australia, is another customer. On the chemical side, other than DuPont, we have Incitec Pivot, which is, I suppose, the ACI equivalent in Australia. They do fertilizers, explosives, etcetera. We also have AkzoNobel, which is a very large European Dutch based business and within South Africa, we’ve had a number of diverse customers, including in the mining sector, Anglo American Platinum, Lonrho, we also have Illovo Sugar.

So there’s some diversity in the customer base, but our focus has primarily been on F&B and chemicals. Although, the TRACC product, the methodology world class manufacturing, continuous improvement, particularly in process manufacturing and in the value chain for multiple processes, it lends itself to almost anything really, even in the service sector, but CCi has concentrated primarily on the manufacturing sectors.

Those are some big names that you mentioned there, CCi though, remaining South African.

The CCi head office, if you like is in South Africa and the product development, Nexus is in South Africa, but really the expansion of the business has been primarily international. We continue to have a footprint in South Africa. We have an associate company, CCi-Growthcon, that has the franchise for Africa and the Middle East, if you like and the names that I mentioned in addition to the SABMiller operations north of South Africa, in Africa, we’ve done a lot of work in those areas, Angola, Mozambique, further north into Ghana, Nigeria but our market facing focus in recent years has been in North America, Western and Eastern Europe, Australia, and in China and we’re also now dipping a toe into India.

John just tell us a little about the formation of the business. It did start in 1987, who are the guys behind it?

Well it was a number of, at that time, young engineers who were looking to expand their knowledge if you like and did MBAs at UCT. They then began working as consultants in the manufacturing sector around the Western Cape and in the automotive sector in the Eastern Cape. There was a lot of work being done on manufacturing the Toyota way, generally world class manufacturing was becoming a thing. This group of people Glenn Leask, Kevin Whelan, John Vaughan-Jones and Pat Whelan realised that they were going into sites, advising people, and achieving results through the continuous improvement process, but in fact there was very little documented in this broad area and they felt that if they were to productise their know how, it would give them something sustainable over the longer term and they began literally to write down their know how.

It became more sophisticated over time into a very extensive body of work. If you printed out the content of the TRACC methodology, you’d probably get to something like 50,000 A4 pages but in order to manage that huge volume of what we call implementation actions which is the real how-to on a day-in-day-out basis, in order to manage that wide scope of information, we developed a bespoke software dashboard called the TRACC Platform and that allows both ourselves and more importantly the customers to be able to manage multiples sites in multiple locations in multiple time zones and be able to keep track, literally, of everything that’s going on with their continuous improvement process across the organisation.

The founders have retained their deep and wider knowledge of engineering and particularly manufacturing and over time have extended that expertise into the wider value chain. So although the origin of the business was in manufacturing, really at the behest of customers, we’ve extended the reach of the TRACC process into the wider supply chain, so we can apply it with expertise and excellence, best practice in a whole range of activities throughout the value chain including things like warehousing and supply and practice optimisation across the whole value chain. The expertise over decades is primarily obvious in the manufacturing sector, but increasingly the supply chain activities have become much more sought after.

The founders have retained their deep and wider knowledge of engineering and particularly manufacturing and over time have extended that expertise into the wider value chain. So although the origin of the business was in manufacturing, really at the behest of customers, we’ve extended the reach of the TRACC process into the wider supply chain, so we can apply it with expertise and excellence, best practice in a whole range of activities throughout the value chain including things like warehousing and supply and practice optimisation across the whole value chain. The expertise over decades is primarily obvious in the manufacturing sector, but increasingly the supply chain activities have become much more sought after.

This is all developed in South Africa by South Africans, initially anyway and exported to the rest of the world. It suggests that the capabilities that the software has are, A, must be world class in the one point to have so many big clients, but secondly, the fact that EY has come along and taken a white labelling of the product as it were, would suggest that it could get even bigger.

I need to stress that it’s not a black box. What it does is it helps the customers embark and maintain a journey towards excellence, and the attraction for the big organisations is that the so-called asset based consulting model, which is very much in vogue at the moment. It was really the model adopted by CCi in the sense that we developed an intellectual property around both the content and the software, which once we licence it into a customer, provided they remain a customer and pay the subscription fees etc. that becomes their own methodology. In many cases it’s been converted into production systems within the organisation and white labelled into those customer organisations.

Many of our customers have imported their own content into the system, so that it’s a blend of the know how that’s incorporated into the system by CCi and the customer’s own know how so that it then becomes bespoke for that individual customer and the stickiness from our point of view is a big attraction to big consulting organisations. A typical engagement for a large consultancy company is probably three to nine months.

We’ve had customers that have been with us for in excess of 20 years, which is very unusual in the consulting world and the stickiness of the customer, in other words, they are subscribers to the cloud based platform and as such, have a continuing relationship with the company and at this stage with CCi. There are multiple points along that journey when other solutions can be offered into the same customer, so retaining that customer relationship over literally decades is a significant attraction for a large consulting company and EY have identified that.

Yes you can certainly get that. John, being Cape Town based, does CCi still recruit in the South African market from universities in the country?

