Jamie Dimon says the US stock market has already voted, booming under Bidenomics

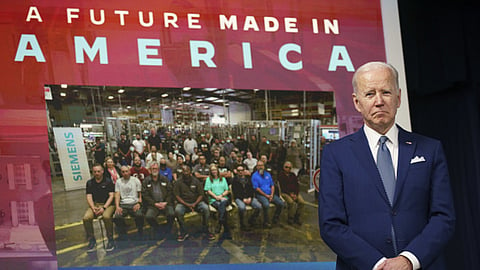

Jamie Dimon has heralded the US economy as "booming" for the first time in his tenure, citing historic lows in unemployment and soaring consumer wealth. Investor confidence in American stocks reaches unprecedented heights, fueled by transformative policies like Bidenomics and the Chips and Science Act. Semiconductors lead the charge, but diverse sectors, from conglomerates to healthcare, contribute to America's economic allure. Under President Biden's stewardship, optimism surges, marking a remarkable chapter in the nation's economic narrative.

Sign up for your early morning brew of the BizNews Insider to keep you up to speed with the content that matters. The newsletter will land in your inbox at 5:30am weekdays. Register here.

By Matthew A. Winkler

Jamie Dimon was recently asked: "If you had to describe the US economy, how resilient is it?" His answer was unequivocal: "Basically, it's booming." It was the first time the chairman and chief executive officer of JPMorgan Chase & Co. uttered such a superlative since he became the head of the world's largest bank almost two decades ago.

___STEADY_PAYWALL___