December 9 2015 will go down in South African folklore, it was the day the heart of the Finance Ministry was literally ripped out, only to be replaced by a complete unknown. It was the day President Jacob Zuma, dispatched of then Finance Minister Nhlanhla Nene, replacing him with David/Des van Rooyen. Van Rooyen’s appointment was the country’s shortest and common sense prevailed as Pravin Gordhan, who was replaced by Nene as finance minister not two years prior, was re-instated. Parity restored? Not quite. The aftermath of the event has been well documented and Biznews.com founder Alec Hogg calculated the immediate loss to the country as R500 billion. The actual loss may turn out to be a lot more as the R500 billion was off equities and bonds. And this staggering number may deepen, especially as this moment in South Africa’s history may have speeded up the path to ‘junk’, which will lead to further losses. A slippery slope. – Stuart Lowman

By Alec Hogg

I recently received this letter from Lebohang Mojapelo, a journalist at Africa Check, a non-profit fact-checking website based in the Wits Journalism Department.

EQUITIES:

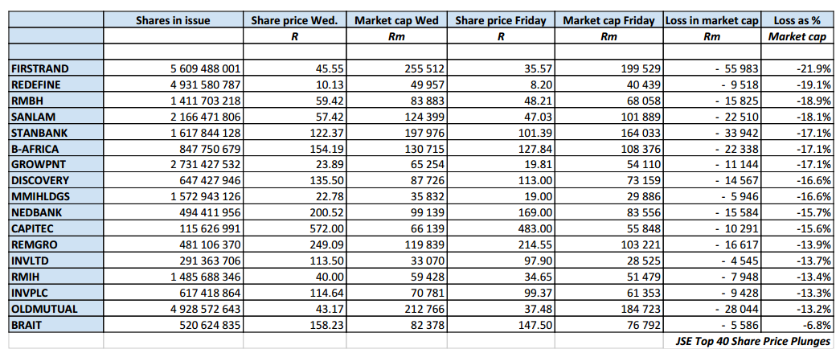

As our detailed table shows in the linked article, in two days the market value of the country’s 17 biggest financial and property shares fell by R290bn (below). I only referred to the financial and property stocks in the JSE’s Top 40 – there are numerous others outside the Top 40 which, obviously, also fell sharply in value.

BONDS:

In the two days post Van Rooyen’s appointment, South African bonds lost 12% of their capital value.

At the end of 2013 there was R1.8 trillion in South African bonds listed on the JSE. That has grown since but using the end 2013 number, a12% capital loss on R1.8 trn is R216bn.

TOTAL:

The total capital losses sustained by South African bonds and directly affected equities was at least R506bn.

The EFF was thus accurate in quoting of this figure in Parliament.

Thankfully sanity prevailed on the Sunday night with the reinstatement of Pravin Gordhan of Finance Minister, first stabilising the market and then helping it to recover part of the Nenegate losses. Had Gordhan not been reappointed, as Mr Canter points out in the interview linked, the losses would almost certainly have escalated still further.

Please note I was only using quantifiable facts. The impact of the Rand’s depreciation on the national capital stock and the ongoing additional cost of servicing the R300bn of foreign-owned SA bonds and the annual balance of payment deficit of R100bn have not been included.