Tomorrow’s SONA tightrope – don’t look down Cyril

There's no denying it. While setting out on the frayed tightrope of State Capture at a dizzying height, President Cyril Ramaphosa has strategically deployed a fistful of loyal generals to oversee the frantic weaving of a safety net below him. Whether it's strong and wide enough to save him is anybody's guess. The weak threads of stalled policy reform and imbedded party Zuptoids will continue to erode potential growth and global competitiveness. Ahead of his 4th State of the Nation address, this analysis of his previous two efforts yields a mixed bag, corrosive party policies eliciting high-decibel pleas for him to be more courageous in risking party fracture. Failure to do so, some contend, will risk economic implosion. Financial meltdown threatens, in spite of his considerable achievements. Ironically, failing to tackle the unions, one of the many stakeholders urgently needing to agree to some kind of short-term pain, will prove pivotal. As will addressing underlying issues at SOEs, the changed leadership of which is among his top achievements. We do not yet have a new dawn of (policy) reform, economic growth and sufficient new jobs. It's pretty messy – and the new broom needs thicker bristles. – Chris Bateman

This is Ramaphosa's South Africa report card after two years

By Prinesha Naidoo

(Bloomberg) – Cyril Ramaphosa came to power two years ago pledging a new dawn of reforms, economic growth and jobs.

The South African president will deliver his fourth state-of-the-nation address on Thursday with a mixed bag of results since taking the helm. Here is a recap of his successes and failures:

In his first speech Ramaphosa conceded that the economy was not expanding fast enough to reduce poverty. While he didn't set explicit growth targets, his 2017 campaign to take over the leadership of the ruling African National Congress centred on an economic recovery.

"The need for a social compact in South Africa, where all stakeholders concede to enduring some of the short-term pain has never been more urgent," said Sanisha Packirisamy, an economist at Momentum Investments.

The president's efforts to bolster growth and undo almost a decade of hollowing out of state institutions that happened under his predecessor Jacob Zuma are being hampered by internal battles in the ANC and powerful labor unions who are opposed to cuts in government spending and state jobs.

Jobs

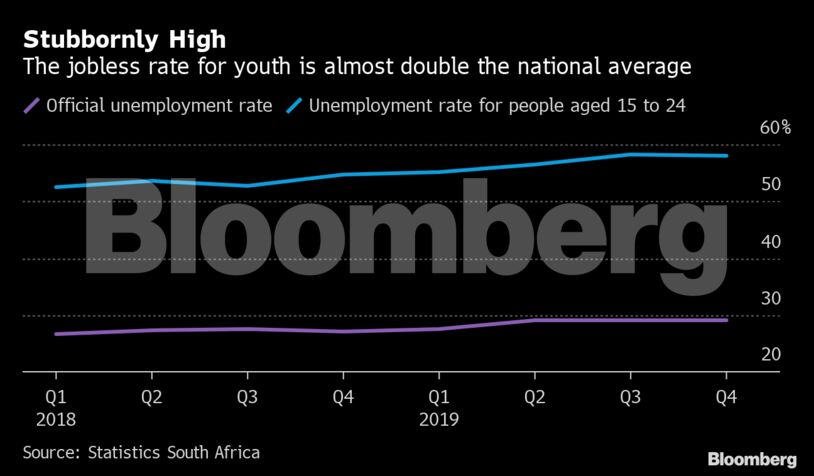

South Africa's unemployment rate increased since Ramaphosa took power. It's at an 11-year high and could climb even further after companies including Telkom and Walmart's local unit Massmart announced thousands of potential job cuts in the first three weeks of 2020.

Ramaphosa has made good on commitments to put youth at the centre of his agenda with the launch of the Yes4Youth initiative, which seeks to create one million job opportunities for young people, as well as a jobs summit that aimed to create 275,000 positions a year. However, the results haven't been forthcoming.

One of the labor-market successes he could count, is the introduction of a national minimum wage, although the work on that was finalised when he was still deputy president. Furthermore, the Labour Relations Act was changed to make it illegal to embark on a strike action before conducting a secret ballot of members, a step employers have long called for.

Investments

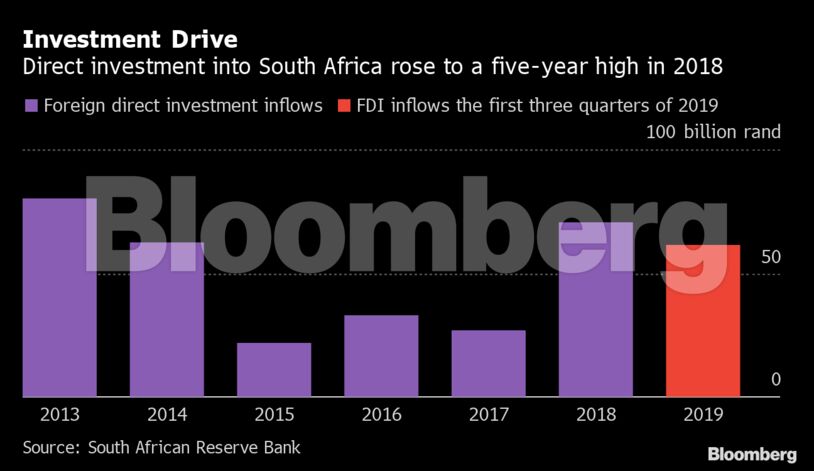

Ramaphosa launched "a major push to encourage significant new investment" with the start of an investment summit in 2018. He has since hosted two such events and his plan to raise $100bn in five years has already reached almost 50% of its target, according to his administration. Not all of the money pledged by companies including Sappi, BMW AG and Ford is new and some of it will come from state institutions such as the Industrial Development Corp.

