Interviews

US, SA market turmoil - Rational perspectives from Piet, Sean on how to not just survive, but thrive

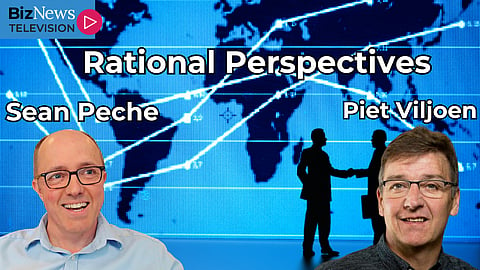

Piet Viljoen and Sean Peche share calm, credible insights

Solid records of consistent outperformance in difficult times add credibility to insights on the current turmoil shared here by Re:CM founder Piet Viljoen and Sean Peche, his counterpart at Ranmore. Both delivered star turns at the BNC#7 conference in Hermanus a month ago. In this interview with BizNews editor Alec Hogg, they provide dollops of common sense to guide fretting stock market investors.