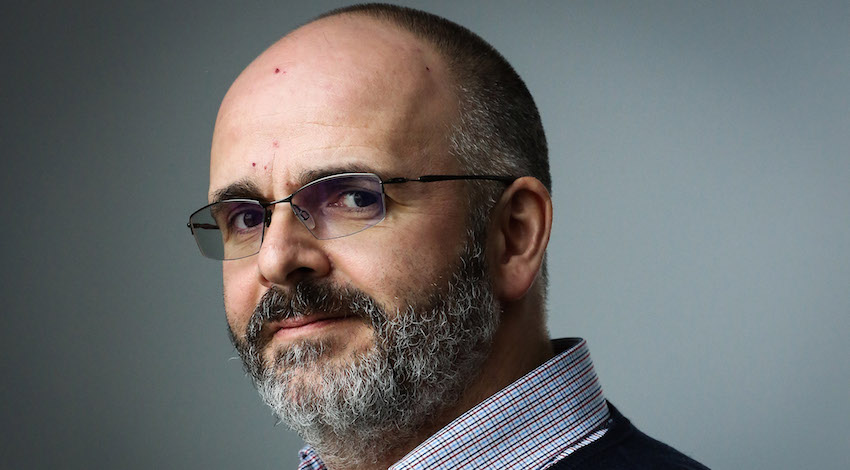

LONDON — Welcome to the Old Firm podcast. I’m Alec Hogg, editor of Biznews.com. Well had different paths opened up for him, David Shapiro could easily have ended up as a financial journalist, he’d have been a really good one too. That’s judging by the excerpts of his son, Johnny. In the previous episode of the Old Firm, David was more than a little agitated by the exploits of Viceroy, the short-selling research firm that had brought the once, mighty Steinhoff to its knees. Shapiro Jnr, no doubt listening to his father’s problems, works for the Australian Financial Review so he picked up the cudgels and in double-quick time, he managed to uncover the mysterious fellow behind Viceroy. What happened next gets this podcast off to a fascinating start, as you’ll hear. As do our divergent views later on, when we discuss property rights, and the rapidity of Southern Africa’s rebound.

So Dave, there’s quite a few things to talk about but let’s pick up from where we left off last week, which was with Viceroy, and now we know that the man behind Viceroy is a guy called Fraser Perring. I actually had a good laugh at your son, Jonathan, who works for the Australian Financial Review, is that right?

___STEADY_PAYWALL___

He does, yes, and I think he discovered the identity of Fraser.

And he did it on the phone while he had two of his children hanging onto him – it’s a beautiful little clip, which we’ve got to put onto the site. He’s a dedicated man, young Jonathan.

He’s very dedicated and a very dedicated father. How they discovered it is that on every document. He had been given certain documents – they had been circulated to a lot of people and he had got hold of one, and they managed to find the signature, which is called metadata. I don’t know how it works and that gives you…

Paul O’Sullivan will tell you all about those things. It’s a fingerprint on anything online.

That’s right so through that it led them to Melbourne, to these two youngsters, and when he got hold of them, he looked at their Facebook page, etc. He merely phoned them and he asked whether he was connected with Viceroy? I think once the chap said, ‘well, you must ask Viceroy,’ I think he had opened himself up and it was just persistent perusal of this chap that led him to Viceroy in London to Fraser Perring. What happened as well, which is rather unfortunate, is that they want Fraser Perring, because of the situation, he had asked for 24 hours just to get certain things in order. He didn’t give them permission but he pleaded with them not to release it. Then he promptly went and told Bloomberg his story, Fraser, before Johnny could publish but they did publish within half-an-hour.

What a nice man? A prince among men, I guess…

Yes, anyway, who knows. You’re closer to journalism than I am but I think they wanted to… I think they feared because this was a short-seller or because of the havoc they had created I think they wanted to get this man’s, if there was going to be protection of the family or the protection of his identity – I think they wanted to give him the benefit. I’m not sure why he wanted 24 hours.

Well, now we know, he wanted to go to Bloomberg.

Yes, he wanted to go to Bloomberg.

Well done to Johnny. That’s a fantastic bit of sleuthing and journalism work, and I guess, the SA connection was one of the reasons why he was so interested.

