Berkshire AGM transcribed: Buffett makes case against active money managers

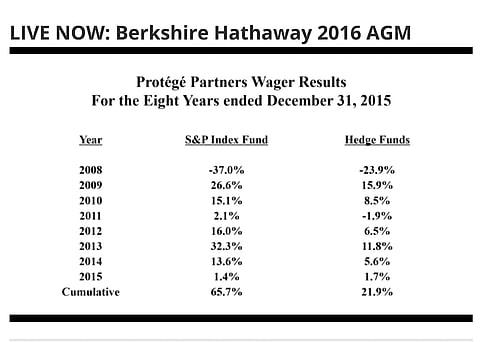

The highlight of this segment of the Berkshire AGM comes towards the end when chairman Warren Buffett delivers a masterclass in why Exchange Traded Funds are always going to outperform actively managed portfolio managers. It's a subject about which the Oracle of Omaha is hugely passionate – and one where he took a $1m personal bet to prove the point. And prove it he certainly has. Eight years into a ten year challenge against the best Wall Street could offer, the performance by Buffett's simple S&P500 Index tracker is smashing Hedge Funds – by a staggering 40 percentage points (65% vs 22%). Also in this segment you'll find Buffett and Munger's position on the controversy around their close ally, the Sequoia Fund, which invested 30% of its clients' assets into the Valeant "chain letter" scheme; reasons why the Berkshire Hathaway conglomerate will never be dismantled; and why most big banking stocks are likely to be poor investments into the future. – Alec Hogg

This segment of the Berkshire AGM opens with a question from shareholder Michael Mozia about investment banking, specifically the way one of Buffett's Big Five holdings, Wells Fargo, is becoming more involved in this area.

WARREN BUFFETT: Well, the public policy since 2008/2009 has been to (very much) toughen up capital requirements in a variety of ways for banks, but it is specifically designed to make very large banks less profitable relative to smaller banks. You do that by increasing capital requirements. You can change the map of banking and the attractiveness of banking totally by capital requirements. Obviously, if you said every bank had to be 100 percent equity, it would be a terrible business. You couldn't possibly earn any money that was significant on capital. If you let people operate with one percent capital ratios, they could make a lot of money and they would cause the system all kinds of trouble.

Since 2009, the rules have been against the larger banks, primarily through capital requirements and that just means returns on equity go down. But returns on equity were awfully high prior to that.

It hasn't turned it into a bad business. It's turned it into a less attractive business than it was earlier. Some of the investment banks operate as bank holding companies so they've been affected by those capital requirements, too. I'm not sure I'm getting 100 percent of the questions here so I invite you to give me a follow-up if you'd like.

Do you feel good about the 'going forward' prospects of the investment banking companies, especially as Wells Fargo moves into that business?

WARREN BUFFETT: Well, Wells Fargo has an investment banking aspect to it that primarily came in through Wachovia and it's not insignificant. But our ownership of Wells Fargo, is very large. It's our largest single marketable security, not counting Kraft Heinz, which is about the same size because in that situation we're in the control position. It's the largest non-controlled situation that we have, at Wells Fargo and that's my intent. I like it extremely well, compared to other securities. Not because it has the most upside, but I feel that it's weighted for upside/downside.

CHARLIE MUNGER: It's not the investment banking that draws you to Wells Fargo. It's the general banking.

WARREN BUFFETT: It isn't that big a deal and that's not what attracts us. We think Wells Fargo is a very well run bank but we didn't make any decision to buy a single share based on the fact that there were going to be more in the investment banking business because of the Wachovia acquisition. They have a lot of sources of income. They've got a huge base of very cheap money but unfortunately, they've got very cheap rates on the other side. Spreads will probably work to their advantage eventually. We think it's a very well run bank. The investment banking business: Charlie and I are probably a little affected by the experience we had in running one for a short period of time (Salomon Brothers in the 1980s). It's not something we invested in significantly. We obviously made a major investment in Goldman Sachs and we continue to hold shares that came out of the warrants that we received when we made the investment in 2008.

I can't recall us making an investment banking purchase a marketable security involving an investment bank for a long time. Could you, Charlie?

CHARLIE MUNGER: No. Generally, we fear the genre more than we love it.

Have you considered installing corporate defences that might prevent future generations of activists breaking up Berkshire Hathaway?

WARREN BUFFETT: I used to worry more about that than I do now. Size is one factor. I think the more important factor would be that Berkshire will always be in a position to repurchase very significant amounts of stock. As long as it's willing to buy that stock close to intrinsic value, there should not be a large margin in terms of anybody that might come along and think that there'd be a lot of money to be made by breaking it up. There would be money lost by breaking it up in terms of certain advantages lost. Mid-American Energy could not have done what has done in renewables without Berkshire being the parent. If it had been split off, the parts would have been worth less than the whole and I could give you significant instances of that in other cases. I don't think there will be a spread that will be enticing to anyone and beyond that; I think the numbers involved would be staggering.

We have a shareholder base that recognises the advantages of both the Berkshire businesses and its culture so I think it's very unlikely.

There have been periods in business history where practically all stocks sold at dramatic discounts from what you might call intrinsic value and it's interesting that very little activity occurred there. In 1973 and 1974, there were really good companies. One of which, was Cap Cities for example (Tom Murphy's business) and they were selling at a huge discount compared to what it was worth. People did not come along and so, to some extent, when the discounts are huge, money is hard to get. It's not a huge worry with me. In my own case, because of the way my stock will be distributed (after I die) it's very likely that my estate – for some years – will be by far the largest shareholder of Berkshire in terms of votes, even with this distribution policy. It's not something I worry about now. I used to worry about it a bit, but it's not a factor now. Charlie?

CHARLIE MUNGER: Well, I think we have almost no worries at all on this subject. Most other people have a lot of thoroughly justifiable worry and I think that helps us. I look forward on this subject, with optimism.

WARREN BUFFETT: Do you want to explain how this helps us, Charlie?

CHARLIE MUNGER: Well, if you're being attacked by people you regard as evil and destructive and you want a strong ally, how many people would you pick in preference to Berkshire?

WARREN BUFFETT: My name is Warren Buffett and I approve of that message.

Could you talk about Berkshire's competitive advantages in its various leasing businesses – are there other leasing business you would be interested in entering, for instance, airplanes or commercial auto fleets?

WARREN BUFFETT: Well, we've got a very good truck leasing business in XTRA. We've got a good primary tank cart leasing business at Union Tank Car and Procor. We expanded it by $1bn when we bought the GE fleet recently. Leasing generally isn't something…. We have to bring something to the party – it's much more than just handing people a trailer and taking a cheque every month. Important service advantages are brought to that. But pure leasing – leasing of new cars, which is a huge business – the math is not that attractive for us. The banks have an advantage over us because their cost of funds is so low now. It's not quite as low as it looks but I think Wells Fargo's last figure was around 10 basis points. When somebody has $1trn or so and they're paying 10 basis points for it, I don't feel very competitive.

Pure money-type leasing is not an attractive business for us when we've got other people with a lower cost-to-funds. They've got the edge. We've got rail car leasing, which involves a lot more than just a financial transaction. We've got huge activity in the repair field and those cars require servicing. It's the same with our trailer business but you will not see us get into aircraft leasing, it doesn't interest me in the least. We looked at that often. Various aircraft leasing companies have been offered to us – that's a scary business. Some people have done well in it in recent years, by using short-term money to finance longer-term assets, which have big residual risks. That just isn't for us. Charlie?

CHARLIE MUNGER: I think you've said it pretty well. I don't think they're huge opportunities.

If you had a silver bullet, which competitor would you take out, and why?

WARREN BUFFETT: I don't think we have to answer this one. We have lots of tough competitors and in many areas we're a pretty tough competitor ourselves.

What we want our managers to be doing is thinking every day about how to achieve a stronger, competitive position. We call it widening the moat.

We want to turn out better products. We want to keep our costs down to a minimum. We want to be thinking about what our customers are likely to want from us a month, one year, or ten years from now. Generally, if you take care of your customer, your customer takes care of you. But there are cases where some force comes along, which you may not have the answer for and then you get out of that business. We had that department store in Baltimore in 1966 and if we'd kept it, we would have gone out of business. Recognising reality is also important. You do not want to try and fix something that's unfixable.

CHARLIE MUNGER: We're not targeting competitors for destruction. We're just trying to do the best we can everywhere.

WARREN BUFFETT: Spoken like an anti-trust lawyer. We really hope to be the ones that the other guys want to use the silver bullet on.

Mr Buffett, you have endorsed the Sequoia Fund on more than a few occasions. Recently, the Sequoia Fund has been in the news because of its large position in Valeant Pharmaceuticals. Mr Munger has termed Valeant's business model 'highly immoral'. Mr Buffett, do you agree with Mr Munger's assessment? Have your views about Sequoia Fund changed?

WARREN BUFFETT: I'm the father of Sequoia Fund in that when I was closing up my partnership at the end of 1969, I was giving back a lot of money to partners. These people trusted me, and they wanted to know what they should do with their money. We helped out those who wanted to put it in municipal bonds for a few months but most of them were equity oriented type investors. We said there were two people we admired enormously in the investment business. Not simply because they were terrific investors but they were terrific people and they'd be the kind of people whom you'd make trustee of your will. Those two, one of whom is in the room Sandy Gottesman. The other was Bill Ruane. They were friends themselves. Sandy took on a number of our partners and they became very happy clients. I'll bet some of them are still clients, or their children or grandchildren are, to this day.

A lot went with both of them actually. In fact, I wouldn't be surprised if the majority, who had a lot of money, gave some to Sandy and gave some to Bill. We had a lot of people whose total funds were really, not of a size that made them economic individual clients. Bill, who would not otherwise have done so said, "I'll set up a fund". They actually had an office in Omaha. John Harding used to work for me and he became an employee here in Omaha (of Sequoia). A number of my ex-partners joined Sequoia Fund as a way to find an outstanding investment manager – both for ability and for integrity – and could deploy small sums with them.

Bill ran Sequoia until roughly 2005 when he died. He did a fantastic job, and even now, if you take the record from the inception to now with the troubles they've had recently, I don't know a mutual fund in the United States with a better record. There probably is one or two but it's far better than the S&P and you won't find many records that go for 30 or 40 years that are better than the S&P. Bill did a great job for people. He died in 2005 and the record continued to be good until a year or so ago. At that time, the manager took an unusually large position in Valeant (30% of the fund). Despite the objection of some people on the board, he not only maintained that position, but actually increased it after a fair amount of doubt had been expressed by the board about the advisability of doing that.

My understanding is that the manager who made the decision on Valeant is no longer running the operation and other people have recommitted to doing so. I know they are very smart and decent people who are probably way better than the average analyst in terms of Wall Street. I think it was very unfortunate the manager got overly entrenched with the business model. I watched the Senate hearings a couple of days ago when Senator Collins and Senator McCaskill interrogated three people from Valeant and it was not a pretty picture. In my view, the business model of Valeant was enormously flawed. It had been touted to us. We had several people who urged us strongly to buy Valeant and wanted us to meet Pearson (Valeant's CEO) and so on.

it illustrated a principle that Pete Kiewit said many years ago: "If you're looking for a manager, find somebody who's intelligent, energetic and has integrity. If they don't have the last, be sure they don't have the first two."

If you have somebody who lacks integrity, you probably want them to be dumb and lazy. If you've got an intelligent, energetic guy or woman who is pursuing a course of action, which gets put on the front page it could make you very unhappy. You can get into a lot of trouble. It may take a while. Charlie and I are not remotely perfect, but we've seen patterns. You get pattern recognition. It's very important in evaluating humans and businesses. Pattern recognition isn't 100 percent and none of the patterns exactly repeat themselves, but there are certain things in business and securities markets that we've seen over and over, frequently come to a bad end but frequently extremely good in the short run.

