Jannie Mouton: So far, so brilliant. Now it’s up to PSG’s “Youth League”

Being at PSG Group's 20th anniversary last night was a great privilege. In those two decades, the now R60bn group started from scratch in November 1995 by then recently fired stockbroker Jannie Mouton, has delivered compounded growth of 54% a year to shareholders. An investment of R100 000 back then would be worth R550m today. No other company in the world, even Apple, TenCent and Naspers, matches that growth rate. So impressive, that two of the big names in global value investing, former Morningstar research head Pat Dorsey and author William Thorndike made the trek to Stellenbosch to see how the one-time shop assistant from Carnarvon did it. Mouton's pride shone through in the 45 minutes he gave me immediately ahead of the formalities to tell his and PSG's story. What followed was a night of celebration and some rare showing off by a group that has never strayed from its hard working, humble roots. And, one hopes, never will. Because the next act only gets harder. More than R10bn of PSG's current market valuation is due to the expectations – for the first time ever its shares trade at a premium to the underlying "sum of the parts" value. That puts huge responsibility onto the next generation, what old-times call PSG's "Youth League". Mouton's sons Piet and Jan and colleagues like recently recruited Francois Gouws have huge boots to fill. With two thirds of the company's underlying value ascribed to its 30.7% stake in Capitec and 58.5% of Curro, the next generation start from a solid base. But they will need to find their own unicorns while guarding against the arrogance and complacency that has destroyed many businesses. Mouton, who turns 70 next year, retired once, very briefly. PSG's chairman has no intention of repeating that mistake. Ensuring his Youth League need only pop downstairs to his office for one of the best sounding boards imaginable. – Alec Hogg

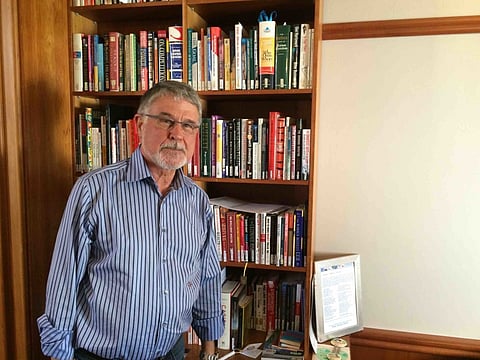

Alec Hogg caught up with PSG founder and chairman Jannie Mouton at the Arabella Resort in Hermanus ahead of the company's 20th anniversary celebration.

Thank you, Alec. It's nice seeing you.

Twenty years ago, November 1995, you started this company that today has a market capitalisation of R60bn. It had achieved a total return to shareholders of 54% a year. When you put it all together, was that in your mind?

I think that we did a bit better than I'd ever thought. Having more than 50 percent annual component growth is fantastic for us.

As a former stockbroker, have you ever any other seen a company achieve this?

No. I haven't seen a company like PSG. Apparently, nobody can find a company in the world that averaged what we have over 20 years.

Jannie, it was interesting when I was doing my research, talking to people from your stockbroking years… they always spotted you as someone who was going to go far. Did you know this?

No. Never. They wouldn't have fired me if they'd spotted me as being somebody with a bit of go in him.

The people who fired you (in 1995) were excluded from that research. But let's start at the beginning. You grew up in Carnarvon – a dusty town. Your father was a shopkeeper and like Warren Buffett you worked in his shop as a young man…..

Yes. That was part of our life at school. Every December school holiday, we (Jannie and sisters Engela and Santie) had to work for month or four weeks of the six weeks and it was actually an unbelievable experience at that stage.

What exactly did you do?

We started in different departments. First in the clothing department, then in the grocery department and in the last two years I was in the accounting department helping to do the books.

Do you think that made a difference in your life?

For sure. My father didn't have it easy. When he was eight years old, he was kicked out of the house. His mother passed away. His father remarried and he wasn't welcome in the house. So after school, he had to go and work for five years before he could go to university. He was always an unbelievable example to me. He was Mayor of Carnarvon as well.

He wanted to go into national politics….

