Good news: SA consumer confidence index rebounds

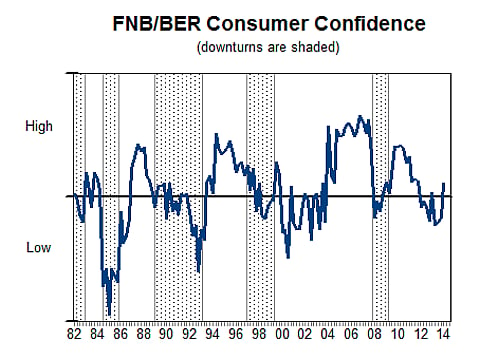

Some could certainly interpret the latest FNB/ BER consumer confidence index rebound as confusing and contradictory given the general public perception of the economy and where it is going. This is especially in light of widespread labour unrest, spikes in inflation, indices in the negative range, and a weak rand. The latest in the numbers from FNB show a move in the index from -6 to +4 in the second quarter of 2014, which is reported as the highest reading since quarter three in 2011. To the lay person it would seem that this positive jump does not indicate what seems to be happening in the country. Making it all clear, and explaining it without any of the contradiction that the numbers seems to relay, is FNB's Sizwe Nxedlana. Sizwe certainly has a good picture to paint, the good news is that it all makes sense, and allows us to enjoy the fact that for all the hard times, an upside must eventually surface. – LF

ALEC HOGG: The second quarter, FNB/BER consumer confidence index rebounded from negative six to positive four index points. Sizwe Nxedlana, did I get it right there?

SIZWE NXEDLANA: It's okay.

ALEC HOGG: I should do better, coming from where I come from but he's the Chief Economist at FNB, and he is with us in the studio. It really is a serious rebound, and if we go back this time, last year, we came from a plus one, minus eight, minus six, plus four. That's quite clearly an improvement.

SIZWE NXEDLANA: Yes, so I think there may have been somewhat of an overreaction, to the bearishness that was implied on the household consumption expenditure growth relative to what is actually being delivered. If you have consumer confidence levels, at say minus six or minus eight, it is normally consistent with negative growth, in household consumption expenditure. While we've had a significant moderation and overall growth in household consumption expenditure, from about five in 2011, we are sitting now at closer to two, in fact just below two. I think there was an overreaction relative to what is actually being…

ALEC HOGG: In that six-month period?

SIZWE NXEDLANA: Yes.

ALEC HOGG: So, it was from around September to March this year.

SIZWE NXEDLANA: Yes, so you had two/three, up until two/one, where we've had DP negative consumer confidence, consistent with a much more negative outcome in household consumption expenditure growth, which actually hasn't been delivered.

ALEC HOGG: It's strange because if you were to ask most people today, the news that's been hitting them has been pretty bad. We've had the platinum strike that we were told is hurting the economy. Now we've got the NUMSA strike, which we were told could be three times worse, well if it continues for as long, because it is affecting three times more people. Yet, the consumer confidence is going the other way.

SIZWE NXEDLANA: Yes, so relative to the NUMSA strike, I think that would be something that we would see in the three/two outcome and it would be relative to how long the strike takes and so on.

ALEC HOGG: But this would include the platinum strike, surely.

SIZWE NXEDLANA: It does include the platinum strike but let's just think through that for a minute. If you look at the detail of the consumer confidence index, a large chunk of the improvement is actually a function of very resilient, reported on finances, right. Consumers are telling us that they are still relatively not optimistic about the outlook for the economy, relative to long-term averages. They don't think that now is a good time to make big, financial commitments, but they're very positive about their own finances. If you divide that by the various income bands, you will actually find that it is a high-income story, so high-income consumer confidence is positive. I think it is plus seven. Low-income consumer confidence is minus four. High income reported on finances, are staying at plus 25, which is significantly above even the long-term average since 1994 where it reported own financial expectations for low-income households are closer to zero. I think it also ties in with what we're seeing in terms of the JSE at record highs. Steady increase in house prices and also if you look at the split of growth in disposable income, what you are finding is that the SARB is telling us that nominal growth in investment income grew 17 percent year-on-year, which is about 15 percent of total, nominal disposable income relative to a growth of nine percent.

ALEC HOGG: This is really, interesting, if you overlay it with what David Shapiro was saying a bit earlier. Many people in the higher income brackets would have Pension Funds, Retirement Funds, and perhaps their Index Trackers and a few shares.

SIZWE NXEDLANA: Correct.

ALEC HOGG: This is all related. The wealth that's growing there is all related to what is happening outside of the country, the Dollar, the Dollar denominator. David says, 60 percent of the JSE top 40 earns its money outside of South Africa, so while that lifts, the people who are invested there will be doing pretty well. However, if you go down the scale, you don't have a share of that, and you just have to make do with the difficult times that we are having in this domestic economy and maybe you won't be feeling so good, so it is all pretty consistent.