One which I talked about last year (and I'm referring to Valeant in this regard), was the chain letter scheme. You're going to see chain letters for the rest of your life. Nobody calls them chain letters because that's a connotation that will scare you off but they're disguised as chain letters and many of the schemes on Wall Street, which are designed to fool people, have that particular aspect to it. There are patterns at Valeant. Certainly, if you go and watch those Senate hearings, I think you'll decide there are patterns there that really should have been picked up on. It's been very painful to the people of Sequoia. I personally think that the people who are running Sequoia now are able people. In a second, I'll get into the difficulty of managing money but first, I'll give Charlie a chance to comment on this.

CHARLIE MUNGER: Well, I totally agree with you that Sequoia, as reconstituted, is a reputable investment fund and the manager, as reconstituted, is a reputable investment advisor. I've got quite a few friends whom I've advised to use Ruane, Cuniff and I've advised them to stay with the place, as reconstituted. I believe you've done the same thing, haven't you?

WARREN BUFFETT: Right.

CHARLIE MUNGER: We think the whole thing is fixed. Valeant of course, was a sewer and those who created it, deserve all the opprobrium that they got.

WARREN BUFFETT: In a few minutes, we'll break but I think it almost ties in with this last question. Some years ago, I made a wager. It probably seems appropriate, since it's developed this far, to point out a rather obvious lesson, which was what I hoped to drive home to some degree by offering to make the wager originally. Incidentally, when I offered to make the wager – viz. that somebody could pick out five hedge funds and I would take the unmanaged S&P Index used by Vanguard fund – I would bet that over a ten-year period that the unmanaged index would meet these funds that were all being managed. They could pick any five funds. They were being managed by people who were charging incredible sums to people because of their supposed expertise.

If you go to the Internet and you put in longbets.org it's a terribly interesting website. You can have a lot of fun with it because people take the opposite side of various propositions that have a long tail to them. They make bets as to the outcome and each side gives their reasons. You can go to that website and you can find bets about what the population will be doing 15 years from now…all kinds of things. Our bet became quite famous on there. A fellow I like, whom I didn't know before – Ted Seides – bet that he could pick out five hedge funds. These were funds of funds. In other words, there was one hedge fund at the top and then that manager picked out who he thought were the best managers underneath, and then bought into these other funds in turn.

Thus, the five funds represented maybe 100 or 200 hedge funds underneath. Bear in mind that the hedge fund (the fellow making the bet) was picking out funds where the manager on top was getting paid perhaps half-a-percent per year plus a cut of the profits for merely picking out who he thought were the best managers underneath. In turn, they were getting paid maybe 1.5 or 2 percent plus a cut on profits. Certainly, the guy at the top was incentivised to try and pick out great funds and at the next level, those people were presumably incentivised too.

The result is that after eight years and several hundred hedge fund managers being involved, the totally unmanaged fund by Vanguard with very minimal costs is now 40-something points ahead of the group of hedge funds.

It may sound like a terrible result for the hedge funds, but it's not a terrible result for the hedge fund managers. (a) You've got this top-level manager who is charging probably half-a-percent (I don't know that for sure) and down below, you've got managers who are probably charging 1.5 to 2 percent. If you have a couple of percentage points sliced off every year…that is a lot of money. We have two managers at Berkshire. They each manage $9bn for us. They both ran hedge funds before. If they had a 2/20 arrangement with Berkshire, which is not uncommon in the hedge fund world, they would be getting $180m annually each merely for breathing. It's a compensation scheme that is unbelievable to me and that's one reason I made this bet.

What I'd like you to do is for a moment, imagine that in this room, you people own all of America. All the stocks in America are owned by this group. You are the Berkshire 18,000 (or whatever it is) that have somehow managed to accumulate all the wealth in the country. Let's assume we just divide it down the middle. On one side, we put half the people…half of all the investment capital in the world, and that capital is what a certain presidential candidate might call 'low energy'. In fact, they have no energy at all. They buy half of everything that exists in the investment world – 50 percent – everyone on this side. Now half of it is owned by these 'low energy' people. They don't look at stock prices. They don't turn on business channels. They don't read the Wall Street Journal. They don't do anything. They are a slovenly group that just sits for year after year, owning half of America's business. What's the result going to be? The result is going to be exactly average as all American business does because they own half of all of it. They have no expenses – nothing.