Yes. He wanted to go into politics but that was never actually realised.

Is that something that's ever appealed to you?

Nee, wat (No) . I think I've learned my lesson. I've always liked being in the business side.

Your mother Juliana went to an English-speaking school…

That's right. It was not as common in those days, if you're from Carnarvon, to send your children to an English school. She went to Grahamstown and she could only come back once a year because it was a long way from Carnarvon in those days.

You upbringing also influenced you with your own children?

My children never went to a private school but at the end of the day, you realise education is important in life. They were always with us in the house.

Fast-forwarding from Carnarvon onto Stellenbosch University in 1966 and Simonsberg Residence, which you still have quite an affection for.

Yes. At that stage, it was unbelievable how I enjoyed my life as a student. I was on the House Committee of Simonsberg. It was an honour for two of the four years and it's a wonderful place. We had the reunion a couple of months ago. It was fantastic to see the old friends.

What's interesting about Stellenbosch University is that so many of the businesses today, are through old friends from that time. Was there anything in particular that gave you an advantage?

Nee, wat. It just happened that many of my colleagues and friends have been with us. Chris Otto for instance, was also at Stellenbosch in those years. A bit behind me was Michiel le Roux and then G.T. Ferreira and Markus Jooste, people like that.

You actually went to university on a teacher's bursary like your father. Were you ever seriously going to be a teacher, or was that just a way to get there?

I think that was a way to start. To begin with, my two sisters also studied to be teachers and the actually went into teaching, repaying their loans by being teachers. When I completed my studies, I had to repay the loan and my father helped me with that.

Then you decided not to go into teaching, but to actually study accounting.

Then I did my Articles. After university, I went for three-year Articles at PWC. Those days, it was called Cooper Brothers.

How important is it to understand accounting? Buffett says, "Accounting is the language of business."

I realised two things. (1) I had to do my Articles in English because at that stage, my communication was terrible so I spent three years with an English company. I think that being an accountant; you learn a hell of a lot of the insides of the business – various businesses. You audit here and there, and so you get a good feeling for business.

Just talking about the English langauge, growing up in Carnarvon your mother was the only person who actually understood English in the whole town. Did you find that it was a disadvantage when got to Johannesburg?

You realise after a while that it's a disadvantage but luckily, doing my Articles in English gave me the confidence to speak English. In this country, you have to be bilingual. Finish en klaar. English is an important language.

And a black African language…

At one stage, my late wife (Dana) and I enrolled at university to do an African language. She did two years studying Zulu. I started with her but I faded out after about two or three months.

She was an incredible woman – your late wife, Dana.

She was a very interesting woman because she matriculated when she was 15 and then she went to America for a year on an American Field Service scholarship. While we were married, she did her BProc part-time and she did the best in her class. I still have the photo where the Minister of Justice, Kobie Coetzee gave her the prize for being the best student at UNISA. Yes, she was clever. She supported me all the way.

When you started your stockbroking firm Senekal, Mouton, & Kitshoff, she actually bankrolled you…

We bought a firm for R150 000. For my third, I had to put in R50 000 and it was just not readily available so she helped me.

The two of you must have had a great marriage.

Yes. We had three children and it was fantastic. They're all in the business.

When Dana passed away in 2004… Some people go to pieces…

It's a tough time in your life. Luckily, I was at Stellenbosch. There were many friends there that supported me and at the end of the day, you also realise you have to pick yourself up. It's something, which you can do. Luckily, my children were also in the vicinity, and so I could survive.

That was after you'd gone through another big dislocation in your life in 1995, when the company you started – Senekal, Mouton & Kitshoff – the people whom you'd employed decided they didn't want you anymore.

It had become a big, successful company. We were 20 partners at that stage and it was an unbelievably successful stockbroking operation. I was the CEO and apparently, they didn't like my way of doing things.

Looking back, you put a lot of store in loyalty. Reading through your book again, Professor Kobus van Zyl Smit was the first man that you appointed to your new board when you started PSG. He was one of your lecturers from Stellenbosch University.