SIZWE NXEDLANA: It is consistent but I'd also say, I would argue the wealth effect is half the story. If you are skilled, educated, and/or employed in the non-cyclical sectors of the economy… For example, if you're in finance, real estate etcetera and not low skilled or employed in a cyclical sector of the economy such as mining and manufacturing, you are doing relatively better. In fact, it ties in with some work that we've done, internally, where we were challenged to get our heads around to disposable income ratios, by the different income bands and net cash flows. What we found, using our internal data on our transactional place as well as SA Inc. Data, is that debt to income is very high amongst low-income earners and it declines steadily as income rises. What we also find is that net cash flows, in other words your earnings minus your essential expenditure… What is left after you've spent on essential items, net cash flows are very positive the higher up the income bands you go, and very low, at the lower income band.

ALEC HOGG: Again, that makes sense, because the banks have not been lending. The banks have been holding back. They don't lend during the boom times. Banks go crazy on giving people lots of money to buy houses. You aren't lending. We've got to stay in the same house. You don't over extend yourself, and so on. Economics is very logical, when you actually unpack it the way you have.

SIZWE NXEDLANA: Well, yes, I think so. It is a consistent story, and I think the last interesting thing is if you split by race groups. What you actually find is that white consumer confidence is still negative, but it has been improving since bottoming I think, in the second quarter of 2012. However, there was a massive surge in black consumer confidence, from minus one to plus 11.

ALEC HOGG: Why?

SIZWE NXEDLANA: I think it might have something to do with the election or the perceived, positive outcome and the stable response to the election.

ALEC HOGG: But why would white confidence be low, because political stability is a fantastic thing for a growing economy?

SIZWE NXEDLANA: It is not low, relative to where it comes from. It is low but it has been improving.

ALEC HOGG: Okay.

SIZWE NXEDLANA: The point I'm trying to make here is that if you are talking about the sustainability of consumer confidence, what we found was that black consumer confidence following the World Cup, increased quite a lot but that increase wasn't sustained. You might find that now that the election has passed us, and things are going back to normal – if we can call it that – that we might see that come off a little bit. Overall, for me I think it is consistent with the theme of a significant moderation in household consumption expenditure, but without a collapse. Sixty percent of the economy – that's the household – is still growing and spending in real terms, but it is significant in lower growth rates.

ALEC HOGG: So what is Gill Marcus likely to do, after seeing these kinds of numbers? Remember, we've had that first interest rate increase, now we see consumer confidences rising, which is saying that people are feeling a little bit more comfortable. Will she continue with ratcheting up interest rates?

SIZWE NXEDLANA: I think so. We started as a theme, as a macro theme for the year, calling the short-term cyclical outlook for the SA economy one of under-performance and adjustments. I just think from a position of a large current account deficit, expecting that current account deficit to narrow… We were expecting it to narrow because you, for the first time, have a weak Rand when you have better global growth, so you should get an export response and then expecting imports to also moderate because you've got this moderation, the slow puncture in domestic demand. What we've had is a partial adjustment, in other words the adjustment is only coming from imports starting to moderate a little bit, because domestic demand is slowing, but without that adjustment, also meeting halfway from the imports, from the export side of the economy.

ALEC HOGG: So it is getting better. We've been forced into it. It is almost as if we were a little bit out of shape. We are starting to get more and more into shape now, and the consumers are saying, 'I can see that we are getting into shape. Things are getting better'.

SIZWE NXEDLANA: However, the implication for interest rates is that you still have a current account deficit that is not narrowing meaningfully or quickly enough. It is narrowing but very gradually. Sooner or later, what is going to happen is that the cost of funding overseas as it ends its taper and then the market begins to price an actual increase in US interest rates, followed by rise in US bond yields, is that if you are still a South African economy with a current account deficit upwards of four percent, it is going to become difficult to fund that deficit, which places pressure on the Rand.

ALEC HOGG: Okay, so rates have got to rise.

SIZWE NXEDLANA: Rates must rise.

ALEC HOGG: Sizwe, thanks for unpacking all of that. It really is logical – economics. A bit difficult to follow at times but, if you listen carefully, the picture is one of readjustment, one of taking a deep breath, and we've been through, perhaps, the worst. The rest of the world is improving. We're not going to be rushing onto its coat tails but that, as David Shapiro said earlier, that rising tide that lifts all the ships. Well it's lifting this little one, in the Southern tip of Africa too. That was Sizwe Nxedlana, Chief Economist at FNB.