Barclays Plc starts to attract rational investors; smart #EPL deal shows why

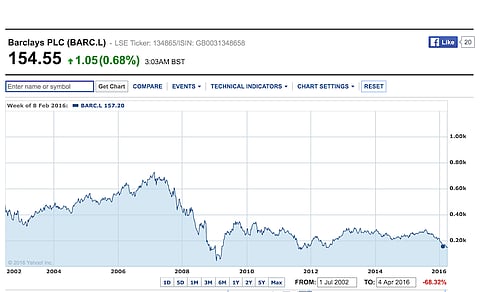

It's not a popular position, but as a potential investor I'm really starting to like what's happening at Barclays plc. Mr Market has lost his initial enthusiasm after the installation of a tough new chairman and then his like minded appointment as CEO. But the decisions they have taken will resonate with rational investors. Selling out of Barclays Africa has hurt the UK group's reputation in South Africa, especially among tens of thousands of Absa employees. But from an investment perspective it is was completely logical – punitive bank capital requirements introduced after the Global Financial Crisis means subsidiaries should be owned either 100% or less than 20%. Trying to get 100% of the African unit, mainly SA's Absa, isn't an option right now. So rather than kick the can down the road, Barclays has grasped the nettle and is sounding out buyers, including the Government Employees' pension fund. The way it has handled the renewal negotiations on its £40m a year headline sponsorship of the English Premier League is also instructive. The Bloomberg story below outlines the option that has been decided upon. My portfolio once included responsibility for SA's second biggest sports sponsorship budget, so have some insight into the complexity of such discussions. The solution Barclays worked out with the EPL is very smart. Reflective of the new logical approach that has taken over at the Canary Wharf skyscraper. Years of blundering are embedded into the Barclays Plc share price which trades at around a third of the level post the 2002 share split (see Yahoo Finance graph below). The new broom is sweeping very clean. That's an opportunity for value-driven, long-term investors. – Alec Hogg

By

(Bloomberg) — For the last 15 years, Barclays Plc has used the global popularity of Premier League soccer to gain footing in new markets. Next month, its reign as title sponsor ends, a reflection of the league's growing ambitions and the bank's shrinking ones.

Barclays' strategy has changed dramatically in the three years since it last renewed the 40 million-pounds-per-year sponsorship ($57 million). About 20 billion pounds of profit has been wiped out by misconduct charges over the last five years, and its plans for global dominance have retrenched.

Since 2014 Barclays has withdrawn from its European retail operations in Spain, Italy and Portugal, and in March announced plans to leave Asia and Africa, regions where the Premier League counts some of its most avid fans. As well as turning away from seven Asian countries, Barclays is looking for a buyer for a 62 percent stake in Barclays Africa. The focus for now is on core business in the U.K. and the U.S.

It has also pulled back from other high-profile sponsorships, including tennis's World Tour Finals. "The thing you pay the big money for — which is to put your name on the top — no longer was relevant for us as a business," Barclays global head of sponsorships, Nathan Homer, said in an interview.

At the same time, the Premier League has grown unabated. Television revenue will be $2.5 billion a year next season, and the value of the title sponsorship has grown more than tenfold in 23 years.

To capitalize on its own popularity, the league has decided to forgo a title sponsor entirely. Like the National Football League, the FIFA World Cup and the Olympics, the Premier League will instead try to add sponsors in each of seven categories. Nike Inc. has become the official ball sponsor, Electronic Arts Inc. is the sports technology partner, and the league is close to naming an official beer.

Barclays will stay on as the official bank. "It couldn't have suited us better," said Homer, who said the role will cost Barclays about one-quarter of what it paid for the title sponsorship.

Looking back on one of soccer's longest-lasting commercial relationships, Homer said Barclays got more than an advertising boost. The deal required the league to use the bank for all of its financial transactions, which have increased significantly in number and value over the years.

"Overseas rights have gone from just under 50 million pounds in year one to nearly a billion a year now — all of that had to come through foreign exchange to become pounds in the bank," he said. "So there's a very attractive revenue side to becoming a partner with the Premier League before you even think about all the benefits a marketing partner would enjoy."

Fourteen of the league's 20 teams also bank with Barclays, giving the lender access to millionaire players, coaches and deep-pocketed owners. Meanwhile, the relationship gave Barclays instant recognition in its new target markets — the Premier League is watched in 212 territories and its most-famous team, Manchester United, claims to have a global following of 659 million.

"As we expanded, it was a very simple awareness and brand stature that worked very efficiently: 'If Barclays can afford to sponsor the Premier League they must be a serious player in the business,'" Homer said.

The new agreement gives Barclays the first right to any of the league's banking needs, though its exclusive access to teams is over. Homer is confident most will stay with his bank. "It's not as easy as saying I'm going change my beer from one to another and just change the barrel."