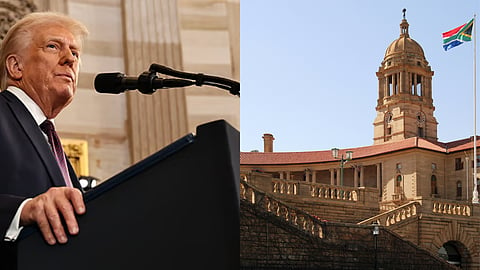

Hlelo Giyose: Wake up Pretoria - Trump’s Lollapalooza is all about the non-tariff measures

Key topics:

Trump uses chaos to disrupt traditional political negotiation norms

His tactics expose flaws in SA's BEE and non-tariff trade policies

SA misread Trump’s genocide claim, missing real trade intentions

Sign up for your early morning brew of the BizNews Insider to keep you up to speed with the content that matters. The newsletter will land in your inbox at 5:30am weekdays. Register here.

Support South Africa’s bastion of independent journalism, offering balanced insights on investments, business, and the political economy, by joining BizNews Premium. Register here.

If you prefer WhatsApp for updates, sign up to the BizNews channel here.

The auditorium doors will open for BNIC#2 on 10 September 2025 in Hermanus. For more information and tickets, click here.

By Hlelo Giyose*

Donald Trump’s behaviour is outside the norms expected of a traditional politician. Much like Ross

Perot, who ran for president in the early 90s, Trump is a businessman who entered politics. Much

like Ross Perot, Donald Trump’s approach disrupted linear thinking in analysing his politics and

policies.

Ross Perot’s jaunt into politics was very short-lived – he dropped out of the race for the

presidency after just a few months – while Trump managed to ascend to the US presidency twice. On

both occasions, socio-political, and economic actors were, and continue to be, completely puzzled by

Trump’s behaviour and objectives.

What is intriguing to us is that Trump, unlike a traditional politician, is a highly transparent individual. He tells you what he’s going to do and does it. Trump does not threaten you. He prepares you, not a fan of outcomes, but for a specific outcome.

Though not immune to political expediency, he is less prone to it than a traditional politician. So, why is the confusion in the things he says such that the market mistakes certainty for chaos?

The Lollapalooza Effect

The reason is that the President employs a negotiating technique called “The Lollapalooza Effect” which

results in enormous miscalibration of the uncertainty of the matter in contention.

This negotiating technique is often so devastating that Trump’s interlocutors do not even, in the first instance, believe what he is asking for, let alone the specific cost he is willing to levy on you should he not get anything close to his asking price. In other words, one does not even understand how Trump came to a particular conclusion, so much that it is incredible to see the risks associated with it.

One is simply bamboozled.

A lollapalooza is an extraordinary, unusual to the point of incredulity, and highly uncertain occurrence.

For instance, winning the lottery two or three times is a lollapalooza. Another example: it is

mathematically incomprehensible for Michael Jackson to win as many Grammys as he did, or for

Michael Jordan to win as many honours as he did, let alone over such a compressed career of 13 years.

Some phenomena are incomprehensible, illogical, and hence inexplicable. Straight away, you can see

the difficulty in assigning a probability to someone else replicating these feats. You would sound

foolish because the statistical distribution of such occurrences is so abnormal as to be referred to as

a grey swan.

That is precisely how Trump’s interlocutors feel when they contemplate the impact of both

his politics and policies on them. They think that something is abnormal but can’t quite put their finger

on it. It does not help that Trump is transactional (deal-based) in his approach to problems.

You must figure out the lollapalooza he causes in you every time he wants something from you.

The schooling system and much professional experience are based on linear thinking. If I disrupt linear

thinking in your problem-solving toolkit, I will enhance the chances of psychological misjudgment on

your part. Let me illustrate how Trump applied this to South Africa.

Playing white genocide card

Trump alleged that the South African government is engaged in genocide against the White population

of the country and offered asylum to members of that community if his concerns are not immediately

addressed.

First, the allegation and the remedy were communicated outside the bounds of diplomatic practice. Second, they were so incomprehensible that one would have to string together a myriad of far-fetched assumptions to make a hair’s breadth of sense of the allegation, let alone the remedy.

