Briefs

SA economy suffers as government struggles to implement revival policies

South Africa's business confidence remains at a three-decade low, while the current acoount gap has narrowed less than expected.

By Rene Vollgraaff

(Bloomberg) – South African business confidence remained close to a three-decade low in November as companies continue to await decisive action by the government to revive the economy.

A sentiment index compiled by the South African Chamber of Commerce and Industry rose to 92.7 from 91.7 in the previous month, the business group said in an emailed statement on Thursday.

Key insights

- Africa's most-industrialised economy contracted in the third quarter as output in agriculture, mining and manufacturing dropped. Low business confidence also continued to weigh on fixed investment spending as private-sector companies are wary to commit large sums of money to projects.

- While President Cyril Ramaphosa has pledged to revive the economy, gross domestic product has now contracted for four of the seven quarters since he came to power and the chamber said there are structural bottlenecks that have to be removed before economic growth can reach its potential.

- "The difficulty in decision making aimed at the inevitable structural adjustments necessary to let the economy perform better, are still lacking," Sacci said. "The effect of indecisiveness and the time lapses to taking action are going to impact critically on the economy and therefore business and investor confidence as year-end approaches."

Current-Account gap narrows less than projected

By Rene Vollgraaff

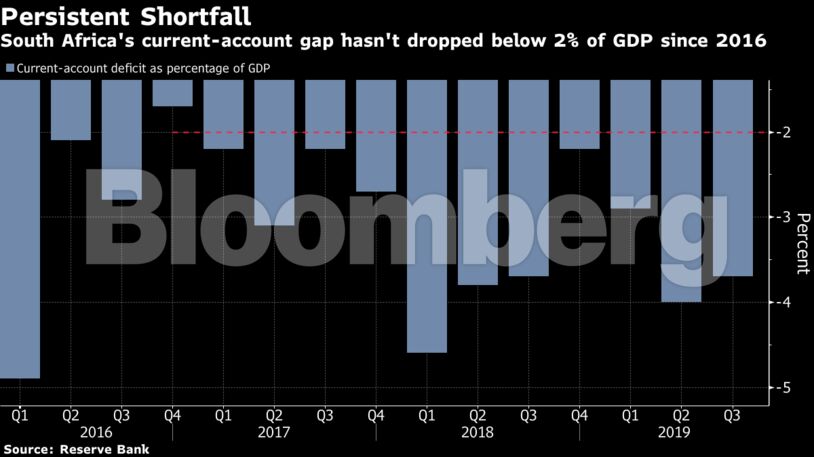

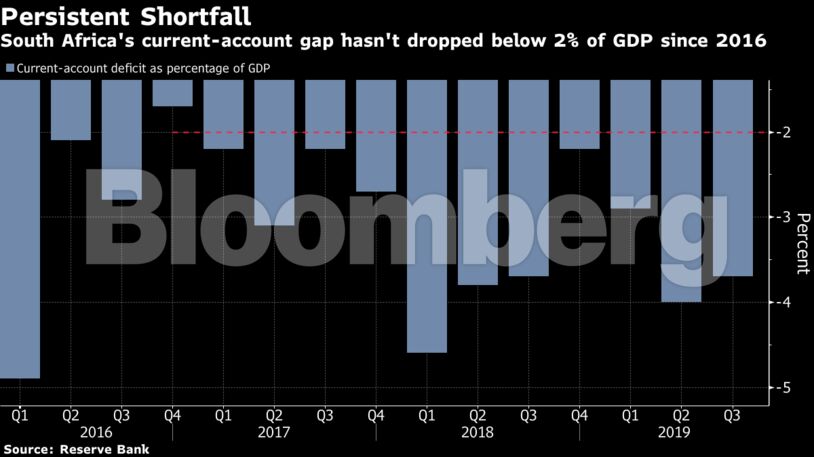

(Bloomberg) – South Africa's current-account deficit narrowed less than forecast in the third quarter as outflows to foreign shareholders increased.

The shortfall on the current account, the broadest measure of trade in goods and services, shrank to 3.7% of gross domestic product from a revised 4.1% in the previous period, the Reserve Bank said in a report released on Thursday in Pretoria. The median estimate of 11 economists' estimates in a Bloomberg survey was for a deficit of 3%.

Key insights

- The main driver of the bigger-than-expected gap was a surge in the shortfall on the nation's primary-income account, which reflects outflows due to dividends and interest payments to foreign shareholders. Naspers, South Africa's biggest company by market capitalisation, listed its internet business in Amsterdam in September.

- The trade account swung back to a surplus of R41.1bn ($2.8bn) as the rand value of exports increased in the quarter. Most of this was due to the currency's 6.9% drop against the dollar in the three-month period, as shipment volumes only rose marginally. Import volumes declined.

- The current-account deficit hasn't dipped below 2% of GDP since the end of 2016 and, together with a budget shortfall that's projected to be the widest in more than a decade next year, it will keep pressure on the rand. South Africa relies on portfolio inflows to fund the gap on the current account.