Yes, absolutely. These chaps at Viceroy had also attacked a couple of Australian companies so I think that was the reason. They wanted to get behind who these people were. Alec, it highlights a lot of things that worry me. We live in a regulated environment, financial services are regulated, and at a regulated house you can’t distribute research unless it’s been passed. In other words, I can’t write research in SA and just circulate it into the US, unless somebody there, whose licensed, has looked at it and is prepared to clean it. So I think there has got to be some kind of regulation as to so-called houses but I suppose at a time where you’ve got web and blogs it’s very difficult to control or keep that information. I think it automatically leads you to believe that these are not regulated houses. These are not big houses. Therefore, there’s got to be something sinister behind the kind of publication of this information. I think that’s where the story is and that’s where people like yourself have to start hunting. Why were they, firstly, anonymous, and who did they represent? Was this only the tip of the iceberg or was there something around them? Those are the questions I’m asking as well. If I publish good research… I mean, we all read your stuff. You write good stuff so, we read it – simple. So, why do you want to publish it anonymously, unless you’re trying to hide something or, alternatively, there’s something sinister about it. That’s what bothers me.

Yes, and where you find out about it in the first place? That’s certainly the flag that’s been waved, was that the information came to him because he was working for an organisation that was approached by part of Steinhoff, and so on, and so forth, and away they go. Anyway, we’re off to the races. We know who Viceroy is and in the future, he will be just another short-seller, and the mystique is now out of the picture. They’ve had one big coupe. He’s probably been getting lots of job offers on top of it as well.

That’s possible.

Yes but not in SA one ventures to believe because in SA things are going in the right direction for a change. It’s been 37-years that Zimbabwe has been struggling but today on the front page of ‘The Financial Times of London,’ all about how the new president, Emmerson Mnangagwa, is going to be having free and fair elections and bring in your observers – we want your investments. We’re going to make this an investor friendly country. We want to rebound and then my friend, Trevor Ncube, put a video out today. He was previously from the Mail and Guardian, who’s gone back to his native Zimbabwe, to build up his businesses there again, and he says that he’s met with the president and he was delighted with the response that he got. He’s doing the role for Zimbabwe, as Trevor that Aggrey Klaaste did in SA, if you recall back in 1994, when Aggrey was championing the whole idea of national building. That’s what Trevor is now championing in Zimbabwe so good news in Zimbabwe. In SA, I guess, good news as well with Cyril Ramaphosa making a very impressive performance yesterday when talking to the guys prior to Davos.

It’s interesting – one doesn’t know what’s Cyril’s role is going to be. I think Davos is always a wonderful forum to meet people and to present something. My worry is that I’m not sure that the kitchen is clean at the moment, by meaning that I use the expression – clean the kitchen before you invite people over for dinner, and I think there’s a lot of work that he has to do at the moment. We’ve got the Eskom issue now, which is very serious. They’re bankrupt and I don’t think they’ve got enough money. It’s something that we have to focus on. He has to get that house in order. I think there’s a lot of things that he has to get in order here as well. The Western Cape is very serious at the moment – the worst drought in over 100-years. We’re not sure how that is going to play out. That is an area, in which they can get investment to help them with water so there are other issues as well, from a pure growth point of view.

He’s got to set out his plan. I think he’s in the middle. There’s one thing, and I promise you, I was with you when this happened. I remember Warren Buffett saying three things, it certainly was a couple of years ago. He said that there’s three things that you need to attract investment and it stuck with me all these years. One is that you have to protect people’s property rights – meaning that if people come in and invest in the country the law has to protect their rights. You can’t just take that away. You can’t just ransack it. You can’t just trash it, whatever. You’ve got to ensure that there’s protection.

The other thing is policy certainty. You can’t introduce policies like tax or whatever it is, and not adhere to it. You want to know that five years down the line those are still going to apply. The third thing he mentioned was labour. I can’t remember how he described labour but I’ll paraphrase it or I’ll try and give an interpretation, was that it’s a labour force that works hard, probably skilled and doesn’t go on strike all the time – it doesn’t change, in other words. I remember those three things distinctly. I think that at the moment, I’m not sure we’re passing on any of them. I think protection of property rights – yes, we’ve got the law courts, etc., but it’s got to be fastened. You’ve got to ensure people that you have got the mechanisms to do that.

