Business: Zuma done SA great harm, is directly responsible for downgrade

SA's business leaders have finally switched from Chamberlain to Churchill – swapping appeasement for confrontation. Since Thursday's midnight cabinet reshuffle, the business sector has grown increasingly vocal, terminating diplomacy and flexing its considerable muscle. Sceptics believe it is overreacting, saying business backed the wrong horse (Gordhan) and over-invested in a "Team SA" project that was only a facade. I'm not so sure. Politicians forget easily that their source of funding is in essence controlled by companies. This is a very big stick. A cohesive decision by the business sector to switch off the VAT and PAYE money taps would make the recent social welfare scare looks like a tea party. Business success requires an ability to embrace complexity and act rationally – two attributes woefully lacking within the Zuma Administration. Coming out swinging now might be regarded by some as too little too late. Again, I'm not so sure. The tax revolt stick hasn't even been seriously mentioned yet. And it is likely to enjoy widespread support from most as the global Edelmans Barometer tells us Zuma's Government is trusted by just 15% of South Africans. Zuma wields power only because of a dysfunctional ANC electoral system that concentrates too much control in one man. In recent times seemingly impregnable but similarly corrupted Presidents in Brazil and South Korea were impeached. A repeat in SA is not beyond the realms of probability. – Alec Hogg

From Business Leadership South Africa:

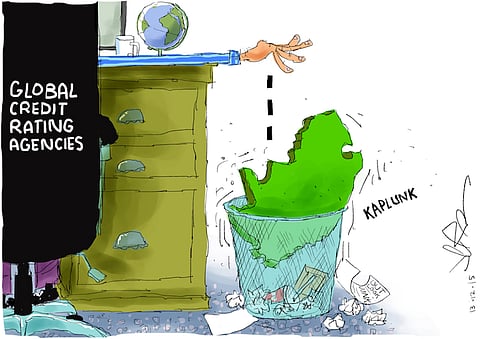

BLSA believes that President Zuma is directly responsible for South Africa's catastrophic rating downgrade by Standard & Poor's today.

Prior to the President's ill-considered decisions on the restructuring of the Cabinet, South Africans working together had made sufficient progress on economic growth, structural reforms and fiscal consolidation to maintain our investment grade rating and engender confidence that was reflected in the gradual strengthening of the Rand.

The cost of the downgrade to all South Africans, the poor in particular, will be felt in higher interest rates, higher inflation, higher food prices and lower economic growth which will reduce investment and employment. In addition, capital from international investors will be less available and more expensive for the funding of government, SOEs, projects and companies.

President Zuma has done South Africa great harm, and should be held to account by all South Africans.

From the Chamber of Mines:

The Chamber of Mines notes Standard and Poor's downgrading of South Africa's sovereign debt rating to junk status 'a consequence of the illogical and damaging cabinet reshuffle by President Zuma on 30 March 2017'.

The firing of a competent, dedicated and globally well respected Finance Minister, Mr Gordhan, and other Cabinet changes, have materially negatively impacted the key institution of Treasury and ultimately the credit worthiness of South Africa's government. The result is significantly detrimental for the entire country.

The downgrade will raise the cost of capital, increasing government and private borrowing costs, increasing the portion of government revenue that has to be allocated to covering debt service costs – thus crowding out other key government programmes, weakening the currency, raising inflation and, ultimately affecting investment, growth, employment creation.

The poor will be especially impacted by higher inflation, less resources available for social grants, low investment, limited growth in employment opportunities, and poverty levels will rise.

Despite the significant effort by business, working with Treasury, other government departments and organised labour over the past 18 months to ensure that South Africa retains its investment grade rating, the irrational and unexplained decision by President Zuma to restructure cabinet has precipitated this crisis.

Given that, in exercising his prerogative to appoint the country's Cabinet, the State President must place the national interest first, the Chamber believes that the ANC and the people of South Africa should hold President Zuma to account.

From Business Unity SA:

In response to today's credit rating downgrade by ratings agency Standard & Poor to below investment grade, Business Unity South Africa (BUSA) is calling for Government to urgently assess whether their current path is serving the broader interests of the country.

"The three social partners of the economy in the form of government, labour and business have been actively engaged to try and prevent such a downgrade. We are deeply disappointed that this has happened. Government has to heed these warnings and decisively act in the best interests of the country and its citizens" said BUSA President, Jabu Mabuza.

The downgrade will have immediate and far-reaching implications for the government's finances and to the economy and society as a whole.

"All individuals will be affected by this change in the country's investment status. South Africa will find it much harder to attract the levels of investment it requires to grow the economy and meet our social support commitments relating to health, housing and education" stated BUSA CEO, Tanya Cohen.

BUSA will seek urgent meetings with officials in the tripartite alliance, and has already initiated meetings with social partners in organized labour and civil society in order to map the way forward so as to re-set the economy on a more positive trajectory.

BUSA expressed concern that the downgrade will result in growing unemployment, higher inflation and an increase in the cost of food and fuel, and will undermine efforts to sustain the growth in social programmes that counteract the harshest effects of poverty and inequality.

"The political instability triggered by the extensive Cabinet reshuffle, is having a domino effect. We are most concerned that it is the start of a negative spiral. With the cost of borrowing set to rise, and less capital being available as a result of the sovereign ratings downgrade by S&P, the country will find it increasingly difficult to service its debt and afford the necessary social development programmes and services.

This will also mean fewer public and private funds will be available to stimulate investment and infrastructure development – leading in turn to lower growth and higher levels of unemployment. This is directly contrary to what the country needs to sustain inclusive growth and employment as a means to transform our economy and address social developmental needs of the country " says Cohen.

BUSA will redouble its efforts in the coming days to engage with all affected stakeholders and underline the importance that the country needs a government that demonstrates ethical leadership, good governance, and accountability. "The political and institutional instability concerns highlighted by S&P indicate that we have to urgently accelerate our efforts to create an environment conducive to stability and investment, and which will yield much needed growth and employment" says Cohen.

BUSA encourages all businesses to play an active role in holding the government to account in order to build an environment conducive to economic growth and employment.