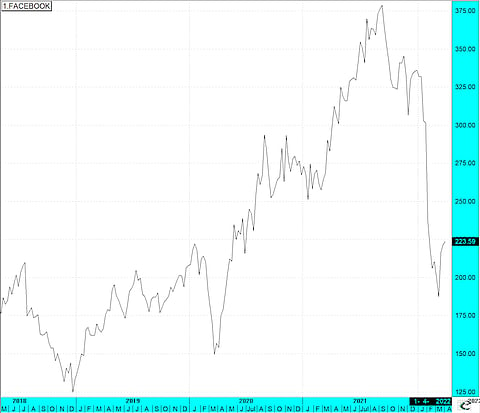

Sean Peche exposes Meta’s Great Houdini trick on shareholders

When it comes to sources of information, investors are spoilt for choice nowadays as many top money managers from all over the world generously share their insights on social media. One of the best we know is UK-based Ranmore Funds' founder Sean Peche whose LinkedIn page is a wonderful source of rational perspectives. A value investor, Sean warned us about the fragility of Naspers/Prosus at a time when the shares traded far above current levels. In an equally forthright opinion piece below, he cuts through the smoke and mirrors of Meta Platforms, previously known as Facebook. The biggest beneficiaries of the strong cash flows, we learn, are not shareholders – but Meta executives and staff whose remuneration packages have rocketed through massive share grants. A reminder to always look under the hood. That's where the real action happens. – Alec Hogg

By Sean Peche*

At the start of my career, I had the privilege of working for Bryan Hopkins at Old Mutual Asset Management. Bryan was a former Accounting Professor and he taught me a trick that I use regularly.

He said, "always look at cumulative cash flow over a number of periods because cash flow in any one discrete period can be misleading. Cumulative cash flow is closer to the truth". He's right.

From time to time, I see fund managers referring to a company's high free cash flow yield over 1 year, but sometimes it's due to falling inventory as working capital unwinds from years of inventory build. Except, you can't unwind inventory forever so using the one year number is misleading. Cumulative cash flow offsetting this unwind against the inventory build from prior years is closer to the truth.

Now let's look at the Cumulative Free Cash flow of Meta.

Over the past 3 years, Meta has generated $133bn of Cash flow from Operating Activities. They spent $49bn on Capital Expenditure leaving $84bn of Free Cash Flow. You see, I told you Meta is an amazing company that pumps cash faster than the Fed.

Hold your horses, Buckaroo!

What did they do with all that free cash flow? Don't you know? They returned it to shareholders. Did they now? Well, let's take a look…

Over the past three years, Meta has spent $55bn repurchasing stock equal to 66% of the free cash flow generated.

You see, I told you they returned cash to shareholders.

Great, so the number of shares in issue fell by how much?

From 2.852m to 2.741m over this period. But that's only 3.9%.

Take a look at their Statement of Equity (useful section of the Financial Statements often ignored) and you'll see that they repurchased 185m shares over this period but issued 115m Restrictive Stock Units – shares to staff so 62% of what was repurchased, wasn't returning cash to shareholders at all, but rather "giving cash to employees" and isn't included in operating expenses on the income statement.

Now if you add the 99m unvested RSUs at the end of the period to the shares in issue, you'll see that the adjusted shares are actually only down by a paltry 0.4%.

So $55bn spent over 3 years buying back shares at $297 a share (now $225) didn't make its way back to shareholders. Meaning that the three year free cash flow yield for Meta is not $84bn/$594bn or 14% but rather $29bn/$594bn or 4.9% over 3 years?

I can give you companies with one-year dividend yields higher than that where the cash is actually returned to you.

So any bond investors scrambling out of bonds into equities in search of higher yields look carefully, because you won't get it in large tech.

- Sean Peche, a regular commentator on BizNews Radio, is the founder of Ranmore Fund. He previously worked for Orbis in London; and Old Mutual in South Africa. He qualified as a CA (SA) in 1996.