As the late Charlie Munger said, a lollapalooza is an occurrence so unlikely that it can only be explained by a confluence of factors so rare that assigning probability to them (as a whole) is futile (a statistical six

sigma event).

Read more:

The beauty (for lack of a better word) of this negotiating style is that it prepares the interlocutor for the outcome – the remedy of asylum to White South Africans right up-front. The mistake the government of South Africa made was to try to correct Trump’s assertions on genocide

and not look through them to see what he wanted.

Incredulity makes one think Trump was bluffing (zero percent chance of the risk of political asylum taking place). The risk was non-existent (0% uncertainty) until the first aeroplane full of asylum seekers departed for America, at which point uncertainty increased to 100% in 3 seconds.

The South African government, as well as other governments around the world, were in denial that Trump was asking for a referendum on how their domestic policies affected world trade. No one, they thought, has the right to question “paywalls” they set inside the countries they earned a democratic mandate to govern.

The paywalls Trump dramatically latched onto were Black Economic Empowerment and Land Restitution.

This negotiating tactic starts with the end result (an offer to White South Africans to take up asylum

in America). It provides a bridge to navigate this outcome (amend domestic policy toward private

property ownership). It leaves the South African government room to negotiate only the severity of

the allegation, not to deny it. But because the entire engagement is incredulous (defies logic), interlocutors tend to suffer the fate communicated to them at the beginning.

The second feature of the negotiating tactic is that it is so draconian in its demands that interlocutors are likely to concede everything rather than achieve a win-win.

What Trump really wants - removing NTMs

What is the solution? The best bet is to interact with the allegation by recognising its intention to

disrupt your linear thinking and seek a solution in a completely different area of enormous importance

to Trump. In other words, employ inverted thinking.

Genocide of any kind is not high on the list of problems Americans want solved. Trump is not going to spend his political capital on a matter so inconsequential to the American people.

Giving Starlink access was not that important to Trump (the evidence is that asylum is still open to White South Africans despite our government’s concessions to Elon Musk on Starlink). South Africa's offering of Starlink (as Lesotho did) was a symptom of a deer caught in a lollapalooza of headlights. The issue was never Starlink. Trump has reinstated April 2 tariffs on both South Africa and Lesotho despite concessions on Starlink.

Instead, what Starlink experienced when it applied for a license, namely, a non-tariff barrier (paywall) in the form of BEE, is an issue consequential to American economic interests. Non-tariff barriers irk Trump so much that he’s willing to go to war with China, America’s largest trading partner, over them. If he’s willing to do that with China, what more South Africa?

The South African government should have approached Trump with a proposal to workshop possible solutions to redressing (not abandoning) the economic imbalances created by the country’s past in a manner that fully preserves the letter and spirit of the global trade order. But we were too caught up in the incredulity of the genocide assertion and its remedy – Lollapalooza in full effect!

Why does Trump think that the way BEE in its current form impedes the invisible hand of the global marketplace?

For better or worse, this is worth debating with America, the architect and material beneficiary of the global trade order. As an aside, one can argue that China’s ascendancy to the WTO has yielded the greatest (or most dramatic) economic transformation of any country and made China--not America--the largest beneficiary of the world trade order, but I digress.

Take it from Lee Kuan Yew, founder of Singapore (and a completely accomplished public servant), when he spoke to Charlie Rose (an American media personality) at Harvard University on October 18, 2000.

He said in global trade and technology, you can create (multiple) sets of bonds or links that will not only bind two economies such that they are both dependent on each other, and the people of the two economies are also reliant on each other: CEOs of various companies in two countries, professional industry guilds in two countries, engineers, accounting systems, legal systems, and so on

such that there is a broad-based appreciation of the elevation of the interests of global trade

system above any one country’s internal interests.

Practically speaking, why should capital move freely in one direction to South Africa’s benefit (e.g.,

South African Breweries acquisition by Anheuser-Busch) but American capital seeking opportunity in

South Africa (or India, Malaysia, or China) be subject to non-market requirements such as BEE,

Economic Indigenisation (Botswana, Zimbabwe, Nigeria) as opposed to Indigenisation for cultural

redress, and so on?

