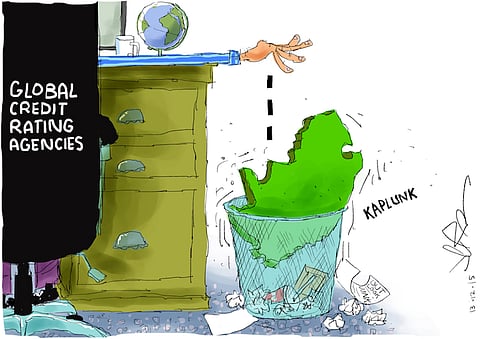

Zuma on Nenegate: “Markets over-reacted to the firing.” Rand tanks again.

Sometimes you just have to take it from whence it comes. SA President Jacob Zuma grabbed television airtime last night to tell the nation that investors "over-reacted" to Nenegate. From his perspective, it's easy to see how he could thus rationalise the disaster. A couple hours after Zuma's fateful decision smashed SA stocks and bonds – wiping R500bn off their value in two sessions – the instigator addressed a small group of businessmen in Johannesburg. Contained within his ad-libbed half hour of rambling was this insight into how prices are determined: "I define it differently, the value of a commodity. It is the necessary labour time taken in the production of the commodity. That is what determines the value." Funny thing that. The worthies who drove the Soviet Union to economic collapse and subsequent disintegration held the same view. Global investors reacted to this latest diatribe last night by selling the Rand again, the currency at one point hitting a low of R17.99 against the US Dollar. If you think education is expensive, try ignorance. – Alec Hogg

JOHANNESBURG, Jan 10 (Reuters) – South Africa's President Jacob Zuma said markets overreacted to his decision to sack Nhlanhla Nene as finance minister in December.

The president last month changed finance ministers twice in a week, sending the rand plummeting, alarming investors and triggering financial turmoil.

"It was an overreaction, really, from my point of view," Zuma told SABC television in an interview aired on Sunday.

The rand rapidly weakened by more than 5 percent after Zuma appointed the relatively unknown and untested David van Rooyen to succeed Nene.

"People didn't understand what was happening, and they exaggerated the issue," he said in another interview aired by ENCA on Sunday.

"The rand, for an example, had been going down when Nene was there. It had been going down for months and months. It was not triggered by the decision," Zuma told SABC.

But Zuma in December bowed to pressure within days and appointed Pravin Gordhan, who held the job from 2009 until 2014, to replace Van Rooyen as finance minister.

The rand has since continued its slide, reaching a new record low on Friday as investors sell out of emerging market assets on worries about a slowdown in China.

RAND STEADIES BELOW R17 AFTER HITTING NEW LOW OF R17.99/$

JOHANNESBURG, Jan 11 (Reuters) – South Africa's rand pared losses on Monday after dropping sharply in erratic Asian trade with dealers talking of Japanese sellers in a very illiquid market.

By 0813 GMT the rand was 2.85 percent weaker at 16.78 against the U.S. dollar, stabilising after falling as much as 10.3 percent at one stage in Asian trade to reach 17.9950 per dollar, by far its weakest level ever.

"It appears as if yield-hungry Japanese retail investors decided to cut their ZAR positions this morning, which triggered a number of stop losses and sent the currency into freefall," Barclays Africa currency strategist Mike Keenan said in a note.

South Africa's currency has hit several record lows already this year on concerns about slowing growth in Africa's most developed economy and in-line with weakness in other emerging markets.

President Jacob Zuma said on Sunday that markets overreacted to his decision to change finance ministers twice in a week last month, comments likely to worry investors.

"Local sentiment remains poor and the fact that this weekend's ANC conference did not address investor concerns, suggests that these fears could persist," Keenan said.

"The underlying ZAR mood remains extremely bearish."

The JSE securities exchange's Top-40 futures index was down 1.04 percent, suggesting the local bourse would open more than 450 points lower.

In fixed income, government bonds mirrored the rand, with the yield for the benchmark 2026 government bond adding 34 basis points to 9.865 percent.