Very much so, on the consulting side the profile of a strong CCi consultant would probably be an individual whose post-graduation had a career in industry, manufacturing and/or supply chain and is able to impart real experience in the workplace, so the profile of our consultants would be quite a significant level of experience. We don’t typically bring in fresh graduates onto the consulting side of the business. Our product development business is an end-to-end product development business if you like. We outsource some aspects, the code writing, the formal software development is outsourced, but everything other than that is developed internally including the management of our multiple languages.

One of the big attractions of the TRACC product is it’s available in 14 different languages and in the colloquial version of that language, an example being Portuguese where we have a Mozambique Portuguese translation together with a Brazilian Portuguese translation, you know they’re different on the work floor. The range of expertise that we require, not so much in the translation per se, but in the management of that process, we outsource as much as we can in software development, in translation, and in many cases, in the technical writing of the content, but we manage the process throughout and that’s all done from our Cape Town office and we recruit almost exclusively for the product development side within South Africa.

Being manufacturing focused, are you also finding that the biggest market would be in China?

The market in China is shifting and is continuing to shift. Our customer base in China up until a few years ago was almost exclusively the Chinese operations of multinational businesses, so we did a lot of work, as I said earlier, with Coca-Cola, some with SABMiller Associates, Snow Breweries, and with DuPont. DuPont has extensive activities there, but in more recent times, we’ve actually been selling directly into Chinese owned businesses, state owned enterprises in the food sector, China is a customer and we’re very actively marketing into the Chinese market. We have an office in Shanghai and we have about 15 employees in that office.

How many employees worldwide?

Full time employees about 150, but we use sub-contractors on the consulting side and probably full time equivalent about 250 around the world.

It’s a lovely success story. You mentioned China, John, since you left the Rand Daily Mail many years ago; you went off to Hong Kong and have remained pretty involved in the whole Chinese market, your story today?

I was in Hong Kong for about 20 years and I was in a very fortunate position of being in Hong Kong at a time when China had begun to open its doors, I arrived in Hong Kong in 1984 and at that point Shenzhen had a population of less than 200,000. The population now is 10-million and the whole Pearl River Delta, the whole Guangdong area, the pace of development was mind boggling really, even in real time and in hindsight, even more so.

The first factory I visited in Shenzhen was producing 14” colour television monitors and people sitting at assembly tables in a very slow moving assembly line. Those kinds of activities are long gone, China is very sophisticated now. You will not find television assembly lines that aren’t robotic at this stage and everything beyond that. China is the ultimate digital economy, so in a generation, if you like, the Chinese story, I think it’s very common knowledge, but I have been very lucky to have seen it over the last 30 years and you know, and enjoyed that journey.

With CCi being in South Africa and China of course being the driver of BRICS, has the whole BRICS setup helped much?

It hasn’t directly played into it. I honestly cannot say that BRICS has opened doors. We’ve done some work in Russia, we’ve done a lot of work in China, but as I said, primarily with multinationals. I think that the more important and the more significant driver of business has been the competitive requirements of the high volume manufacturing sector. I think the brewing side is a classic example. There’s very little that a brewing company can do to influence the selling price of their product. So their competitive advantage has to count the backend in inefficiencies on productivity and keeping costs at a low end and keeping efficiencies at an optimal level.

That’s what the TRACC product brings to that, it allows companies to achieve maximum efficiency in the backend of their operations. I think that’s why we’ve gone into organisations like DuPont and SABMiller, where they realise that their competitive advantage is in achieving the most efficient cost base in their market and then they can allow themselves to be subjected to price pressures without any fear or favour knowing that they are the most competitive in the market. That’s where our edge has been in taking waste and excessive cost out of the system.

It’s so interesting South Africa are talking about a new industrial policy, today Rob Davies is releasing his update, I think it’s the eighth one and here you have in your own backyard one of the world’s leaders in becoming more productive in manufacturing. You’d think that there’d be plenty of engagement between a company like CCi and the South African government.

We did our best to market the product, leave it at that. I think that the TRACC product and the methodology, it’s a maturity based system. In other words, a company will start at stage one and gradually move through the gears and it’s unusual, but eventually getting to stage five of the process of maturity and through that journey will see enormous productivity gains. It’s improbable that those companies will go as far as five but somewhere between three and four is probably going to be the sweet spot. This type of efficiency is available in all manner of activity, so you come into the airport and I think everyone has experienced the frustration of the slow process of moving through immigration and so on.

Those kinds of services can be improved immeasurably using the methodologies available to TRACC but it’s not easy to get into that market and we’ve concentrated on where, what for us, is the sweet spot, it’s very high volume, multinational, multi-site manufacturing companies. We’ve had a look at the healthcare sector in South Africa and elsewhere and there are good opportunities, we’ve had a look at financial services and there are some excellent opportunities there, but we’ve stuck to our last and concentrated on the areas that are growing for us immediately, but the opportunities for diversifying, whether it’s into government services or into other services, financial or otherwise, they’re definitely there and I suspect that one will see EY diversifying their offering into some other markets.

John Mulcahy is the Chairman of CCi, which today has struck a global deal with EY.