Legislative creep of NTMs

Legislative creep in many countries, in the name of economic empowerment of locals or strategic industries, has led to the suboptimal functionality of the very trade system that has lifted billions of people out of poverty. And America underwrote that prosperity – ask Western Europe

and China.

For instance, in the media industry, many countries have local content quotas for entertainment at the expense of foreign content, while the United States has none. In America, South African artists have equal (exposure) opportunity as their American counterparts for Americans to enjoy their music or movies.

What if America added back a “counter local content tax” on South African music and movies that play in America to compensate American artists for the needle time they miss out on in South Africa?

That would be akin to Sarafina or Lion King paying to play on Broadway rather than being paid for their artistic creativity. The production company enjoys the economic benefit Americans attach to the cultural value they derive.

The French also assert local content quotas in music and movies. What if America adds back a tax to

penalise French movies aired in America?

Don’t get me started on “strategic” interventions in China and India. Strategic interventions by the Chinese government in all industries are exactly why America adds Chinese government subsidies to the tune of 100% on exports of solar panels and Battery Electric Vehicles (BEVs).

Today, the global system intended to facilitate the freest era of trade in human history is marred by numerous impediments. Think about it - how can governments around the world think

that they can make their citizens prosperous through “developmental” or “strategic” non-market

policies while grinding the very vessel of prosperity, the global trade system, to a halt?

Why elevate State interests, through paywalls, above the interests of the commons? It truly is difficult for most people to appreciate that less is more.

South Africa, along with many other countries, either does not comprehend the idea of sanitising (not

corrupting) the commons, or it disagrees with it.

The country is reported to start soon its trade negotiations with the United States and rather than institute structural reforms of domestic policies that soil the commons, it is offering a framework of transactions it thinks America wants (e.g., a joint fund to invest critical minerals, duty free quotas on US autos and steel, and duty free import of US Liquified Natural Gas (LNG)).

The government does not realise that in trying to placate the Trump administration, such deals constitute a continuation of soiling the commons. Anything to maintain the status quo!

The United Nations Conference on Trade and Development (UNCTAD), a unit of the UN, is a body to

which South Africa is a member of, refers to such self-interested measures as Non-Tariff Measures

(NTMs).

Read more:

In a report titled “Unseen Impact of Non-Tariff Measures”, UNCTAD concludes that while

most NTMs have legitimate policy objections, in most sectors of the economy, their restrictiveness far

exceeds that of customs duties on imports (tariffs).

It quantified NTMs by converting their impact into a numerical expression (dollars and cents) it terms Ad Valorem Equivalents (AVEs). Without saying whether NTMs cause poverty, it is clear from the chart below that countries with low per capita GDP encounter high NTMs when they export to countries higher up the per capita GDP ladder (locking them out of global seaborne trade).

Corrupting the commons

In other words, they have low bargaining power over their customers and they are locked in poverty. Djibouti finds it hard to penetrate South Africa much like South Africa finds it hard to penetrate China. Another stylized fact is that all countries, to varying degrees, have NTMs. To illustrate, Washington’s trade complaints against Pretoria comprise NTMs that impede free trade in a range of industries from vehicles to citrus to meat and so on.

To be fair, South Africa employs NTMs commonly deployed by countries around the world to protect local industry. One of them is the phytosanitary (health and hygiene) requirements for meat (beef and pork), as well as a 62% tariff on chicken, which are additional costs that US meat exporters must comply with to land their products in South Africa. South Africa recently made a big song and dance about the same phytosanitary requirements the EU imposed on its citrus produce.

Now, a foreign company may decide to set up shop in an end market (we can use South Africa as an

example) to bypass both excise duties and technical NTMs such as phytosanitary requirements, only

to be told that there is one more NTM (this time, non-technical) that the company must comply with,

namely, BEE, as laid out in the charter of the relevant sector.

Instantly, you can see that customs duties are the least of the problems in the global trade system (South Africa has a trade-weighted average customs excise tax of 7% but its NTMs are material – your guess is as good as mine). The people who ridicule Trump’s calculation of reciprocal tariffs (30% on South Africa) are themselves none the wiser on how to unscramble the egg that is NTMs.