He was a lecturer at university and I have unbelievable respect for him. He did an LLB and a CA, and then he moved on to PwC and he was the partner when I was doing my Articles there. He was the senior partner. He actually headhunted me.

Into accounting?

Yes.

Marcus Jooste helped you through one of your difficult times as well, when there was a hostile takeover from ABSA. He again, What I'm getting at Jannie, is the disloyalty that was shown to you at SMK; were there any resentments?

At the end of the day, as time goes by you focus on the great things in your life. To sit back and think about that incident, it was a turning point, a defining moment in my life and I think it was actually a good thing otherwise I may still have been a stockbroker. It forced me to go into business and do my own thing.

It also forced you perhaps, to get rid of resentments and to look at having a positive attitude.

Yes. You realise then that only you can make a difference in your life. You also learn from an incident like that. My advice to people is just 'never give up'. If something like that happens, there must be a reason. Even my closest friends said to me, "Jannie, there was a reason. Maybe the reason was that you were too driven, etcetera." One tends to rectify that in years to come.

As you look back over 20 years, the resentments have gone. As we were coming in here, I saw Pierre Brink who was one of the guys who was in the room when they fired you. He was an old school friend of yours. He's now working with you…..

A couple of them are actually with us. For example, Jaap du Toit, Pierre, and Chris van Wyk. I don't know whether you can remember him – he was the CEO of Trust Bank. He was a partner as well. A number of old SMK colleagues have been with us for many years.

One of the fascinating things from that time was that up to that point, you apparently never read business books. Then Francois Gouws who now works with you and was then at UBS, gave you a book on Warren Buffett.

Ii is a bit of an exaggeration to say I never read any business books. Bit after they fired me I started reading seriously because I had time, I summarised each book and Dana typed them for me. It then became a fashion for me from those days to read business books.

I love your library in your office. How many books do you have there?

I think about 240 business books. Bear in mind that I'm also getting older and a bit lazy, and so I sometimes page through the book rather than read every word. If someone like Piketty comes to South Africa and he has written a book, I would read it and summarise it for my colleagues.

Do you learn from every book?

You learn from every book. You learn something from everything.

Is there one that you favour, that you would recommend to someone who's starting out in business?

There are so many. I can't think of a special one because there are different people with different skills and different views. I learned a lot by reading a lot about Warren Buffett: why he analyses investment and you can pick up a lot from him…he focuses on good management because he can't run each and every company. It gives you a view on how to approach a company. Is it a sustainable business? Does it have good management,?

When we last visited at your office in Church Street in Stellenbosch, you were busy going through the latest annual report of Warren Buffett's Berkshire Hathaway. Is that one of your things that you do every year?

I would do it on a yearly basis. Okay, he has a different approach to us. For instance, Berkshire Hathaway never paid a dividend. He's a special person. He's prepared to stay in the same house because if you don't pay dividends, you don't pay yourself an enormous salary. It's difficult. I have to pay good dividends to support my lifestyle.

Jannie, at 54 percent total return per annum, those dividends cost you a lot of money.

That's true, but that was a wonderful 20 years. I enjoyed my life as well. I had a nice farm and a nice place at the sea, etcetera.

You have to balance it?

Yes. I think you have to balance it. What's the use in not enjoying it as well?

How do you enjoy the money you made?

I have more than one house at the sea and I like a bit of travelling. I like to eat out regularly. I like giving something back to society as well.

You've come a long way. Again, you write in your book about how when you were at university, you used to save the train money by hitchhiking home and then you wouldn't pay the porter R1.00 to carry your luggage to the residence. You would rather walk 100 metres, go back, and fetch the second box. You were clearly motivated in those days, to make money.

It's interesting. There is a famous writer who actually discovered that all successful businessmen are, to a certain extent, frugal. In Afrikaans, "Daar's 'n groot verskil tussen suinig (stingy) en spaarsamig (frugal)." 'Suinig' is actually bad, but 'spaarsamig' means you look after your things and I'm still like that. I would switch off the lights when I walk out of my office in the evening. I won't leave it on – little things like that.