David, wait, we do have that at the moment. We have that in the constitution. We do have the protection of property rights in the SA constitution. The question mark, surely, is the agitation to change it, and for all the good reasons. I was telling my colleagues a story that my old friends, Will Ngcobo, when we worked at the SABC, it must be 20 years ago, (the two of us). He asked Professor Buthelezi, who was then at Wits, because he’s also from Newcastle, where I come from, to have lunch with us. In this incredible conversation over lunch Professor Buthelezi explained to me how, in my hometown not too many years before, when the apartheid government came in, around 1948, how the black people were scooped off the land around Newcastle and dumped in a brand-new township that they made, called Madadeni, which became the second biggest town, I think, in KwaZulu-Natal because they scooped people off the land and stuck them there. Now, this was only in the 40s and early 50s. Surely to goodness that wasn’t fair, and I can understand and sitting and listening to Professor Buthelezi, telling us the story I was thinking to myself no, come on – this has to be put right at some point in time. So, those issues.

Read also: Land reform mirage: ANC govt fails to take property rights seriously

When you get an issue, where for instance, the guys who went into the Free State, when the ‘Settlers’ arrived in the Free State there was no one there so there’s nobody whose land they were taking away. At some point there has to be justice in this but the land question in SA is now getting contaminated with radical economic transformation. Everybody who wants land, because they happen to be black, can take it from someone, because they happen to be white and it’s become a racist thing. Hence, it goes into the constitution on ‘let’s change property rights.’ Let’s screw up the country or screw up the constitution because of a political issue. Surely, Cyril Ramaphosa, the man I know – he knows. He’s smart, David, he reads a lot and he knows history. He knows that there isn’t one blanket rule that you can impose and certainly, he would know the dangers of tampering with property rights. Again, there has to be some kind of a redress for the stuff that happened around Newcastle, which is a little town in KZN, and presumably, in many other parts of the country, at that time.

You are 100% right – we can’t justify what happened in the past, but when he goes across to attract investment – these are people who are coming in for the first time. They have no interest in our history. They’re coming in to buy or to invest in bricks and mortar to manufacture things that other people want or the rest of the world wants and they hope to make a profit on that. So they’re going to create employment, pay tax, and hopefully, send profits back or get a return on their capital. That’s foreign investment and you’ve got to ensure that they’re able to produce something here better or more efficiently than anywhere else in the world so that’s the message of Davos. You go across there because you want people to take an interest in SA rather than building a factory somewhere else.

At the moment Apple are thinking about a factory and it’s become this huge competition as to where, or is it Amazon?

Amazon’s second head office, yes. It’s called 2HQ.

I knew it was one of them, and there’s a massive competition and question marks about where they’re going to place it because it has huge impacts on a local economy and the ecology around a factory because once people are employed of course, they use the facilities around there – the schools, the hospitals, the shopping centres, etc., so it’s very important to lay down bricks and mortar, and to have foreign investment. I think what he has to get across, if he’s going to attract he’s got to be sure that he’s got policy certainty. That whatever he offers these people, someone else is not going to change it in the next few years or come and grab, and so on. So, those are the issues. My point about it is that I wonder if they’re ready yet? I wonder if we’re in a position to really make an impression or merely to lay down, okay, these are the things that I’m going to address in the next year or so.

David, he spent five-years being the gofer for a very inadequate and incompetent president, who was more interested in lining his own pockets and those of his friends. That we know – that’s the reality of it. There’s no more mystery around what Jacob Zuma was up to. Cyril, if he’s been waiting for this moment – I don’t think it’s a question of not being ready, but going back to property rights. Property rights are, unfortunately or fortunately, depending on where you stand, if you don’t have property rights, as you said earlier, you are not going to have investment but there is another way to restitute the issues that happened in the past.

Think of it this way. Let’s just say you and I were the sons of a farmer from, and I’ll just talk to my own background, to offer me Gogo, which is near to Newcastle, and we hear the story that our grandfather got the land because the Gumede’s and the Zwani’s were taken off this and put into Madadeni. What are we going to do? We aren’t going to say, ‘no, but it’s our land and we demand it.’ Of course, people are honest and most people are good. You can see that, you can see there’s an issue and you say, ‘okay, let’s try and find a solution and obviously there was a wrong that was perpetrated.’ You don’t have to change the constitution to make that happen, and I think that’s really, where we’re getting at here. Cyril Ramaphosa will know how to negotiate those kinds of tricky issues, without having to throw the baby out with the bathwater, which that is what it seems to be on property rights.