What's going to happen with the other half? The other half are what we call the 'hyperactives'. The hyperactives' gross result is also going to be half, right? The whole has to be the sum of the parts. This group, by definition, can't change from its half of the ultimate investment results. This half is going to have the same gross results. They're going to have the same results as the 'no energy' people but they're also going to have terrific expenses because they're all going to be moving around, hiring hedge funds, hiring consultants, and paying lots of commissions etcetera. As a group, that half has to do worse than this half does. The people who don't do anything have to do better than the people that are trying to do better. It's simple.

I hoped through making this bet, that it would actually create a little example of that but that offer was open to anybody. Incidentally, I would make the same offer now except being around a 'ten-year to collect' gets a little more problematic as we go through life. It seems so elementary but I will guarantee you that no endowment fund, no public pension fund, and no extremely rich person wants to sit in that (passive) part of the auditorium. They just can't believe that because they have billions of dollars to invest, that they can't go out and hire somebody who will do better than average. I hear from them all the time. This group over here, supposedly sophisticated people and generally richer people, hire consultants. And no consultant in the world is going to tell you 'just buy an S&P Index fund and sit for the next 50 years'.

You don't get to be a consultant that way and you certainly don't get an annual fee that way. And so the consultant's got every motivation in the world to tell you 'this year, I think we should concentrate more on international stocks' or 'this manager's particularly good on the short side'. They come in and they talk for hours and you pay them a large fee, and they always suggest something other than just sitting on your rear end and participating in the American business without cost. Then those consultants – after they get their fees – in turn, recommend other people who charge fees which, as you can see over a period of time, cumulatively eat up capital like crazy.

I felt sure – well, I didn't feel sure, because nothing can tell for sure about any ten-year period – but I certainly felt very probable, which is why I stuck my neck out. It just demonstrates, so dramatically… I talk to huge pension funds and I've taken them through the math. When I leave, they go out and hire a bunch of consultants and pay them a lot of money. It's unbelievable. And the consultants always change the recommendations a little bit from year to year. They can't change them 100 percent because then it would look as if they didn't know what they were doing the year before. So they tweak them from year to year, and

the come in, they have lots of charts and PowerPoint presentations and they recommend people who, in turn, are going to charge a lot of money and they say, well, you can only get the best talent by paying 2/20 or something of that sort.

The flow of money from the hyperactive to what I call the helpers is dramatic while this group over here sits here and absolutely gets the record of American industry. I hope you'll realise that for the population as a whole, American business has done wonderfully and the net result of hiring professional management is a huge minus. At the bookstore, we have a little book called 'Where are the customers' yachts?' written by Fred Schwed. I read it when I was about ten years old. It hadn't been updated, new editions had been out a few times but he basic lessons are there, though. That lesson is told in that book from 1940. It's so obvious and yet, all the commercial push tells you that you're bound to think about doing something today that's different to what you did yesterday. You don't have to do that. You just have to sit back and let American industry do its job for you.

Charlie, do you have anything to add to my sermon?

CHARLIE MUNGER: We are talking to a bunch of people who have solved their problems by buying Berkshire Hathaway. That worked even better. There have been a few of these managers who've actually succeeded. There are a few in the universities who are really good. But it's a tiny group of people. It's like looking for a needle in a haystack.

WARREN BUFFETT: When I was given the job of naming two, in 1969, I knew a couple. I knew Charlie wasn't interested in managing more money then and my friend Walter Schloss would not scale up well although he had a fabulous record over 45 years or thereabouts. That was all I could come up with at that time. Fortunately, I did have a couple of others and the people who went with Sequoia Fund have been well served if they stayed for the whole period. There's been far more money made by people in Wall Street through salesmanship abilities than through investment abilities. There are a few people out there, who are going to have an outstanding investment record, but there are very few of them and the people you pay to help identify them don't know how to identify them. They do know how to sell you. That's my message.