Oil set to rise as drones attack Saudi oil facility; US blames Iran

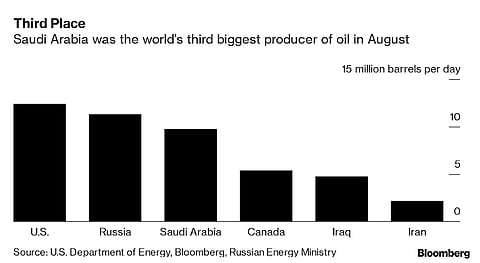

Friction between the US and Iran escalated to a dangerous level after Saturday's attack on a critical Saudi Arabian oil facility which knocked out half the country's crude production – around 5.7m barrels a day or 5% of global oil supply. US Secretary of State Mike Pompeo blamed Iran for the apparently co-ordinated strikes. He dismissed claims from Iran-allied Houthi rebels in Yemen who claimed responsibility, saying they had sent 10 drones to strike at critical Saudi facilities. Pompeo didn't explain how the US believes Iran was to blame or where the strikes originated. According to the official Saudi news agency, US president Donald Trump called the Saudi crown prince Mohammed bin Salman after the strikes, offering to co-operate with the kingdom in supporting its security and stability. On Sunday Iran rebuffed any suggestion that it was involved. Its foreign minister Javad Zarif said after the US had failed at its "max pressure" campaign it is now focusing on "max deceit". The Saudi stock market dropped 3% on Sunday, and analysts expect that when markets re-open the oil price will trade at least 20% higher as a result of the disruption to oil supply. – Alec Hogg

Saudi oil attack is the big one

___STEADY_PAYWALL___