Venezuela’s slide into chaos emphasises the danger of giving control of economic levers to those who lack understanding of how the machinery works. The country’s vast crude oil reserves together with the easy-money inspired price bubble, disguised the folly of late President Hugo Chavez’s populist experiment. As oil generates 95% of Venezuela’s hard currency earnings, while times were good, Chavez-onomics became the toast of socialist regimes worldwide. There was, it seemed, more than enough of other people’s money to be spent. But as the tide receded, the socialist hero’s fan club has been shrinking rapidly as reality reveals how his ideas are actually a fast-track to ruin. Now Chavez’s political successors are being forced to dump the nation’s gold reserves, raising cash to offset a collapsing economy and stem social unrest it has caused. Admitting the error and switching away from the economic insanity would be the rational option, but seemingly not available to those elected on the Chavez ticket. The track record of the politics’ Hard Left suggests that will condemn Venezuela to more of the same – until its cupboard is completely empty. – Alec Hogg

By

(Bloomberg) — Venezuela has ratcheted up efforts to sell off its gold holdings and raise the cash needed to fund imports and pay back debts after the collapse in oil throttled the economy.

The country cut its gold reserves by 16 percent in the first quarter, following a 24 percent reduction in 2015, according to data from the International Monetary Fund. The 1.38-million ounce reduction was the largest by any central bank since Switzerland sold 3.2 million ounces in the third quarter of 2007, and coincided with continued increases in gold reserves in mainland China.

The country cut its gold reserves by 16 percent in the first quarter, following a 24 percent reduction in 2015, according to data from the International Monetary Fund. The 1.38-million ounce reduction was the largest by any central bank since Switzerland sold 3.2 million ounces in the third quarter of 2007, and coincided with continued increases in gold reserves in mainland China.

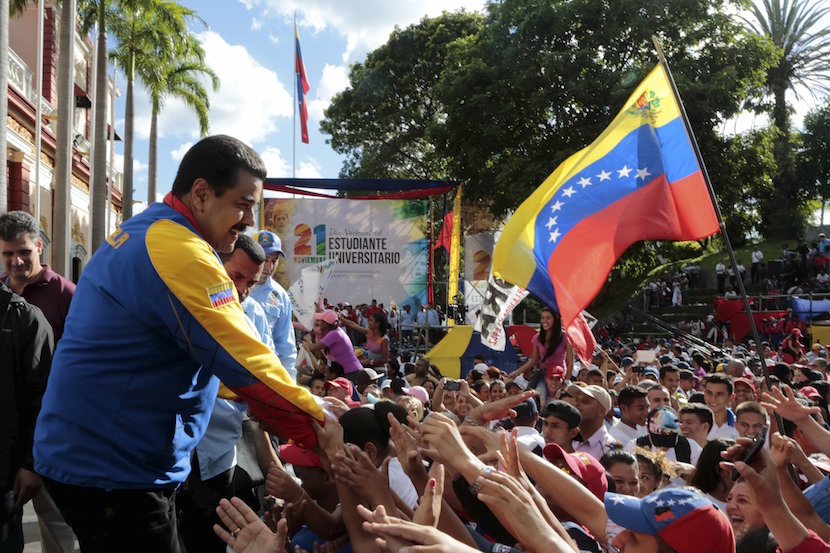

Venezuela has been thrown into turmoil by the collapse in oil prices, and President Nicolas Maduro faces rising political tensions amid runaway inflation, a contracting economy and shortages of some basic goods. Vice President for Economic Policy Miguel Perez Abad said this month that Venezuela will continue to use international reserves to help meet its commitments, while cutting back on imports.

Read also: This is SA’s Future? Bloomberg View: How socialist Chavez trashed Venezuela

As Venezuela’s gold holdings fell in the first quarter, prices surged 16 percent, the most in three decades. The country’s hoard, which stood at 8.77 million ounces at the end of 2015, was unchanged in January, dropped to 7.67 million ounces in February and contracted to 7.4 million ounces in March, IMF data show. The World Gold Council this month said Venezuela’s gold holdings made up 66 percent of its total reserves. Spot bullion traded at $1,218.95 an ounce at 10:45 a.m. in New York on Wednesday.

Make Payments

Officials have repeatedly said the country will honour its financial obligations in full and without delay. In February, Trade Minister Jesus Faria said every debt payment this year was guaranteed, including those near term, as well as in October and November. The same month, central bank President Nelson Merentes said the country will continue to make debt payments.

Read also: Venezuela opposition wins 59% in election, ejects “21st Century Socialists”

The possibility that the country may be tempted to sell some bullion to raise funds was flagged in August by Citigroup Inc., which listed Venezuela as a potential seller amid concern that it may default. The nation is one country that may be at risk of selling part of its holdings after oil fell, analysts including David Wilson wrote in a report.

Venezuela’s gross domestic product will shrink 8 percent this year after contracting 5.7 percent in 2015, according to the IMF, which forecasts that inflation may climb to almost 500 percent. The reduction in imports this year means the country will have enough cash to honour its bond payments in 2016, according to Eurasia Group and EMSO Asset Management.

The country shipped almost 60 metric tons of gold to Switzerland, a major refining hub, in the first quarter, Swiss Federal Customs Administration data show. Swiss imports from the South American country totalled about 12 tons last month, the data show.