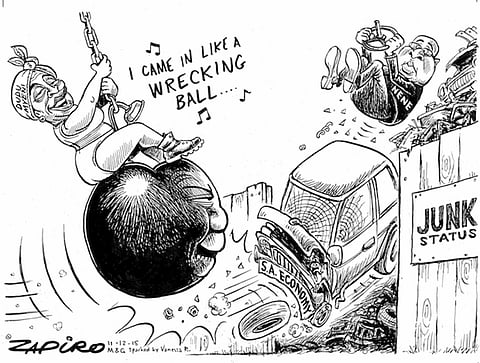

Stocks, bonds, rand plunge as global investors tells Zuma: You’re Fired!

All of us has someone we must answer to. Even politicians who promise the earth every five years to get elected – then rapidly develop selective memory loss. In South African President Jacob Zuma's limited grasp of economics, supply and demand are irrelevant. As Zuma is starting to discover, and will have emphasized when his newly appointed lackey tries to balance the national books, those laws of economics are actually all that matters. Northstar's CEO Adrian Clayton explains these realities in this superb assessment of the market's reaction to Zuma's decision to replace Finance Minister Nhlanhla Nene with a maleable backbencher. – Alec Hogg

By Adrian Clayton*

As one absorbed the news of Finance Minister, Nhlanhla Nene's sacking late on Wednesday night, the 9th of December 2015, one felt a primal chill and an undeniable realization that what we faced in financial markets on Thursday would reconstitute our historical paradigms. This was no ordinary event for South Africa and our markets.

Our immediate concern was the extent to which markets would react to the news. These concerns were not misplaced. The long-end of our domestic bond curve has seen yields rise from 9.54% to 11.46% over 2 days. This represents a capital collapse of 16.2% and using monthly data, this is the largest move in yields on our market since 2009. Considering foreigners control 33% of the SA bond markets, the current dynamics of falling yields and a collapsing currency create a poor framework for confidence and no doubt will lead to lasting memories for foreign participants.

The JSE All Share Index has fallen 4% since its high on Thursday. This completely belies the underlying malaise though, the domestic banks index has fallen 23% in two days and the property index has collapsed 15%. This is the worst collapse since 2005! The ALSI has been, so far, protected by the falling rand, with dual listed stocks remaining relatively buoyant.

The key question is why would the market respond differently this time round relative to what we have witnessed since Zuma became president on the 6th of May 1999? Until this week, the JSE has tacitly stomached the misappropriation of funds, atrocious malpractices with regards tender rigging and diabolical mismanagement of the economy. However, in all previous instances, the State had a hands-off approach to the Fiscus and to a large extent, the SARB.

The sacking of Nene and appointment of David van Rooyen changed this and thus changed the mindset that investors have towards the South African Government's view of fiscal discipline. From a technical perspective, market participants are terrified about the degree to which Government will now have no financial custodian resisting populist spending on social welfare, state employment and wages and then non-essential state projects. This could prove hyper inflationary, leading to the cost of financing rising for all sectors of the SA economy and undermining confidence. It then becomes a virtual loop! The real worry is that it is impossible to pin a number on the degree to which mismanagement could take place. For managers of money, escalating inflation and thus rising bonds yields displace existing valuation models of assets – it makes understanding what assets are worth, literally farcical and creates havoc on markets – hence the collapse we have seen.

But we also see a deep irony in that Zuma's most aggressive and boldest move to date, might well prove to be the one that damages his political future most. His decision this week does not only hurt the wealthy, which have easy access to financial markets, it undoubtedly erodes the wealth of all prospective pensioners, be they state employees, members of union funds or those in private schemes.

Zuma has shown an utter disregard for the well-being of all South Africans and for foreign investors too and the secular economy (namely, the stock market) is now delivering a clear message, an ANC Government under Jacob Zuma will no longer be tolerated and confidence will only return once this changes. Zuma, we believe, has fiddled with the ultimate power, mobile capital, he has signed his political death warrant and ultimately, the markets will force his removal. The stock market is the visual map of his tenure – we have not seen that until now!

- Adrian Clayton is the CEO of Northstar Asset Management