BHI Ponzi: Allan Gray explains its connection with Global & Local

By Chris Steyn

Africa's largest privately owned investment management company Allan Gray says it does not have any exposure to the BHI Trust, the ponzi scheme in which investors have lost billions.

The asset manager has also implemented steps to protect the funds on its platforms of investors represented by Global & Local, the financial intermediary firm which facilitated investment of client funds into self-admitted fraudster Craig Warriner's ponzi scheme.

Last week Investec issued notice that it was closing all banking accounts associated with Global & Local. Allan Gray's Head of Retail Tamryn Lamb says that funds on its platform can only be withdrawn on direct instruction of investors – ie it is not possible for Global & Local to now access any funds it previously placed with Allan Gray for clients.

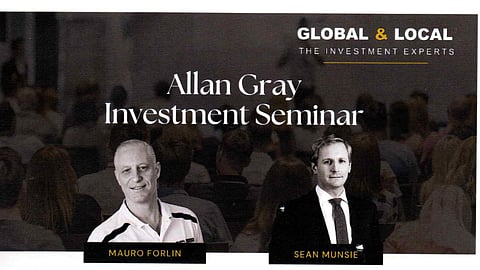

Concerns have been raised about Allan Gray's relationship with Global & Local. On September 7, the two companies co-hosted an Investment Seminar, headlined by Allan Gray Portfolio Manager Sean Munsie and Global & Local MD Mauro Forlin.

Global & Local founder Michael Haldane was also present at the seminar. Haldane's company aggressively marketed Craig Warriner's BHI Trust, and on occasion allegedly recommended they move funds away from regulated investments into the Ponzi scheme, an unregulated trust. The FSCA says this is a criminal offence.

According to a BizNews community member who often attended Global & Local events, Haldane usually took centre stage. At the Allan Gray seminar, however, he kept an uncharacteristically low profile and did not participate from the podium.

Allan Gray's Lamb said that co-hosted events of this kind are not unusual as they give the asset manager an opportunity to engage with underlying investors. She said at the time of the seminar, Allan Gray had no reason to suspect there was any association between Global & Local and a Ponzi scheme.

Barely a month after the seminar, Warriner handed himself in to the authorities, admitting BHI Trust had been run as a Ponzi scheme since 2008. The jailed former St Stithians old boy said he had been "robbing Peter to pay Paul" since his apparently foolproof day trading system lost heavily in the stock market crash that accompanied the Global Financial Crisis.

Last month Warriner pleaded guilty in the Katlehong Magistrates court to any and all charges brought against him; requested incarceration; represented himself in court; refused the option of bail; and asked only for a single cell as he feared being harmed by other inmates.

Lamb said: "While Allan Gray does not have any exposure to BHI, we are obviously aware of reports of fraud at BHI Trust as outlined in the media and understand there are – but we are not privy to the details of – ongoing investigations into BHI and involved parties, including any financial services providers who had clients who were invested in BHI, including Global & Local."

Lamb added: "Global & Local's advised clients invest in unit trusts, which are administered by the Allan Gray investment platform, including those of third party investment managers. These unit trusts do not, to our knowledge, have any exposure to BHI Trust, based on the published holdings information.

"Our focus and responsibility remains to safeguard all unit trust investments administered on the Allan Gray investment platform, and we will continue to ensure we have all necessary controls and procedures in place to do so, as governed by the Financial Advisory and Intermediary Services Act.We will monitor the situation closely and will act on developments as they occur."

She said there is a legal obligation for investment platforms like Allan Gray to communicate directly with clients, usually through monthly statements. Lamb added that any Global & Local clients who have been told they have money with Allan Gray but are unsure whether it is actually there, should first refer to these statements.

If there is any doubt, she added, these clients should call Allan Gray or email info@allangray.co.za.

At the September 7 seminar, despite it being a major part of the broker's offerings Warriner's BHI Trust was notably absent from the 57 "Product Providers" listed by Global & Local in the information pack given to attendees.

The Introduction to this handout stated Global & Local manages R5 billion for over 4 000 clients. It also contained a list of reasons why Global & Local was "different" from "many other advisory firms" in the industry

Those reasons ostensibly included "thorough research" of investment products: "Only once this research is presented to our in-house investment committee where, if a particular investment house, product or fund meets the strict criteria, is it then considered worthy to be presentable to our clients."

Despite this, Haldane personally touted BHI vigorously. In one Personal Financial Planning Proposal for a client, he wrote: "BHI is able to provide alternative investments to the private or company investor. Over the years the company has obtained a proud record of high investment returns."

In the wake of Warriner's admissions, Global & Local has now sent a gmail address to clients for all their legal queries regarding the BHI Trust. "Please note that queries sent through any other channel will not be attended to," according to Forlin.

The email address is litigationgnld@gmail.com

The BHI Trust has been provisionally liquidated.

Ponzi kingpin Craig Warriner is due back in court on November 29.

Read also: