Ratings downgrades: wake-up call for SA

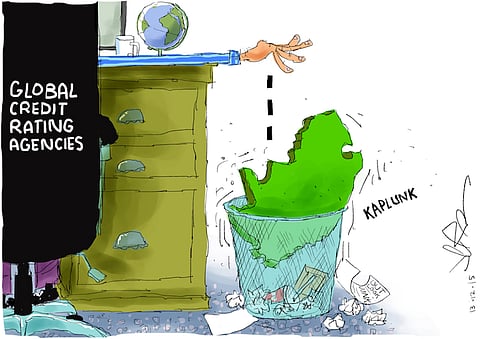

Ratings agencies took analysts and the government by surprise at the start of the weekend. South Africa plunged deeper into junk territory after Moody's Investors Service joined Fitch Ratings in lowering the country's credit ratings to a level worse than in 1994 (full details, here).

The National Treasury has warned that spending cuts and tax increases are on the table, and to expect more economic pain of the order caused by the Covid-19 shutdowns – in particular business closures and job losses. It seems to put much of the blame on the Covid-19 pandemic, urging South Africans to adhere to rules aimed at curbing the spread of the disease to avoid stricter rules.

But it's clear South Africa cannot afford another lockdown. What's more, the investment community is unimpressed with plans and strategies set out by President Cyril Ramaphosa and Minister of Finance Tito Mboweni in recent months to revive the economy.

As Stanlib chief economist Kevin Lings underscores: the downgrades reflect 'significant and sustained deterioration' in the SA economy and government finance. Bright spots include SA's exchange rate flexibility, credible monetary policy, a well-capitalised and regulated financial sector, deep capital markets and moderate external debt. But, he says, there is no substitute for high economic growth accompanied by job creation.

* Lockdowns are the hot topic under the microscope at today's Great Debate webinar at noon, hosted by BizNews founder Alec Hogg. World authority on health policy Professor Alan Whiteside, OBE, Chair of Global Health Policy, BSIA, Waterloo, Canada & Professor Emeritus, University of KwaZulu-Natal takes on PANDA's Nick Hudson, who is fiercely opposed to lockdowns. Free, but you must register: https://attendee.gotowebinar.com/register/6730147365502274830.