Most fail, but when you do get it right in the media space, the riches are boundless. The greatest private equity investment in history continues to reward Cape Town headquartered Naspers which, in 2001, took a bet on a then Chinese start-up called Tencent. Naspers has held onto every share it bought and after listing a some other dilutions, now owns 34% of Tencent. After its latest set of financial results Tencent’s shares surged to a new high, valuing the company at more than R2-trillion for the first time. That’s around half South Africa’s annual GDP, valuing Naspers’s shares in the company at R680bn, or 95% of the market cap of the group’s shares on the JSE. Among those celebrating this morning will be Vestact’s Sasha Naryshkine – earlier this year he made Naspers his #1 pick for 2015. As long as Tencent keeps running, its SA associate will continue to flourish. – AH

(Bloomberg) — Tencent Holdings Ltd. rose to its highest level in more than two weeks after reporting a surge in revenue from the more than 1 billion users of its WeChat and QQ messaging services.

Shares of Tencent rose as much as 1.6 percent to HK$138 in Hong Kong on news of Wednesday’s fourth-quarter earnings announcement, its highest price on an intraday basis since March 3. The company was trading at HK$137.80 as of 10:08 a.m.

Tencent’s net income rose 50 percent to 5.86 billion yuan ($945 million) in the three months that ended December, the Shenzhen, China-based company said. That compared with the 5.93 billion-yuan average of 11 analysts’ estimates compiled by Bloomberg.