Just getting onto your second idea of policy certainty. There is no doubt in my mind that Ramaphosa will give us policy certainty. Whereas we know under Zuma, and you only have to look at the MPRDA to understand how they messed around with policies there. So that will also be something that we can tick the box of Mr Buffett. The third one on labour. Well, remember he was a trade unionist and he comes from that background, he’s also been in business. If anybody can bridge the divide it’s got to be this guy.

Yes, well, he knows how to negotiate with them. I think that’s one of the biggest issues that we can’t afford, at this stage, to continue increasing, particularly in government, wages way beyond inflation. Also, we’ve got to uphold our efficiencies. I think very few people realise that if you work slightly harder and a little more productively, what the benefit for the economy could be. Those are his challenges because our growth rate, at the moment, is way below the mean. While I was listening to Lesetja Kganyago yesterday, and I like him very much, I think he’s a very balanced person. He says he’s increased his growth forecast, but by decibel points. He sees inflation picking up but if you look at the growth rates, Alec, we’re way below the global mean. We’re way below even advanced countries.

But are you surprised? There can be no mystery in that either, given the pathetic way that the economy has been managed over the last 10 years, well, mostly the last 5 years, but even before that.

No, I know.

The fact is that you’ve got a new CEO, Dave, you’ve got a turnaround situation here, in business terms and you’ve got a really bad CEO, who’s in the process of being shown the door, who wasn’t acting on behalf of shareholders. He was acting on behalf of himself and his cronies. Now, you’ve got a new CEO, who’s going to act on behalf of shareholders. Isn’t that a reason to buy the stock, and we’re talking about SA as a company?

I’d be cautious because I am cautious. I’d like to see it starting to happen but please, don’t take it the wrong way. I’m not negative. I’m saying that I don’t want to buy the hope. I want to buy the evidence. He’s got to balance…

David, let me put it differently to you. Would you short-sell or if you were short of the country, as many people have been, would you stay short given that you’ve swapped the CEO?

No, I’d probably be on the side lines, which in a way, is kind of short and let me give you the reason. It’s that there are a lot of other countries that are growing faster and there are a lot of other businesses in the world that are growing faster, but if we start to make the right signals to the rest of the world, and we start to change things here – I think they can change pretty fast. I don’t think we’ve got a workforce that is naturally lazy or indolent. I think that given the right leadership I think people will work harder. I’m confident that that can happen but we’ve got to wait for Cyril. First of all, we’ve got to wait for him to get into the top position, firstly. I think that’s imperative that he gets there and we get rid of the past. That we get rid of the Zuma administration and that he makes the changes that he needs to make. Then we can start to address the issues. I think we have to get growth because from growth we get higher tax revenues. From higher tax revenues we can still satisfy all the social demands but it does give us extra money to reinvest in our future, which we haven’t got at the moment. We haven’t got the money to actually reinvest and grow, and grow our infrastructure. That’s why I’m remaining slightly cautious and a little bit on the side, waiting to see what happens without getting too emotional. We can’t get emotional in stock markets. You’ve got to look at the risks on both sides.

The good news though is, as you stand apart from this, the slide appears to have been arrested. I would bet very good money to say that it has been and that a turnaround is coming. But where you pick the turnaround depends on your risk appetite and I think that’s really what it’s all about. There are alternatives to SA, and Zimbabwe for that matter, which are far more appealing and both Zimbabwe and SA are going to have to make it very attractive for foreign investors to come in so don’t even start talking about fiddling with property rights because then you won’t even get them in the door.

The good news though is, as you stand apart from this, the slide appears to have been arrested. I would bet very good money to say that it has been and that a turnaround is coming. But where you pick the turnaround depends on your risk appetite and I think that’s really what it’s all about. There are alternatives to SA, and Zimbabwe for that matter, which are far more appealing and both Zimbabwe and SA are going to have to make it very attractive for foreign investors to come in so don’t even start talking about fiddling with property rights because then you won’t even get them in the door.

