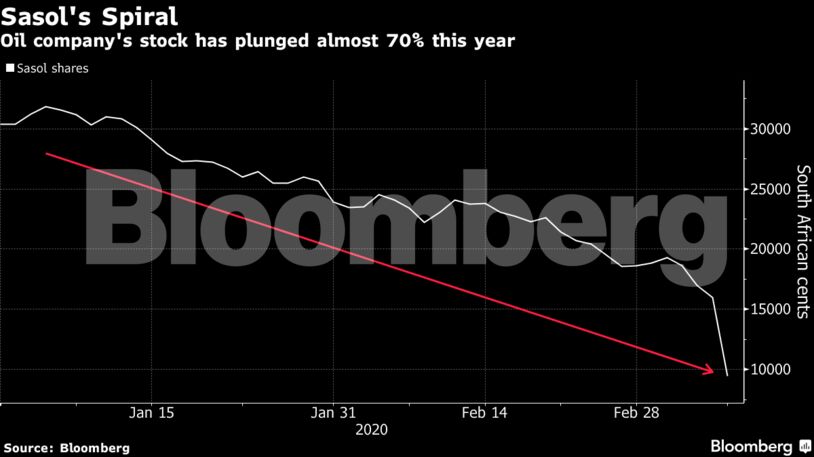

Sasol crashes as global oil price plunge hits at absolute worst time for energy giant

By Adelaide Changole and Paul Burkhardt

(Bloomberg) – Sasol shares plunged by a record 50% in Johannesburg on Monday as the crash in global oil prices added to concerns around the company's debt levels and cost overruns at a US plant.

The sharpest slump in oil prices since 1991 hit the South African fuels and chemicals producer just days after Moody's Investors Service downgraded it to junk, citing high debt and spending on the Lake Charles Chemicals Project in Louisiana.

"This oil price crash has come at the absolute worst time for Sasol," said Seleho Tsatsi, an analyst at Anchor Capital in Johannesburg. "The market is concerned about the company's balance sheet."

Shares in major global oil companies fell on Monday, but the decline in the world's biggest producer of liquid fuel from coal was more pronounced.

While Sasol has assumed oil prices staying at $50 to $70 a barrel for its outlook projections, Brent plummeted to as low as $31.02 on Monday. The Johannesburg-based company's half-year earnings already showed the effects of a 9% decrease in the rand-per-barrel price of crude oil and lower refining margins due to weaker demand during the period, the company said in a February 24 results statement.

Moody's said last week that Sasol's free cash flows over the next two years won't materially reduce the company's R138bn ($8.5bn) of debt, accumulated mostly because of the LCCP. The latest slump reduced Sasol's market value to about R59bn.

Sasol "has a significant US dollar-denominated debt load that it needs to deal with," Tsatsi said by email. "Unless we see a significant recovery in oil prices soon, there is a high likelihood for Sasol to take measures to address its balance sheet."