The RW Johnson school of SA’s inevitable economic crash is gaining converts. After reading his apocryphal How Long Will SA Survive, many fellow citizens found the South African former Oxford don’s conclusions hard to swallow. Now they are digesting them in some detail. Every day more people are converts to Johnson’s forecast that widespread corruption and overspending by the Zuma Administration is driving the country into bankruptcy. Many in the international community have also added their voices. As you can read in today’s commentary on Zuma’s firing of Finance Minister Nhlanhla Nene by the influential Financial Times of London, this rash move is interpreted as a sign of serious trouble. The FT concludes with the prediction that “The only alternative, however unpalatable to Mr Zuma, could soon be the International Monetary Fund.” When we spoke yesterday, Johnson told me recent actions are likely to accelerate that inevitable consequence. Worse luck, after Zuma’s cabinet reshuffle, the country will be relying on an long-time backbencher, plucked from obscurity, to negotiate the most important bailout in its history. If you thought education was expensive, try ignorance. – Alec Hogg

Today’s Editorial Comment by the Financial Times of London:

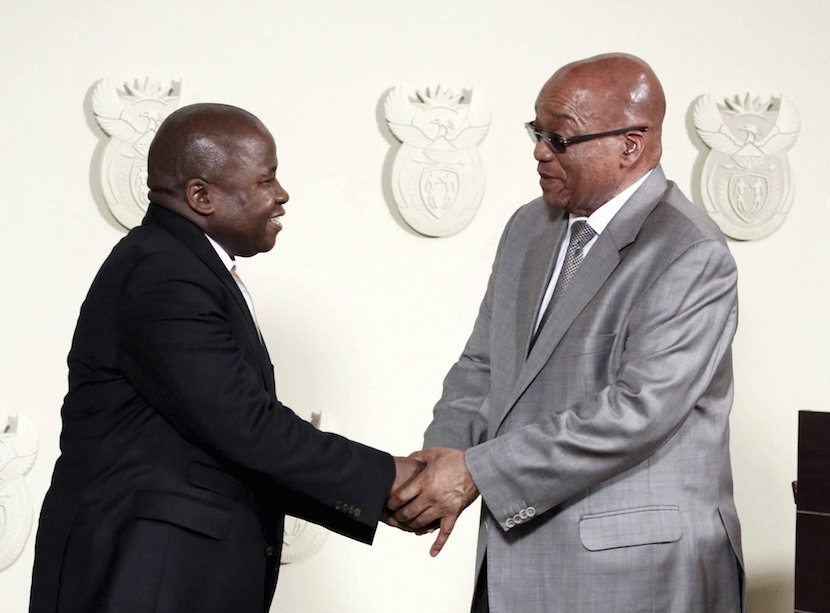

Jacob Zuma, South Africa’s president, could scarcely have provided a clearer signal of trouble to come than he did on Wednesday when he sacked his respected finance minister, Nhlanhla Nene. No less troubling was Mr Zuma’s choice of successor, David van Rooyen, an obscure backbencher from the ruling African National Congress whose sole experience of government to date is at municipal level.

Not only was the timing of the move terrible, rattling markets at a moment when the news for South Africa’s economy was already grim. It was also opaque. In the terse announcement, the president gave no credible justification for changing the minister in charge at the Treasury, which together with the central bank, has maintained a reputation for excellence, resisting a generalised trend towards institutional decay.

During a difficult period of economic stagnation, declining world prices for South Africa’s commodity exports and successive scandals, Mr Nene acted as a bulwark against the increasingly populist inclinations of Mr Zuma and the ANC. In doing so he took on the distinguished mantle of Trevor Manuel and Pravin Gordhan, the two former finance ministers who painstakingly established South Africa’s record among global investors for prudent macroeconomic management in the post-apartheid years.

By replacing him with a relative novice, Mr Zuma left the pundits to surmise the worst: that Mr Nene had resisted powerful allies of the president once too often. In recent months the Treasury intervened to prevent South African Airways, the lossmaking national airline, from rearranging an aircraft leasing deal. As part of broader efforts to check public spending, he also sought to stymie Mr Zuma’s plans to build a nuclear power plant.

Amid an increasingly public battle within the government, the fiscal picture had been darkening, thanks in part to declining demand for basic resources from China, South Africa’s largest trading partner.

The rating agencies had already taken note, with Fitch warning five days ago that it could cut the value of South Africa’s debt to junk. Standard & Poor’s has also cautioned that it may follow suit.

These warnings do not appear to have persuaded Mr Zuma to cherish whatever market credibility his administration still enjoyed. His cabinet reshuffle prompted the rand to hit a new low against the US dollar. Bond yields also spiked.

If the rout persists it could have a significant impact on the country’s already elevated cost of borrowing. The national debt has risen sharply in recent years to fractionally under 50 per cent of gross domestic product now. Under the tight rein of Mr Nene it was already costing more than the education budget to service. The choices facing the new finance minister will almost certainly be starker still.

Even the stars of recent South African governments struggled to initiate structural reforms that might have made inroads into chronic unemployment and the apartheid legacy of racial and income inequality.

The times are much leaner now and the clamour for more even distribution of wealth much greater. This is trumpeted in ever more insistent fashion by Mr Zuma’s most effective opponent, the populist firebrand, Julius Malema. The temptation for the government will be to lurch in his direction, and unravel in the process South Africa’s hard-won reputation for fiscal prudence. The only alternative, however unpalatable to Mr Zuma, could soon be the International Monetary Fund.

(c) 2015 The Financial Times Ltd.