Alec, can you imagine from a tourist point of view. I was just thinking that Zimbabwe, Zambia, and the Victoria Falls – that whole area, coming down to SA. I can’t think, and I know there are wonderful places in the world. There are some very beautiful spots but I think from anybody who came here you get a mixture of everything. The Zambezi is the most wonderful area in the world, from the Victoria Falls, on both sides – it’s a beautiful area. Then you’ve got the Cape. We’ve even got the game reserves. If you want a little sophistication you’ve got the gambling joints in Johannesburg. You’ve got a mixture of everything. You’ve got a mixture in Johannesburg of multi-cultures, from restaurants and nightclubs, to everything. It can become such a tourist hotspot if we get all those countries right. I would include Zambia, not that there’s anything terribly wrong with Zambia but Zim, Zambia, and even Chobe, that whole area, along with Botswana, and Kalahari – those areas they’re magnificent.

It is indeed, and once you get the good leadership, and I think that’s really what we’re talking about. An improved leadership, and start addressing the issues that keeps tourists away, i.e. crime, and then you have to worry about the other issue that keeps tourists away, which is the strong currency. Relatively speaking, hasn’t the Rand done well?

At the moment, and it looks like it’s getting stronger.

What’s going on there?

Alec, it’s very difficult to fathom. What’s happened is we’ve seen a massive turnaround for economic reasons of the Euro. It’s trading, as I look at the screen at the moment, at $1.22. I can’t remember, this is maybe 2.5 years ago that we saw these kinds of levels. Certainly, the Pound at $1.39, those were levels before Brexit, and one of the reasons and it’s not my reasoning, this was told to me because I couldn’t fathom out why the Dollar was so weak and why it was going weaker, was that there are fears of the current account. With Trump’s introduction of the tax reforms – it’s going to mean that the fiscus there is under a bit of pressure and that the current account could widen. I don’t think that it has anything to do with increasing interest rates, which we’re seeing in the US, we’re seeing the 10-year bond up. It’s that people are beginning to fear some of the economic fundamentals there and are choosing to rather go towards the Euro, even the Pound and some other GTM currencies. That’s what was explained to me by very high-level analysts, and who hold very high positions in international banks, who’s just had a presentation this morning. That’s one of the reasons that we have to watch out for now, and that could worsen, which could mean that the Rand actually improves from these levels as the Dollar continues to deteriorate.

What does that mean for the country and what does it mean for stocks?

Well, it’s good and bad. It’s good that it allows us to afford overseas things a lot cheaper. It keeps our inflation down so we don’t import inflation. On the other hand, our exports become uncompetitive, whether it’s gold, platinum, iron-ore, or coal, everything else like our fruit and our wines – all of that becomes a lot more expensive for foreign people to buy, and that could put us under a bit of pressure. On the other hand, it makes oil imports cheaper, even though oil is now just under $70 a barrel. So there’s good and bad. I don’t think we like the Rand at these levels. Probably 12.50/13 is probably the mid-point or break-even point that we would prefer. When I say, ‘we,’ I mean from an exporters point of view as well. Look, those companies like Adcock Ingram here, who import ingredients, it’s great for them. I would imagine that a place like Aspen, on the other hand, it exports a lot but it imports as well. It’s a two-edged sword, from my point of view.

Who’s the winner in a stronger for longer Rand environment? You’ve mentioned Adcock Ingram are there any others that come to mind?

I suppose a lot of the retailers would also benefit, those who import. But anybody, the exporters, and of course a lot of our big dual listed businesses they’ll still carry on. The only problem is when we convert their share price into Rands it’s down, and that has a big impact on the performance of the overall index. But I think the local economy, a balanced local economy benefits from a stronger Rand but tourism could come under pressure. I will have to think about that because issues, like tourism, could also battle in a strong Rand. On the other hand, and let’s be devil’s advocates as well or take another side – remember, we’re going into a stronger global economy, where people are going to have more money so they might not be that fussy about price. That could also offset it. When people are feeling affluent they spend regardless.

And when people are feeling safe, they spend twice as much so if one can see an improvement in the perceptions on crime anyway, we start seeing those crime figures coming down. You see a more effective police minister, who’s driving it. Well, not just the minister but, more importantly, is the criminal justice system getting rid of all these criminals with badges, as Paul O’Sullivan calls them, and replacing them with career policemen. That has to have a trickle down or probably a swamp down effect on crime throughout the country, and of course, that will also offset whatever improvement the Rand has done. So all round David, it does look to me, and I know you are sceptic at the moment, but it does look to me, sitting far away and looking at SA as a potential destination for capital. In the past you had to think twice, but now, you’re starting to consider it again. Here, in London, I engage with a lot of international companies. Those who’ve got investments in SA they like to find out what’s going on from me, and my message to them throughout, in the last couple of years since I’ve been here has been, well, if you’ve got the investment just hang onto it but I certainly wouldn’t be putting more money for these crooks to go and steal from you. Whereas now, I would say to them, it’s really crazy to be leaving the country. It’s like having run the Comrades Marathon and you’ve got to the last 100m, and you decide to stop and give up because there’s the finishing line, and things can change.