To appreciate why regulations are a royal waste of taxpayer money, please explain how we spend

taxpayer funds to police private sector compliance with poverty alleviating global initiatives, such as

United Nations Development Program (UNDP) Sustainable Goals or COP conferences on the one hand,

while also spending taxpayer funds to erect barriers to a trade system that has patently raised the

prosperity of many people around the world (Americans, Europeans, Chinese, Singaporeans, South

Koreans, Japanese, etc.)?

It turns out the government’s left hand is undoing the work of the right hand. This is a failure of Kafkaesque proportions!

What is required, in much of the world, to solve the current tariff impasse is to replace legislative

creep in the guise of developmental policies with legislative creativity that enhances GDP per capita

(citizen prosperity and not State-based wealth).

The current trade negotiations between America and the 17 priority countries are indeed workshops of the very kind South Africa should have requested, with no sacred cows (BEE, VAT, and other NTMs that favour domestic production over imports) spared. Now imagine how much pressure India (one of the 17 priority trade deals under negotiation), giving up its own version of BEE (requirement for foreign capital to partner with an Indian citizen) heaps on South Africa to move unempathetically on BEE sector charters!

Regulatory quality over quantity, less is more

One last point on NTMs, if you are still unconvinced of the argument that relieving the commons of

country-based regulatory burdens is a catalyst for prosperity and not poverty, the World Bank ranks

countries by Regulatory Quality (the ability of the regulatory architecture of countries to formulate and

implement policies that promote private sector development).

First, there is an inverse relationship between regulatory intensity and regulatory quality (e.g., the left-hand undoing what the right hand did). Second, the higher the regulatory quality, the greater the economic prosperity per capita is.

More regulation leads to lower quality, which leads to less prosperity.

In short, it is beguiling how more interventionism leads to undesirable outcomes. Of interest to us is where South Africa ranks on the World Bank Regulatory Quality Global Index. With a score of -0.22 out of a possible 2.5, South Africa ranks 104th out of 193 countries, just below Tuvalu and above Türkiye. Singapore ranks first in the world with a score of at 2.31 (out of 2.5).

To put BEE in perspective, the question in Regulatory Quality, the fact that Malaysia, from whom South Africa copied the concept of BEE ranks 49th with a score of 0.66 means there is a lot to be desired from South Africa’s implementation of the policy (not whether redress is necessary). No wonder the country has been in a per capita GDP recession for the last 11 years.

One may very well wonder why, when presented with a fresh canvass to paint its economic policies, South Africa copied Malaysia and not Singapore, given that Singapore seceded from Malaysia in 1965 (on account of deep, irreconcilable differences over political and economic policies) and went on to generate economic prosperity on a per capita basis in the shortest amount of time known in human history.

In less than the fullness of time, the individual responsibility-based policies of Singapore trumped those of state-sponsored rights policies in Malaysia by a wide margin.

Conclusion

Because South Africa failed to untangle itself from the lollapalooza effect, much-needed private

school kids of non-black ethnicity have a free pass on American residency for their skills. The burden

of proof of genocide on the part of an asylum applicant is so low that the allegation of genocide was

a ruse for something else. It wasn’t for Starlink. It was for non-tariff barriers.

As for BEE, we have ideas of how it can be implemented to better achieve both per capita economic growth through economic mobility and factor productivity. However, that is a subject for another time.

Lastly, rather than decrying the effort to sit across the table from America to negotiate tariffs, the world should aim to hold America’s feet to the fire of a sanitised world trade order, not just its economy.

*Hlelo Giyose is the Founder, Chief Investment Officer, and Principal of First Avenue Investment Management, a boutique asset manager specialising in value-driven equity investments on global stock exchanges. With a career spanning over three decades, since entering the investment industry in 1993, he has served as a portfolio manager at leading institutions, including HSBC, Investec Asset Management, IDC, and Stanlib Asset Management, before launching First Avenue in 2010.

Raised in exile as a political refugee in Uganda, Botswana, and the United States, Hlelo developed a keen global perspective and an early interest in financial markets at the age of 12, influenced by his accountant mother. He holds a BSc in Business Administration with majors in finance and economics from the University of New Hampshire and an MSc in Investment Management from Cass Business School in London. A proponent of multidisciplinary investing, inspired by legends like Benjamin Graham and Warren Buffett, Hlelo emphasises temperament, unconventional thinking, and quantitative skills in managing risk and building long-term client wealth.