State-Owned Companies

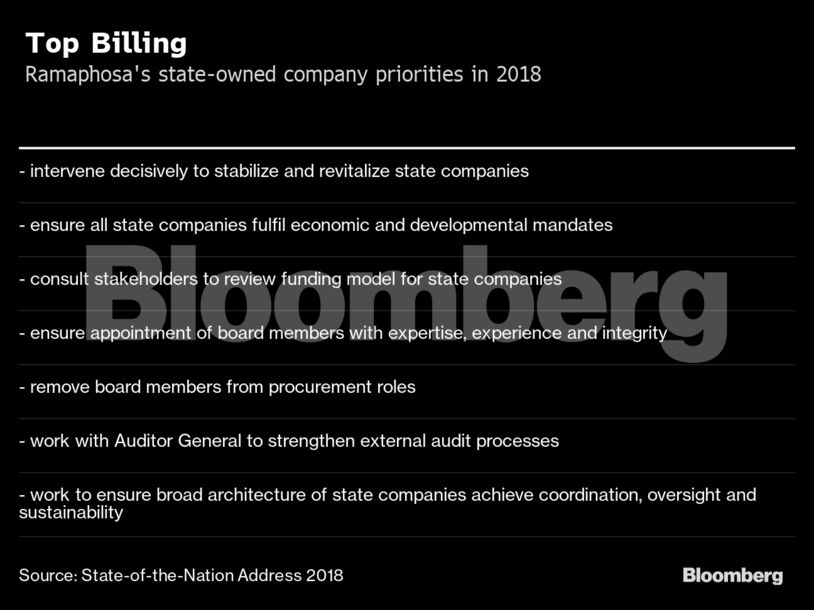

While Ramaphosa kept his promise to address governance issues at state-owned companies, most notably with the appointment of Andre de Ruyter as permanent chief executive officer of Eskom, the financial crises at many of the firms continue.

Plans to split Eskom into three separate units and reorganise its R454bn ($31bn) debt pile are yet to be finalised. The power utility is seen as the biggest threat to South Africa's economy because it doesn't generate enough cash to service its debt and is surviving on government bailouts. The growing debt burden poses a threat to state finances, with guarantees for the utility that stood at R350bn a year ago.

A turnaround plan for loss-making South African Airways, which includes the scrapping of some routes, faces opposition from government and labor unions. The carrier was placed into a local form of bankruptcy protection in December.

Policies

The November 2018 announcement of the new Automotive Production and Development Plan that will take effect next year fulfilled some of the president's pledges to boost investment in key manufacturing sectors. The automotive industry is the largest component of South Africa's manufacturing sector. It accounts for 14% of the country's exports and employs more than 100,000 skilled workers.

The same can't be said for the Mineral and Petroleum Resources Development Bill, which Ramaphosa said two years ago would be "reasonably finalized" in the first quarter of 2018. It is yet to be signed into law and the window for public comments on potential changes closed last month.

Justice

The commission of inquiry into state capture has been running since August 2018 to uncover the extent of corruption and Ramaphosa appointed Shamila Batohi as National Director of Public Prosecutions in December 2018.

However, while the president said that people found to have stolen public funds under the previous administration should be prosecuted, former State Security Minister Bongani Bongo is the only high-profile person who has been arrested.

Taxes

Ramaphosa's effort to rebuild the South African Revenue Service continue after he dismissed Tom Moyane as head of the agency based on the recommendation of a judicial inquiry into governance at the institution. Edward Kieswetter, who took over as commissioner in April, has started a revenue-recovery project and is implementing the recommendations of the inquiry.

"The last 18- to 24-month period has been one where the administration has built a more solid foundation through putting good people into the right places at the South African Revenue Service, the National Prosecuting Authority," said Jeffrey Schultz, a senior economist at BNP Paribas South Africa. "It's time to move on some of those policy issues."

What Bloomberg's economist says

"So far, pronouncements on 'progress' have raised more questions than answers – creating more political uncertainty. Examples include the mining charter, spectrum allocation and private electricity generation. I am expecting more of the same. Stalled policy reform will continue to erode potential growth and global competitiveness – challenges in addressing the wage bill and underlying issues at state-owned enterprises' will lead to continued deterioration of fiscal metrics." – Boingotlo Gasealahwe, Africa Economist