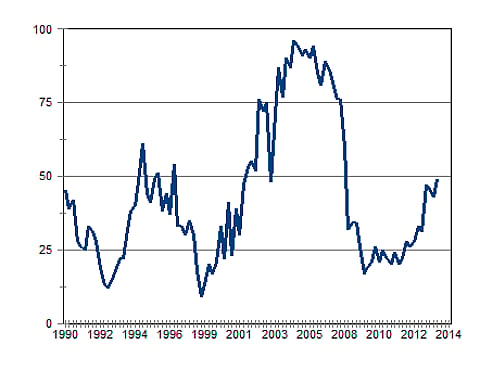

Housing recovering; builders’ confidence highest since 2007

John Loos is the embedded economist at banking group FirstRand's Home Loans division. His position gives him a unique insight into South Africa's housing market, one of the key constituents of its economic growth. He was my guest in the CNBC Africa Power Lunch studio today with an update on the bank's Building Confidence Index which is compiled by Stellenbosch University's Bureau for Economic Research. Some fascinating conclusions as you'll gather from watching the video or reading the transcript. Once again we are informed of a recovery being underway and economic rebalancing in progress. Loos says confidence among home builders is now at its best level in eight years. Home owners may join them. If another interest rate hike is avoided, he says, the housing market could achieve double digit price growth this year. That's the kind of feel good injection many South Africans would appreciate right now. – AH

ALEC HOGG: The Building Confidence index broke through the key 50 mark in the first quarter. That means it's back in positive territory for the first time since 2007. Despite the rise in confidence overall though, activity was largely unchanged. Joining us is John Loos, FNB Household and Property Sector Strategist. It's really good news that confidence is now above 50. That 50 mark…pretty important?

JOHN LOOS: Yes, it's an index which reflects the percentage of respondents that are satisfied with business. It's a subjective index, but when it gets above 50, it means that a greater percentage is now satisfied with business conditions – it has gone up from 48 to 52 overall. I think one has to drill down and separate residential from non-residential. What happened is non-residential has been a lot stronger when you look at the sub-indices, the contractor indices of the two industries. That has come down from 59 to 50 – the non-residential component, whereas the improved residential components have been responsible for the rise. There's a bit of a change in the mix, which is probably not a bad thing, because you've heard of mounting stock constraints on the residential side whereas when I cast an eye over office vacancy rates etcetera, we probably don't want too much building activity on the non-residential side because vacancy rates are quite significant.

ALEC HOGG: How long have we had the opposite – in other words – where the money has been flowing into offices and industrial, rather than into houses?

JOHN LOOS: Probably over the last two or so years, we've had better growth in the non-residential building sector. Residential has been very slow and as a result, more and more estate agents in the existing market have been reporting stock constraints. The balance has been restored slowly, but surely, in the residential side.

ALEC HOGG: Is this because banks are getting a little more free and easy with mortgage loans?

JOHN LOOS: Well, I'm not sure if we have in the last year or so. We got a bit more easy…say, 2/3/4 years ago. We were at our tightest probably, around 2009, and gradually relaxed, so yes, it's probably the lagged effect of that to an extent. It probably also has to do with… Over time, you had this gradual… All these leads and lags come into place. You've had this gradual demand growth since the recession, with the economy growing in some form over the past couple of years on the residential side, with stock constraints mounting because of a lack of building activity.

ALEC HOGG: This index then tells us about how the construction sector feels and the construction sector is telling us people are starting to build houses again or, at least, thinking about building houses.

JOHN LOOS: Yes, it's swinging more towards residential. If we look at some other sub-indices – the surveys of quantity surveyors and architects – those have improved quite significantly, which suggests that there's building activity to come in the pipeline. I would suspect more of that is now the improvement towards the residential side.

ALEC HOGG: They must have had it pretty tough, the Quantity Surveyors and the architects, if they can have such a huge increase in this quarter, in their confidence rating.

JOHN LOOS: I would imagine so. It has probably been a few tough years for them, but I guess that's the nature of the industry. Building is incredibly cyclical.

ALEC HOGG: Have we lost many, given that these are highly skilled people – QS's and architects – who might in fact, if they couldn't make a living here, find somewhere else in the world?

JOHN LOOS: It's tough to say, but my guess would be that we haven't lost as many as say, estate agents. The barriers to entry in terms of skills in quantity surveyors and architects are tougher, so you probably didn't get quite as big a surge in the skills levels of all those coming into the industry in the boom years, as what you did in say, estate agent sector. We know that the estate agent sector lost a lot after the boom years. I suspect it's not as severe on the QS and architects' side, but you would lose some capacity. In tough times, people often diversify into other areas.

ALEC HOGG: Well, they can globalise, can't they – the highly skilled, whereas estate agents I guess, would go and sell cars or something different.

JOHN LOOS: Well, you can globalise, but the global cycle and our cycle weren't too dissimilar, so it was tough in many areas of the world during the slump after 2008.

ALEC HOGG: Is it a popular sector for people going to university, going into quantity surveying and architecture, given that you have to study for a long time?

JOHN LOOS: I'm not sure what the numbers are in recent times. I suspect that the numbers would have picked up in the boom years, but that 'moving of scholars to varsities to study these things' probably goes with the cycle as well. My guess is that that probably, over the last five years it was not as popular. In the boom years, you did probably get a pickup in aspirant QS's and architects. The whole industry in the boom years was quite sexy.

ALEC HOGG: I guess they are also a very good leading indicator. If you're going to build a house, you have to first go to an architect or a quantity surveyor, and there's a lag until the first brick is actually laid.

JOHN LOOS: Yes, the QS's and the architects picking up, is something of a leading indicator.

ALEC HOGG: When do you expect that the construction companies themselves will get a feel of this?

JOHN LOOS: Well, I would think that would be during the course of this year. For residential especially, I don't think it's that long – the lead and lag. People plan and then, shortly afterwards, they build. Certainly, if we look at the buildings plans past versus buildings completion data or stats, you'll see there's not too much of a lag. It may be a matter of months or so before the building starts. I suspect we should see some pickup. The question obviously, is how far interest rates rise, because that can nip things in the bud. I think the one isolated interest rates hike we've had to date, doesn't make too much difference. Stock constraints have been mounting. Demand still seems good in the residential market, so we should see some building sector pickup this year. Do we have another few percentage points' worth of hikes and if so, does it at some point actually cool this down again?

ALEC HOGG: It's a very relevant factor then, I guess, for the Monetary Policy Committee to take into account, because if they can keep rates where they are – and I guess that would be your advice – then maybe the momentum will continue growing in a very important sector.

JOHN LOOS: It could, yes. Look, I like to look at the bigger picture too. They have other issues, such as big current account deficits and other considerations to make, but certainly, from a residential market point of view and from a residential building activity point of view, yes, it would be nice for rates to stay where they are at the moment. Given that mortgage lending hasn't gotten out of hand, I certainly don't see any need to curb that side of the economy. I don't think we're in some crazy boom time/irrational market that we were in a number of years ago. We need schooling.

ALEC HOGG: We've also had good indications that the rebalancing on the current account is happening, as well. John, just to close off with, what does this all mean for the housing market?

JOHN LOOS: Well, I think what we've been waiting for, for a while, is some growth in residential building activity. That would contain house price growth, I think. Where we've been recently with stock constraints and the existing market mounting: that's threatened to take us into, perhaps, double-digit house price inflation. However, this could keep it in single digits, so it's great for those wanting to buy houses. Probably, more supply means curbing house price inflation. It's perhaps not so great for those who already own houses and would love to see that capital growth. I suppose it depends on which side of the fence you sit.