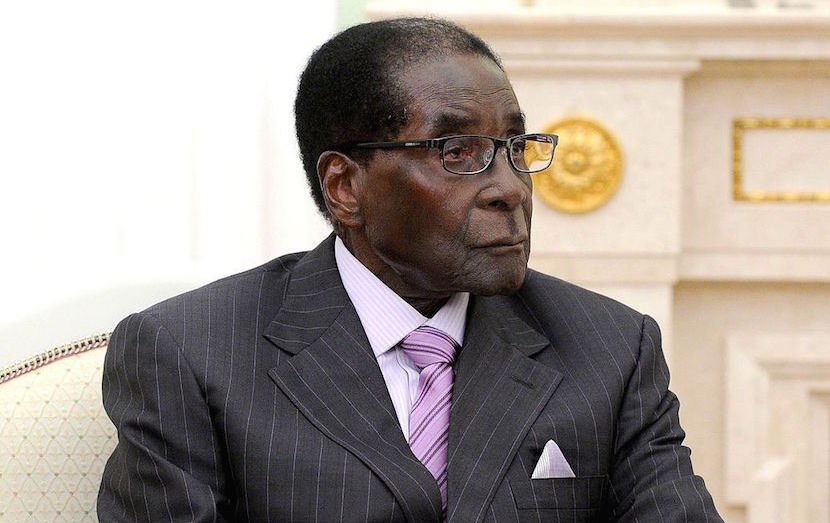

In economics. every dumb decision brings consequences. The more important that decision, the longer its impact – and more significant the result. Economic laws can only be bent for brief periods. Another reality forgotten by instigators of incoherent economic policy is how the consequences eventually destroy basic functions citizens take for granted. Like being able to withdraw cash at an ATM machine – a simple action no longer available to Zimbabweans as the country has, quite literally, run out of money. The insanity of Mugabenomics caused hyperinflation and the well documented destruction of the Zimbabwe Dollar. Switching the system over to US Dollars provided some respite – but failure to effect urgently required fixes meant this was only ever going to be temporary. That wasted period of “extra time” is over. If the latest obvious illustration of what bad economics visits on nations isn’t heeded by South Africans political leaders urging a repeat of Zimbabwean economic madness, what wlll be? – Alec Hogg

By

(Bloomberg) — Banks in Zimbabwe, which abandoned its own currency in 2009 because of hyperinflation, have limited cash withdrawals and shut down some ATMs as the country’s ailing economy causes dollar supplies to evaporate, threatening to result in company failures.

Lines of people are growing outside banks in the capital, Harare, as cash-strapped residents try get money to pay for everything from school fees to groceries. The shortage highlights the struggle President Robert Mugabe’s government faces in resuscitating an economy that’s half the size it was 15 years ago, according to government estimates, with about 90 percent of the population out of formal employment.

“The problem is related to Zimbabwe’s balance of payments,” Sam Malaba, the chief executive officer of Agricultural Bank of Zimbabwe Ltd., said by phone from Harare. “We’re importing more than we’re exporting and we can’t print money because we use mainly the U.S. dollar.”

The start of state-sanctioned seizures of white-owned commercial farms in 2000 by black subsistence farmers deprived of land during colonial rule slashed exports of crops ranging from tobacco to roses, triggering a near decade-long recession. That caused hyperinflation and the introduction of currencies including the dollar as legal tender.

Read also: Mugabe’s ship sinking – deflation eclipses hyperinflation

New Measures

While the dollar has strengthened, the currencies of neighboring countries such as South Africa have declined, allowing imports to undercut factories in Zimbabwe and leading to plant closures.

The Reserve Bank of Zimbabwe on Wednesday unveiled measures to encourage the use of other currencies. It will convert 40 percent of all new dollar receipts from exports into the South African currency and 10 percent of the income into the shared European currency at the official rate, Governor John Mangudya told reporters in Harare. It will also introduce “bond notes” in denominations of $2, $5, $10 and $20 as an extension to bond coins it already uses, while limiting daily withdrawals to $1,000, 1,000 euros ($1,149) or 20,000 rand ($1,345).

Banks operating in the country include units of London-based Barclays Plc and Standard Chartered Plc, subsidiaries of Johannesburg-based Standard Bank Group Ltd. and Nedbank Group Ltd., and local lenders such as CBZ Holdings Ltd. and Econet Zimbabwe.

Cash Injection

The southern African nation is in talks with the Cairo-based African Export Import Bank to inject $200 million of dollar bills into Zimbabwe’s economy, Mangudya said by phone from Harare on Tuesday. Zimbabweans should use debit and credit cards and mobile-phone payment services to try and alleviate the crisis, he said.

Read also: Dead wrong: Mugabe promises Zim will get China-driven economic growth

Minimum wage workers, accustomed to being paid in cash, have either gone unpaid or received only a portion of their wages as employers struggle to withdraw notes.

“We all received $20 only and that was a week after payday, but we’ve been told the balance will come bit by bit,” Sarudzai Mawere, a farmworker in the northern tobacco-growing district of Mvurwi, said on Wednesday. His monthly pay amounts to $130 plus supplies like corn meal, dried fish and soap. “We, as workers, have suggested that we be paid in food and goods until the problem is solved.”

Structural Deficiencies

The government in March said it will send teams to the U.S., U.K., Canada, Australia and South Africa to encourage the three million of its 14 million citizens who live abroad to invest about $1 billion into the economy this year.

“The cash crisis is a reflection of structural deficiencies and distortions in the economy,” Prosper Chitambara, the chief economist at the Labour and Economic Development Research Institute of Zimbabwe, said. The country faces “weakening economic growth as a result of dwindling domestic demand, de-industrialization, high public debt, drought, poor infrastructure, institutional weaknesses and a volatile political environment,” he said.

Read also: SA’s future? Bribe cash exhausted, Zim cops moonlight selling airtime, food

Zimbabwe’s reliance on informal labor for employment, high banking costs and low levels of confidence toward lenders mean most cash doesn’t pass through the nation’s lenders, Chitambara said.

Confederation of Zimbabwe Retailers’ Association spokesman Denford Mutashu said the problem is undermining sales volumes and would probably curb economic growth.

‘May Worsen’

“A large chunk of the shortages is caused by Zimbabwe’s large import bill, so retailers are going to have to source locally,” he said.

Mugabe declared a state of national disaster in March as the worst drought in almost two decades killed cattle, withered crops and left millions of people needing food aid. The government’s also struggling to meet monthly wage bills that consume more than 80 percent of revenue.

The shortage of cash may worsen company closures, Christopher Mugaga, chief executive officer of the Zimbabwe National Chamber of Commerce, said by phone from Harare.

“If cash is the blood of the economy, then treasury and tax authorities are the pistons that pump the economy,” he said. “But if the pistons aren’t pumping it means nothing is working.”