Stats Guru: Pam Golding property index a “marketing gimmick”

When leading estate agency Pam Golding Properties launched its residential property price index, one had to question whether the country needed a third such measure as those produced by ABSA and FNB seemed to be doing a rather good job. Andrew Golding provided a spirited argument claiming those indices provided the wrong information. But now he has been challenged by the Department of Trade and Industry's retired Director of Statistical Analysis, Kryzsztof Wojciechowicz. After reading this and looking at his charts, Krzyszstof makes a strong case. Have a look and make up your own mind. – AH

From Krzysztof Wojciechowicz:

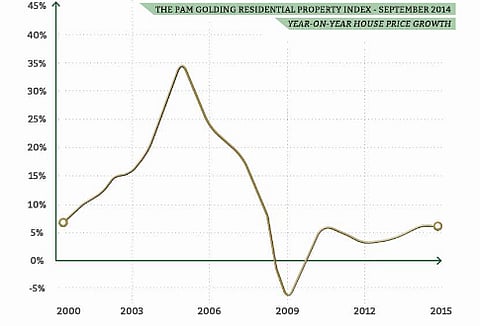

I just happened to read your interview with Andrew Golding concerning the new Pam Golding house price index. It looks like another marketing gimmick. There are no significant changes from ABSA or FNB indices.

- There is a shift of a peak from 2004 to 2005. This can be easily explained by the new method which looks at the title deeds register as opposed to the time of actual sale. Other differences can also be explained by this shift in time.

- I can't see any merit in using 'repeated sale' method to the average price one. First of all, it considerably limits the size of most recent samples. There were not many sales of property bought in 2012 and sold in 2013 (one year change). Secondly, this method doesn't really look at the same product. A house purchased say, 10 years ago, may now be in depilated state, or it might have been completely renovated and improved. So the price change over time doesn't apply to the same product.

I enclose a graph comparing the Pam Golding (above) and ABSA (below) indices. Not much difference.