You don't waste.

No. I don't waste. I don't like people around me wasting.

The allocation of capital by the same token, means 'don't waste', and so if you put it in the right places…

For sure. A function like today; we discussed it. We think that every five years r so, we can celebrate. Otherwise, even at PSG we don't waste money.

Jannie, moving on to (again) the time after you left SMK and now you were starting your own business… You did something there at that time, which helped me a great deal when I went through a similar experience and I think many other people who've read your book. Just take us through the thought analysis, what went on in your head and why you decided to take that approach when launching your second career.

Firstly, during the first month or two you're so in shock that you can't think, and then you realise that only you can make a difference in your life and so you rather lift your head and make a plan. I would always try to tell people, "Analyse yourself." I have to put something in SWOT analysis about me. Apparently, I have to watch my temper, etcetera. If you analyse yourself… Not all people are fit for the same business scene. I still believe you must analyse yourself. List it so that you can look at it tomorrow again, and look at the opportunities. For instance, opportunities in life. I will never be Steve Jobs. I've read his books and I admire the man, but we are not there. We won't discover a Tencent like Naspers in China, because we're not there and we realise that property for example, is not our forte. After a while, you realise what opportunities there are in life and what you have to leave alone.

Thinking became your new business….

Yes. You have to constantly come up with new ideas, put it to your EXCO, and let them think. There must be a culture of thinking and not only complaining and moaning. Thinking means future planning.

How do you think? How do you get those juices going?

Every day, when I go for a walk I think 'is there something, an opportunity that we can buy something, sell something, or bring somebody into the business' and then we discuss it. Sometimes it's a good idea. Sometimes I realise it's not a good idea. We have the type of EXCO where we discuss things and we disagree but most of the time, we slowly build a line of thinking. For example, we have to go in that direction. Sometimes I'm in too much of a hurry. It takes time to build a decent company. It takes a couple of years.

The positive attitude: You see South Africa as a land of opportunity where many others have lost that thought.

Today, wherever you are with friends, during the course of the conversation we would talk about what's going wrong in South Africa. It's a fact. Now I'm telling people for example, that we didn't have a chance to start a Capitec in Europe. It's been done there, and so that's an opportunity South Africa and Africa can give you. Yes, it would also have been difficult to start a PSG Konsult. Here in South Africa, there are definitely opportunities.

And Africa itself? Your subsidiary Zeder is moving there.

In Africa, we realise there are opportunities, but it's tough. I'm just watching the people doing business in Nigeria. Then they change certain regulations and if you made money in Nigeria, it's impossible to bring it out to the controlling shareholders, etcetera. Africa is difficult, but there are opportunities.

Jannie, this is your 20th anniversary … at one of these previous events, you announced your retirement. You then quickly retracted that. What was going through your mind at that time?

I can't actually remember retiring. Maybe I was almost trying to joke about it. At a JSE listed company you can't be the CEO and chairman and so you have to make a choice. I actually spoke to Johann Rupert once about that. He said to me, "Ag Jannie, just stand back as being CEO but do exactly what you did in the past". We wanted to do it a bit more formally. That's how we appointed Piet (his son) as CEO and I'm the non-executive chairman.

Both Piet and Jan (your sons) are in the business. Is your daughter Charite in the business, too?

Her husband is in the business with us.

Well, family are involved in the business.

Yes, but they have the freedom to do whatever they like. Jan is in the Fund Management business in Constantia in Cape Town. Alex is with Energy Partners. He's an engineer. He's Charite husband. Energy Partners is a company that we think has tremendous potential in years to come.

When you appointed Piet as the CEO, did you have any concerns that it would be seen as nepotism?

I recused myself from that. Chris Otto and other members of the EXCO did that. I was specifically worried that people would… However, he was with the company for many years. We had to look at somebody and he is doing a fantastic job.

Well, 'fantastic' is underplaying it because your Sum-of-the-Parts valuation is R226 per share. Your share price is R269 per share. That's most unusual in that in fact, the market is saying it will give you a premium on the underlying value of what is an investment company.

For us, it's fantastic. There are a couple of reasons. With Francois (Gouws) joining us, he and Piet – and maybe they'd take somebody from Curro or Capitec -, are talking more and more to international investors. There's much more interest in PSG from outside South Africa than there was previously. I think that since we're a JSE Top 40 Company now, some people have to buy because there are funds or Tracker Funds etcetera, and so they're doing a fantastic job – they youngsters. They go and see the bigger investors in the world.

Doesn't it worry you though, that they putting you onto a treadmill, or is the youngsters who are on the treadmill now?

You can look at the Sum-of-the-Parts and the share prices every day, which I do. But at the end of the day, there are different businesses. Each has what we call an internal focus and every company whether it's Pioneer, Curro, or Capitec; that they have the right people there, that they're loyal, and that they are doing a good job. That's actually, our most important task.

People?

Yes.

How do you find the right people?

That's difficult but over the years, we've been lucky.

How?

Firstly, people like to come and work for the group and be associated with the group. Through the network of friends within the company, they would also come up with ideas on whom to talk to.

Is it different? Why would a young man who is cum laude at Stellenbosch University decide to come to you rather than say, Discovery or some of the other highly rated companies in South Africa?

We see many people coming to us. Some come to us through our network. We actually approach some people. It's not that we appoint people on a daily basis. Just bear one point in mind: I go into the office later every day. I go in at nine or nine-thirty and leaving at four. It's fantastic. Every day they come and chat to me about something. It's very much about consensus/opinion. They would discuss things with me on a daily basis. I'm still on the EXCO.

So retirement is not on your mind…

Nee, wat. For me, I don't know what I would do, sitting at home. To be honest (and everybody knows it), I arrive there. I'd already read the Afrikaans paper at home. Then I take the Business Day and the Cape Times, read that, and do the Sudoku before I actually start. There's always somebody coming to see me or one or other thing that my colleagues want to discuss with me. It's unbelievably fantastic for me.

So you're still having fun every day.

Yes.

You see Warren Buffett's 85 now. Are you going to go back to one of his AGM's?

I've been to one. Yes. It was an unbelievable experience. What he said there, you can read. It is available but I think everybody should go there once or twice in their lives. I've been there and maybe one day I'll go again.

So in 15 or 20 years, would you, like him, see yourself still going into the office every day?

Nobody would know. He's fantastic. I think maybe, if your brain is still working. It depends on your health and things like that, but it would be wonderful. I don't know what would happen to me if I were to sit at home.

Jannie, how would you use your journey to encourage young people?

School is one thing, but at university, you must participate and not only study. You need to participate in student life and talk here and there. For example, here's an opportunity with friends… Yes, we still have fantastic friends from university and we have unbelievable discussions. Then you learn from every one.

You've kept your friends. You think about the guys from FirstRand. You listed their company.

G.T. Ferreira and Paul Harris: we are still unbelievable friends. G.T. has an office in the same building we're in, in Stellenbosch. He actually bought the building and subdivided. He is a wonderful friend. There are other people like Chris Otto. Michiel Le Roux played an unbelievable role in building out Capitec. Even for the youngsters, you could say… Bear in mind that at one stage, PSG unbundled Capitec three-for-one. For every three PSG you had, you got one Capitec. To really look at the size of the company, you should take that into account as well.

You have an incubator in PSG Private Equity. Do you have any other Curro's or Capitec's coming through?

Yes, we're always looking at opportunities like that. There are a couple of interesting companies in private equity.

You always write your own Chairman Statement. That's something, which is appreciated by investors but not replicated by many JSE companies. Why do you that?

I have to be honest. Wynand and his team from the accounts department know my style and what they do is, they help me a hell of a lot by writing something and saying, "Jannie, now you can put in something special." However, the accounting people take care of the normal stuff for me. I don't think I spend a lot of time and I don't think I want to make profound statements but if people ask me, I will give them an opinion. I'm not afraid to give an opinion.

