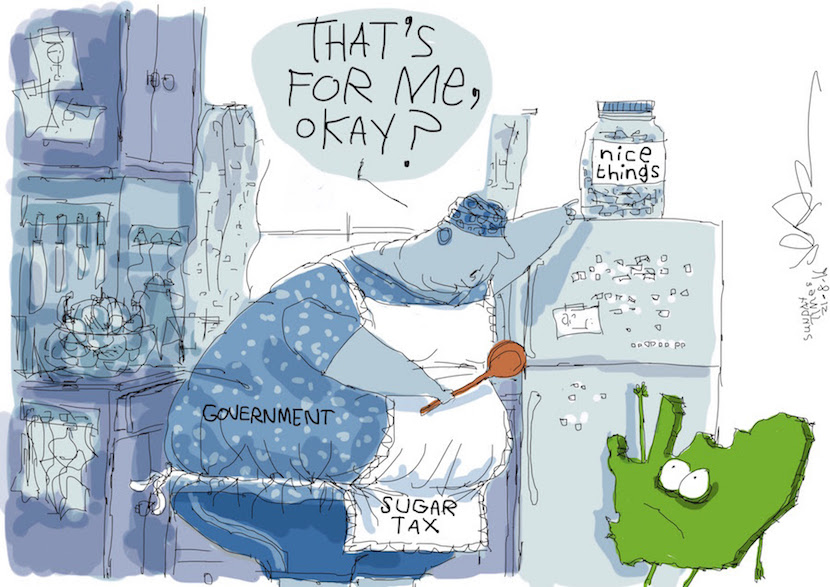

Many equate a sugar tax to a strict form of nannying. And in South Africa’s case it’s a plan to cut down on levels of obesity. But there’s no historical correlation to prove that adoptng a sugar tax will reduce obesity levels – people will find their sugar elsewhere. So what is government’s real objective here? Frans Cronje, CEO of the Institute of Race Relations applies his mind to the debate. He’s concerned that South Africans have fought so hard to re-assert their freedom from an overbearing state, but such a tax is forcing them to let go of those rights once again. A good read. – Stuart Lowman

By Frans Cronje*

If government and a few paternalistic nannies get their way, from April, next year, we will all be paying 20 percent more for a can of our favourite cold-drink and any other sugar sweetened beverages (SSBs). Apart from the fact that a tax targeted at SSBs is clearly discriminatory and arbitrary, what governments the world over fail to recognise is that what people do with their own bodies is none of the state’s business.

A tax on SSBs will not result in any perceptible difference to obesity rates. Consumers in South Africa, like elsewhere, will simply switch to alternative products such as fruit juice, sweets, cakes, and biscuits. And producers will switch to sweeter alternatives such as high-fructose corn syrup or perhaps non-nutritive artificial sweeteners. Their good intentions unsatisfied in time, our self-appointed health overlords, to ease their distress and further attempt to achieve their goal, will, no doubt, widen their net to include taxes on these alternative products.

Broadly speaking there are two types of taxes: direct and indirect taxes. Direct taxes, such as personal and company taxes, are paid directly to government. Indirect taxes are collected on behalf of the government by intermediaries, such as retail outlets, and paid over to government at a later date. The most common example of indirect taxation is VAT.

Most indirect taxes are stealthily applied to only certain goods and services. Some people are not even aware that their purchases of these goods include tax. These taxes are typically referred to as ‘soft taxes’ because they can be easily imposed by government without the public knowing anything about them. Prime examples are fuel levies and the so-called ‘sin taxes’ that are levied mainly on alcohol and tobacco products.

Taxes are imposed for one of two reasons or a combination of both: either to raise revenue for government coffers or to raise the price of certain goods or services so as to reduce the demand for them. Proponents of sin taxes believe that certain goods are bad for consumers and thus argue that they should be taxed in order to raise their prices and thereby deter people from consuming them.

Imposing a soft tax on SSBs is a blunt instrument that not only undermines consumers’ individual liberties, treating adults like children, but will do wide, untold harm to millions of people who rely on the relevant industries for their livelihoods.

By attempting to occupy the moral high ground, paternalistic individuals and bureaucrats divert attention from their insatiable appetite to control people’s lives and to raise revenue for the state. As Deloitte tax partner, Nazrien Kader, states, “What SA does not need is another ‘stealth tax’, such as the plastic bag levy, which is ineffective and has had no visible impact on changing behaviour”.

Read also: Sugar tax – a ‘sin tax’ that could help fat people get thin?

The supposed logic behind government taxing sinful products is that if a government is to pay for healthcare, then it should be allowed to tell citizens what they must do with their own bodies. This kind of hubris fuels the erroneous argument that the government is the foundational source of health and prosperity and is thus entitled to regulate consumers’ behaviour. Better health outcomes can only be achieved by consumers taking charge of their own lives.

A more durable strategy would be to educate individuals about the benefits of a balanced, nutrient-rich diet. There can be no disputing the fact that a wealthier nation is a healthier nation. Taxing a nation is a sure way to reduce the wealth of citizens and prevent them from being able to afford and make healthier food choices.

South Africa levied a tax on soft drinks and mineral water from 1993 until it was abolished in 2002 purely to raise revenue. The proposed “new” SSB tax, estimated to bring in approximately R7.6 billion in tax revenue, will not be ring-fenced for health purposes. This raises an interesting dilemma. If, as the Treasury claims, this is not a revenue raising scheme, then by same logic applied in 2002, this tax should not be introduced. If the tax is not meant to raise revenue, then another needs to be reduced or done away with. Which one, in that case, is Treasury proposing to reduce or abolish? A reduction in VAT to offset the amount would be the obvious target, since this can be easily achieved and would benefit poor consumers given the fact that VAT is a regressive tax.

A tax on sugar-sweetened beverages will further erode our personal freedoms. Yesterday, the target was tobacco and alcohol, today it is aimed at sugary drinks, tomorrow it could be sweets, chocolates, artificial sweeteners. The range will only get wider and wider and in time government imposed restrictions may very well encompass how close you sit to your TV; minimum amounts of exercise; how long you should be out in the sun and, even impinge on your choice of whom to share your bed with. Choices will no longer be yours to make – all in the name of your health.

South Africans fought hard to re-assert their freedoms from an overbearing state. With taxes like this one on sugar sweetened substances, we are being forced to let go of those rights once again.

- Frans Cronje, Chief Executive of the South African Institute of Race Relations. He can be followed @FCronje_IRR