Zimbabwe backtracks on BEE – ownership laws abandoned to attract foreigners

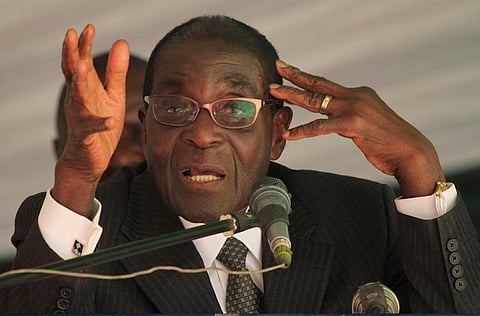

Economic reality is forcing Zimbabwe into a belated backtrack on its seven year old law starving the country of foreign capital. With the exception of the mining sector – an obsession of President-for-Life Robert Mugabe (91) – foreign investors will in future merely be "encouraged" to take on local partners. Will this make any difference? Are the investment taps about to be turned on? For Zimbabwe, almost certainly not for this generation of business leadership. But it does send a strong message to the country's southern neighbour. The more radical among South African politicians look to Zimbabwe for intellectual guidance with its misguided empowerment laws latched onto. As a result, the vast majority of foreign investors in SA have scaled back their fixed investment to a trickle. With an entire world bending over to attract their capital, multinationals are reluctant to commit anything extra to a country where politicians want to force more giveaways to an already well-heeled elite. Where Zimbabwe goes, SA must surely follow. – Alec Hogg

HARARE, Aug 30 (Reuters) – Zimbabwe, suffering from economic recession and lack of foreign investment, is relaxing a black economic empowerment law forcing foreign-owned firms to sell majority shares to locals in a bid to attract investment, a cabinet minister said on Sunday.

Signalling a shift in policy, Christopher Mushohwe, minister for youth, indigenisation and economic empowerment, said the law would only be mandatory in the mining sector, which generates half of Zimbabwe's export earnings and contributes about 17 percent of GDP.

Foreign investors in other sectors would be able to negotiate with the government what proportion of their businesses they could sell to locals, he said.

"The only area where we do not entertain negotiations is mining, because as indigenous Zimbabweans, our contribution is the (mineral) resource," Mushohwe told the state-owned weekly Sunday Mail.

"In other sectors, proposals are considered case by case. We are saying to the investors, if you come, your investment is safe, but we encourage you to partner locals," he added.

The southern African country is struggling to recover from a catastrophic recession that was marked by billion percent hyperinflation and widespread food shortages.

Foreign investors say the Indigenisation and Economic Empowerment Act signed into law in 2008 requiring foreign-owned firms to sell at least 51 percent shares to locals, is the biggest obstacle to investing in the mineral-rich country.

President Robert Mugabe has defended the law, saying it aims to redress colonial-era imbalances.

Anglo American Platinum and Impala Platinum Holdings are the two largest mining companies operating in Zimbabwe and have previously expressed reservations with complying with the empowerment law.

Zimbabwe has the second largest reserves of platinum and chrome, but has lagged behind neighbours like Mozambique and Zambia in attracting foreign investment largely due to Mugabe's economic empowerment drive and high political risk.

Outside mining, foreign investors are interested in Zimbabwe's manufacturing and tourism sectors and infrastructure projects like power generation, but are often discouraged by the indigenisation law and red tape.

Zimbabwe has halved this year's growth target to 1.5 percent while labour unions say more than 20,000 workers have lost their jobs in the last month as firms close due to power shortages, high cost of capital and competition from cheaper imports.