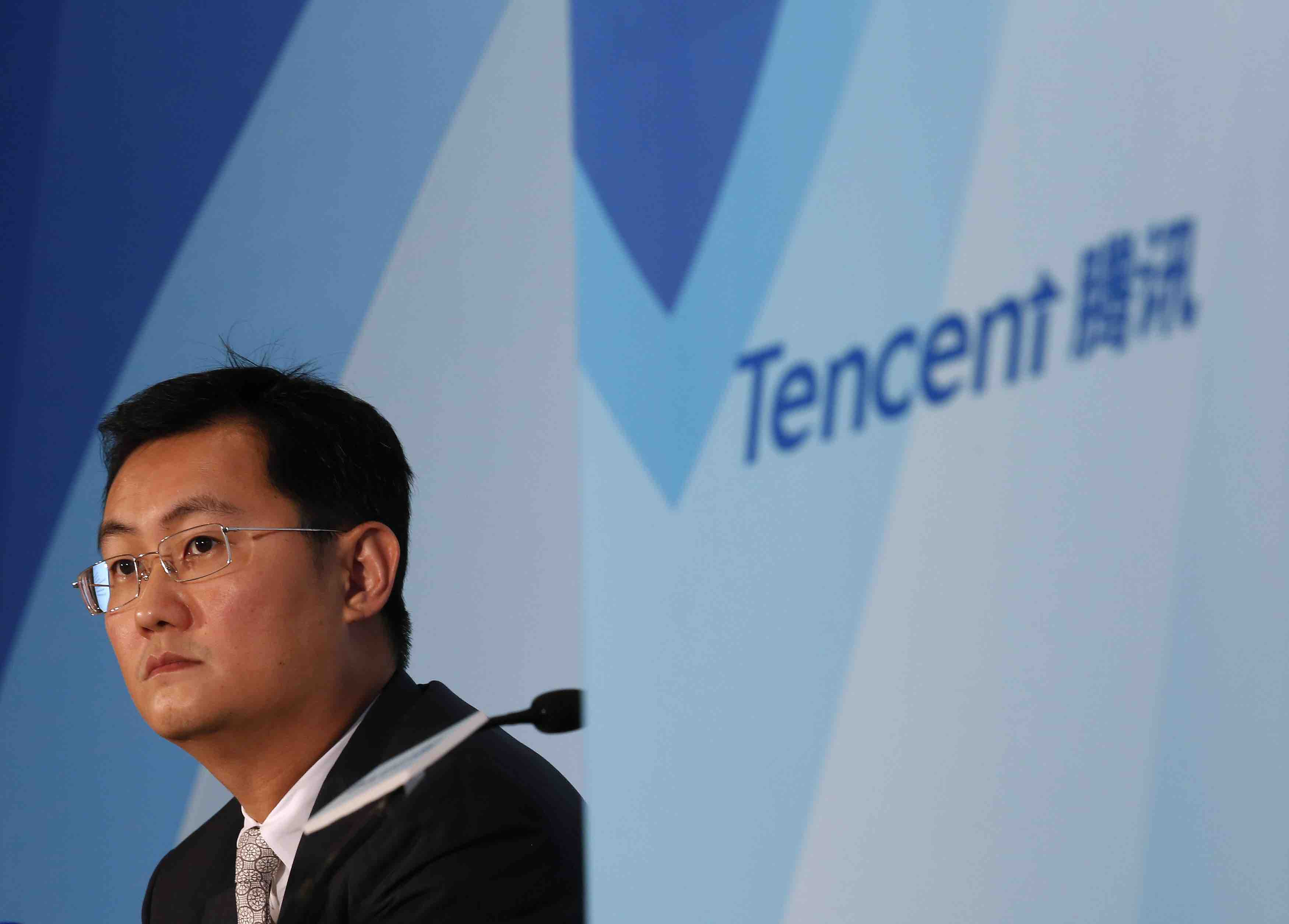

Billionaire Chairman Ma Huateng is finding ways to make money from instant messaging through advertising and payment services as Tencent steers shoppers to partner JD.com Inc. and expands its game lineup to compete with Alibaba Group Holding Ltd. The company is trying to reach more users with deals to stream content such as “Game of Thrones” and to make WeChat among the first applications integrated with Apple Inc.’s smartwatch.

“Tencent has been buying entertainment content including anime to make sure users stay longer on its platforms,” Jeff Hao, a Hong Kong-based analyst at China Merchants Securities Holdings, said by phone. “More content is also a premise for creating more space for advertisement.”

The company’s stock had gained 21 percent this year before today’s trading, compared with a 2.2 percent increase in the benchmark Hang Seng Index.

Tencent Literature

Tencent is open to listing its literature unit in the future, President Martin Lau said at a news conference in Hong Kong on Wednesday.

The company merged its literature unit with Cloudary Corp. to form a new company called China Reading Ltd., according to an e-mail from Tencent.

“Our literature platform is one of our new initiatives, we recruited a very influential person, the founding father of China’s online literature business to build up our business,” said Lau. “We consolidated other businesses and formed a new operation.”

Lau separately said China’s new proposals on so-called variable interest entities, or VIEs, is a positive for the company as it helps legitimize such structures.

China’s Commerce Ministry in January put forward a draft that could unify regulations overseeing foreign investment, scale back restrictions and begin regulating VIEs that are commonly used to circumvent foreign-ownership limits.

WeChat, QQ

The draft proposal, which is now in consultation, requires companies such as Tencent to ensure Chinese investors hold control of the company or ask for a State Council waiver.

“We believe the rationale of this consultation is positive as its purpose is to legalize VIE,” said Lau. “There’s not a lot of specifics right now and what we are doing is participating proactively in this consultation process.”

Revenue rose 24 percent to 21 billion yuan, compared with the 20.4 billion-yuan average of 16 analysts’ estimates compiled by Bloomberg. Tencent’s sales were lifted by new mobile games, increased user spending and expanded advertising efforts.

Fourth-quarter sales from the Value Added Service unit, which includes online games and messaging, rose 44 percent to 17.1 billion yuan. Online advertising surged 75 percent, while e-commerce transactions dropped 87 percent after Tencent put its shopping assets into a venture with JD.com.

Tencent is trying to cash in on the huge user base of QQ and WeChat, known as Weixin in China, with an open-platform strategy that lets third-party developers, marketing agencies and merchants such as Lenovo Group Ltd. use the platforms to promote goods and services.

‘Healthy Growth’

QQ has more than 815 million monthly active users, and WeChat has 500 million, Tencent said. The two instant-messaging applications and Tencent’s app store attracted 2.4 million third-party programs, Chief Operating Officer Mark Ren said in October.

The company’s QQ Wallet and Weixin Payment have integrated more than 100 million bank cards, Lau said.

Revenue from China’s online gaming market is projected to climb to 225 billion yuan by 2017, from an estimated 147 billion yuan this year, according to IResearch, a Shanghai-based Internet consultant.

Tencent expects the pace of expansion for smartphone games to slow this year, Chief Strategy Officer James Mitchell said on a call with investors after the earnings announcement.

The company’s mobile-game revenue rose about 27 percent to 3.8 billion yuan in the fourth quarter from the previous three months ended September, Chief Financial Officer John Lo said on the same call.