Alec, I think where you are so right is that I don’t think we understand the damage that president Zuma, his associates, and his administration has done to this country. I don’t even think we can quantify it, it’s so, incredibly large. I think the simple fact that that’s going to be addressed and that people have had absolutely enough of corruption. I think that in itself is a turnaround strategy or is going to improve the way that people think. What we need to do now is, I think we need some people in jail. I think we need the law courts to take over and that part is also going to have a big impact because there’s a lot of anger that is brewing up against people who have stolen from us, and stolen from the country, and stolen money that wasn’t meant for them, but really meant for people who are a lot poorer. I think the Trillian cases, the Gupta cases, or whatever shape they take, I think it’s incredibly important for redemption.

This time last year, who would have thought criminal charges against SAP, McKinsey, Trillian, and of course, KPMG – criminal charges against these multinationals and the Guptas plundering arm. It’s here, it’s now, and the opportunity for the country has arrived. However, one last thing on that score, and I hear you when you say, you want to see people in jail. We did have a very successful TRC (Truth and Reconciliation Commission) and perhaps, just perhaps that would have the same kind of an impact. Rather than the retribution of seeing people rotting away in cells. Having them come out and as the apartheid police and security branch, and those people who did some awful things during that time, who had to come out and face their accusers and tell the people, whose children they had killed or spouses they had tortured exactly what they did – that was a cleansing process as well. So we’re very good at doing this, Dave, as South Africans. We’re incredibly good at being able to address the issues and then move on. Should we be addressing them through retribution, like the Brazilians are doing? Or should we be addressing them in a more forgiving approach? Well, I guess only time will tell but the fact is, we have that option now and that wasn’t even an option before the 18th December.

Sure, I think we need to get to the bottom of it. We need to know how far it stretched. I think it’s going to be very cathartic and help heal the country again. We’ve hurt, we’ve been very hurt. When I go back to 1994, and to the feeling around the country at that stage. When you go back to the 1995 rugby World Cup, and we think of how we felt then and how we feel now, and you ask so many questions. What’s very interesting, I never feel hostility or animosity. I know there’s a lot of rioting and everything, but I’m a runner and I run through some of the dodgiest areas you’ve ever seen. I can’t avoid them. I run through crowds of people, early in the morning, going to work. Literally, 100s and 100s of people walking very early to get to work. I’ve never had an insult thrown at me. I’ve never had anybody curse me or attack me. Yes, I was held up once and had my takkies stolen but that was a long time ago, but when I run in the morning, and go through the suburbs and areas, the highways to Sandton, I never feel that anger. A lot of people stop me, who recognise me either from TV or radio, and so on. It just shows you that deep down there’s actually a lot of goodwill here. I’ve never said that before, and never thought that actually.

And of course, South Africans are very smart because they recognised you from radio, David. Are you singing as you go along the road, or is it because you run so fast and they say, well that could only be one man? Mr Shapiro, I’ll probably not be talking to you next week, because I’ll be in Davos but when I get back from Davos we will certainly have lots to talk about there. Thanks again for the Old Firm it’s always such a privilege and a pleasure to engage with you.

Oh, thank you. I always love your stories and I advise anybody listening here, I think they must follow you on Davos. They must follow your articles on that because you’re the one person who goes there with a purpose, and you always seem to capture what’s happening there so, we look forward to that.

Well, very kind words from my friend, David Shapiro, to end this podcast with and in truth, I’m looking forward to Davos as well. It’s my 15th visit to the World Economic Forum’s annual meeting, having attended the last 13 in a row, but my first visit was back in 1993 – a nicely, rounded quarter-century ago, and not since then have I been as excited about seeing Team-SA on the global stage. This time, under new leader, Cyril Ramaphosa. Well, here’s hoping the rest of the world are as impressed by SA’s president-in-waiting, as we are. I’m also hoping to bring back a story or two about how I met Zimbabwe’s own fresh breeze, Emmerson Mnangagwa, who will also be in attendance. Until the next time, so long.