We did a survey this week. Apparently, there are only two annual general meetings worth going to – PSG and Remgro's. Have you made this a special effort?

It's something that I picked up from Warren Buffett, to be honest. Our first AGM was in Johannesburg. We were still based there. We actually had two baritone singers there. It was more of a concert than an AGM. It's true. We thought that rather than simply doing straightforward things, we'd talk a bit and tell people about the companies. We give the people from the underlying companies the opportunity to say something as well. Even at Capitec, they kept that tradition. They're also getting a hell of a lot of people coming to their AGM.

It's a fantastic story – Capitec. Forty-three percent now of your Sum-of-the-Parts value.

I mentioned to you that we unbundled Capitec in 2000 when ABSA launched a hostile takeover for us. PSG didn't have a single Capitec share and then about two or three years later, I decided I would like to sell my Capitec's to PSG and then we had to make a similar offer to other people. My children (Jan and Piet) can still do the calculation. I would have been better off keeping the Capitec's and not exchanging it for PSG because Capitec as an entity has done better than the other investments.

It's been an incredible story, but it also had a bumpy time when Abil went bankrupt.

Yes. Those were difficult times. We had to support them because people were worried about unsecured lending. Capitec is growing at a phenomenal rate. Their annual component growth rate since they listed in 2002 until today is 65 percent. Not many companies in the world can average that for 13 years.

The bigger banks, from dismissing Capitec at one point in time, are now pretty worried.

Yes. Caitec is taking market share. Certain research is coming out from the banking industry and each month they show that to me. Some or other agency did some research, and asked the man on the street, "What bank do you know?" It's the normal population, not just the 'have's' driving with cars. It came out that Capitec is the most well-known bank in South Africa, amongst the population (not amongst the top end of the market). ""What bank do you want to bank with?" Capitec came in at number one, as well.

In Stellenbosch, you have some very interesting people together – two of them are close friends of yours. We mentioned Markus Jooste earlier. You are personally involved with him through various private relationships but also, through Steinhoff. Are you still on their board?

Yes. I'm still on the board. They now have 27% interest in PSG. It happened that Marcus bought out a stake himself, as well as Christo Wiese and various other people. They exchanged that for Steinhoff shares. Marcus has always been a loyal supporter of PSG and we are great friends. We are living in the same area in Stellenbosch. Our farms are opposite each other on the Jonkershoek Road. The other one you're talking about is G.T. Ferreira. We've come a long way together. We were friends at university. We were on the same floor in the same residence and he was always a soft-spoken person but if he speaks, people listen. He's interesting. Sometimes, other people have to say 'quiet down', but they never used to say that because they listened when he spoke.

Stellenbosch is an extraordinary place. People like you, G.T., Markus Jooste, Christo Wiese, Johann Rupert, some of the big guns of South African business congregate there.

People often talk about that. I think it's a coincidence. It's nice living there. I don't spend a lot of time sitting in the traffic. My office and my farm is 4.3kms apart and it takes me seven minutes. My car has a little meter. If I start it, it measures the time and the distance.

So the frictional cost of life is low…

It's so fantastic. Living in Stellenbosch and having an office there… At lunchtime, we will phone one another (G.T. is in the same building) and go for a quick lunch. A sandwich, not wine and a big meal every day. No. It's nice, having the people around.

A big difference to Johannesburg?

You have friends but just to go and visit them, you have to phone them or make an appointment, sometimes for half-an-hour or you drive. In Stellenbosch, people are still close to one another.

Jannie, the first 20 years is behind you. Now you have an incredible performance for shareholders. Do you get nervous that the next 20 years can't be as good?

I never get nervous about that. We have fantastic people right through the group. We will do well. It's all in capable hands. We've spent a lot of time and we are surrounded with very good people.

So you still apply your mind to the business of thinking.

Yes, and it's nice. I come up with ideas and sometimes the young ones say, "No, Jannie. Go and think again. It's not a good idea."

Jannie Mouton, the Founder and Chairman of the PSG Group.