Direct indexing is in: here’s why you should be doing it

*This content is brought to you by Shyft, the global money app, powered by Standard Bank.

One size doesn't fit all. Netflix and Spotify know this, which is why you get personalised recommendations based on your watchlist or listening habits. Across the spectrum, big data and smart algorithms are creating a hyper-personalised world where – at the risk of being exposed to only one worldview – you are (as you should be!) seen as an individual. Now, thanks to a new model called direct indexing, your investments can work the same way.

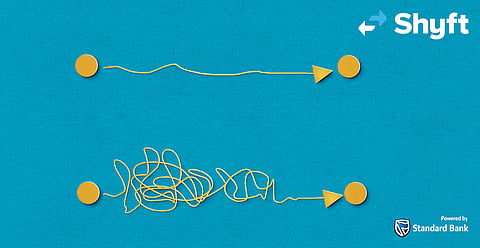

Direct indexing allows you to replicate the performance of an index by buying a representative amount of the underlying shares. If that sounds a lot like an exchange-traded fund (ETF), then you're close… but there's a key difference. Unlike with traditional index funds, where you indirectly invest in the companies that make up an index (say, Naspers or MTN in the JSE Top 40), direct indexing lets you directly own shares in those companies.

In an ETF, you're also tracking the index – so you're not a shareholder in the individual companies, and you can't buy or sell shares within that index. With direct indexing, you're basically building your index from scratch, so you can customise it and tweak it as you go.

This allows you to align your investments with your needs and values. Don't like the way "Evil Corp" ignores its ESG responsibilities? Then don't invest in them. Easy. While your friends are stuck with "Evil Corp" in their Top 40 ETF, you can happily sit with your own Top 39, knowing that you're not helping to destroy the planet. (Think of it like a personalised Spotify playlist, where you have your favourite artist's greatest hits, minus that one awful song that you hate.)

Easier access

Until quite recently, direct indexing involved specialised expertise and prohibitive trading costs. It was expensive, and only the ultra-wealthy could afford it.

Digital tech has changed that, enabling a massive shift towards commission-free trading and fractional shares, making direct indexing more accessible to many more people. So while mutual funds disrupted the investment scene by allowing Average Joes and Joannas to access financial markets, and while ETFs gave them diversification, direct indexing is the next major investment game-changer.

The biggest benefit of direct indexing lies in its flexibility, and in how it allows you to align your money with your personal values and investment aims. While there are several ETFs or tracker funds that target specific factors, sectors or geographies, you might find that you'd prefer to pick and choose individual equities or industries to create something that matches your preferred allocation.

Your reasons for wanting more personalisation and flexibility may be values-based. Maybe it's the ESG issue we mentioned earlier; maybe you have moral or religious reasons for not wanting to put your money in a booze or tobacco business; or perhaps it's less about avoiding certain companies or sectors, and more about wanting to increase your exposure in others. Maybe you believe that South Africa's mining industry is where the future's at; maybe you're super into tech stocks; or maybe you want more exposure to India or Brazil than, say, the MSCI Emerging Markets Index is giving you.

All of that is possible with direct indexing. Just remember that the more you stray from a particular index, the less likely you are to match its returns (which could be a good thing or a bad thing).

Another benefit of direct indexing is that it can help you generate additional capital losses. That – for those who're new at this game – is a good thing, if you need to offset your capital gains from other investments. If you're an investor who doesn't really have any other capital gains, then the tax benefits are obviously limited and you can safely ignore this paragraph.

Lower costs, lower fees

There's a catch, though. Most ETFs are passively managed and simply seek to track an index, so they're not going to involve huge amounts of research and market analysis. You pick an index, track it, and watch your money grow (in theory). As a result, the operating expenses are low and so are the fees. That's why so many entry-level investors love ETFs: they're cheap and cheerful, and they let you feel like you're matching or beating the market.

Management fees for direct indexing portfolios will vary, but they're typically higher than what you'd pay for an ETF. That makes sense: direct indexing can be complex to manage, requiring constant updates on changes to the index you're tracking, with tweaks and adjustments as you go – and all while keeping an eye on the tax implications.

But they're still lower than most other investment vehicles, and those costs are offset by the increased personalisation. Instead of picking an index out of a catalogue – JSE Top 40, Nasdaq 100, MSCI World, whatever – you'll have the power to design your own, customised to fit your needs and your take on the prevailing market conditions.

With a mobile app like Shyft, it is now very simple to personalise your investments and construct a custom investment portfolio that mirrors the composition of an index. Shyft allows you to invest in 300+ stock options and ETFs (if you do prefer to go that route), with fees charged at just 0.4% per share, with a minimum transaction fee of just $1.99 (excluding VAT). You can easily track the performance of your portfolio and sell or buy shares when you're ready.

As a recent Nasdaq article put it: "Recent market volatility has many investors swept up like Dorothy in The Wizard of Oz with no place to turn to, but direct indexing could be the ruby red slippers to take you home or at least mitigate some losses."

This post was sponsored by Shyft, the global money app, powered by Standard Bank. With Shyft you can buy forex instantly anytime, anywhere, and at the best rates, and invest in top US stocks and ETFs. Shyft was named Best Financial Solution at the 2021 MTN Business App of the Year Awards. Visit Shyft to download it now, no matter where you bank. Shyft operates under the license of The Standard Bank of South Africa Limited, an authorised Financial Services Provider (FSP number 11287).

Read also: